You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. Dear Fellow Traveler, In March 2024, I wrote “Hedge of Tomorrow…” This report argued that rising (no… EXPLODING) U.S. debt and the nature of its issuance would drive inflation and asset bubbles, recommending investments in stocks, gold, and Bitcoin as hedges against monetary debasement. The report recommended gold at $2,100 and silver at $25. Both have since doubled. Gold cracked $4,200, silver touched $52. Now some pundits are asking: Was this a black swan event? How did we miss it? And more importantly, what does this tell us about the fundamental shift happening in global currencies? Well… first things first… This wasn’t a black swan. This was a white swan that everyone chose to ignore. Nassim Taleb’s black swan definition requires three things. The event must be unpredictable, massively impactful, and rationalized only in hindsight. Gold doubling in 18 months fails the first test… It was entirely predictable if you were paying attention… (and it was… predicted…) The conditions were visible to anyone willing to look…

The rise wasn’t unthinkable… As I’ve said, it was inevitable given the monetary conditions. Traders and policymakers chose to downplay these tail risks because acknowledging them would have required admitting the entire post-1971 monetary system has reached its limits. Why Did We Ignore the ObviousGold bugs have long gone ignored… or mocked. And a lot are taking their victory laps now. But the reality is that several factors created this massive blind spot… all converging at the same time. What kept their views suppressed?

For decades, central banks and mainstream finance promoted the “gold is dead” story. Equities were the default growth asset, and bonds the default hedge. Gold was dismissed as a “barbarous relic” even as central banks quietly accumulated it.

From 2012-2020, gold underperformed while equities soared. Investors assumed this pattern was permanent and that financial assets would always outperform physical assets. The money printer made everything else seem unnecessary.

Most institutional risk systems don’t treat gold as a core hedge anymore. Portfolio allocations were tiny compared to debt and equity positions. When your models don’t account for currency regime change, you can’t see it coming.

Investors assumed the dollar’s reserve status was unquestionable and permanent. They underestimated the speed of BRICS dedollarization, China’s push for RMB trade, and the acceleration of alternatives by weaponizing the financial system. The financial establishment had too much invested in the current system to acknowledge its vulnerabilities. Admitting gold’s relevance meant admitting their entire framework was flawed.

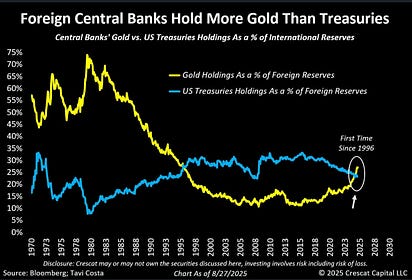

What we’re witnessing isn’t just gold going up… It’s a fundamental shift in how the global monetary system works. The last 18 months marked the beginning of the end for dollar-centric finance. And the next 18 months should be similarly violent… Consider for a moment, the failed weaponization of the U.S. Dollar. Freezing Russian reserves and cutting countries off from SWIFT accelerated the search for alternatives. Every central bank now knows its dollar reserves can disappear overnight if it displeases Washington. You shouldn’t be shocked that Janet Yellen was involved in that decision… What happened next? A lot of nations adopted a multipolar reserve strategy. This meant that central banks were buying gold instead of Treasuries as their primary reserve asset. We’ve just witnessed the threshold where central banks now owns more gold than U.S. dollars… Oops… but enjoy your job at PIMCO, Ms. Yellen. Gold is becoming the neutral reserve currency of a fractured world where no single nation’s paper is trusted. Also, when your reserve currency issuer has 120% debt-to-GDP and is printing money to finance deficits, rational actors look for alternatives. Gold became that alternative. Then… there’s the big thing that goes ignored. It’s the end of Risk Free assets… One of the other issues, especially post-COVID, is the fact that Treasuries no longer offer genuine “risk-free” status. Crisis continues to appear in the risk-free asset, especially when we see large amounts of unwinding of leveraged bond positions in the event of an emergency. Ask British pension funds about their views on GILT Bonds… or regional banks about their feelings on Treasuries when trying to raise cash during the Silicon Valley Banking crisis. The risk-free assets weren’t risk-free when bond yields were spiking, and the value of those assets collapsed in 2023. What This Means Going ForwardThis isn’t about “gold bugs finally being right….” It’s about recognizing that the monetary system is in a generational transition. We’re moving from a world where one country’s paper money dominated everything to a multipolar system where physical assets matter again. The trade isn’t “gold up forever” but rather that currencies and debt instruments are no longer unquestioned hedges. In the new paradigm, portfolios must account for…

The Money Printer Hits Its LimitsWhat my March 2024 recommendation really captured was the moment when the money printer started hitting its limits. You can’t solve every problem by creating more currency when the currency itself becomes the problem. Gold’s rise signals that markets are pricing in the end of the post-1971 monetary experiment. Not tomorrow, not next year, but eventually. And “eventually” is arriving faster than anyone expected. When central banks are buying gold at a record pace while simultaneously claiming it’s not important, you know something fundamental is changing. When countries are making trade deals specifically to avoid dollar settlements, the writing is on the wall. The smart money saw it coming because the signs were obvious: massive debt, currency weaponization, inflation, and central banks accumulating the one asset they can’t print. Everyone else missed it because acknowledging gold’s relevance meant acknowledging that everything they thought they knew about modern finance was wrong. The paradigm shift is just beginning. Plan accordingly… Stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "The White Swan Everyone Ignored"

Post a Comment