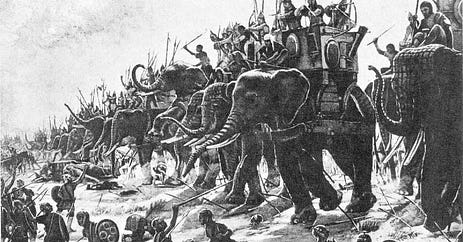

You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. Two Brothers Against the First Great Extraction MachineWe did our homework... Here's how Rome’s elite turned reform into the greatest wealth grab in history... and how it's happening again...Dear Fellow Traveler, Not long ago, we explored the story of Jesus’ confrontation in the Temple, and the extraction system in first-century Judea. It was the most-commented-on article I’ve ever written on Substack… I promised I’d follow up on the theme. That’s because several readers asked: “What happened to those who challenged similar chokepoints in other eras?” And more importantly: “How did the wealthy protect themselves during those periods of uncertainty?” Of course… it takes time to research… But today… let’s step back to 133 BCE... to a story that most people know as a simple tale of Roman politics gone wrong… As always, I ask you to keep an open mind... Two Brothers Broke the MachineToday’s story is about the Gracchi brothers… two Roman politicians who tried to redistribute land and got killed for it. There’s a standard narrative in economic history… They’re viewed by many as reformers against greedy senators (although there are critical views that I’ll address). But when you strip away the togas and examine the economics... You’ll see the same extraction patterns we discussed with the Temple… and today. And you’ll discover how the Roman elite turned political crisis into the greatest wealth accumulation opportunity in Mediterranean history. Military expansion made Rome rich… That said, it also shattered its economic foundation. Small farmers got drafted for decades-long campaigns. So, they’d be gone for long periods… When they came home, their farms were gone… bought up by elites who worked them with slave labor. The result? The citizen-soldiers who built the empire couldn’t afford to serve in it… let alone operate in it… anymore. Think of it this way… imagine if today’s military required you to own a house to serve, but housing policies systematically transferred all the houses to Wall Street firms. That was Rome in 133 BCE. Military recruitment was collapsing. Social unrest was rising. But the Roman elite were good at extraction and incentivized to continue doing it… They turned public resources into private profit… (gee… that sounds a little like private equity… doesn’t it?) The elite grabbed “ager publicus” (public land meant to be shared) and worked it with forced labor while citizen-farmers got nothing. This was wealth extraction disguised as empire building. So, these two brothers decided to call it out. Spoiler alert… it gets stabby… Tiberius Gracchus: The First ChallengeTiberius Sempronius Gracchus wasn’t some radical outsider. His family was Roman aristocracy. His grandfather was Scipio Africanus, the guy who beat Hannibal at the Battle of Zama (202 BC) despite the Carthaginians having 80 war elephants. In 133 BCE, as tribune, Tiberius proposed a simple idea. He wanted to enforce an existing 500-acre limit on public land… not confiscation, not socialism, just the law already on the books. The Senators lost their minds. Why? The entire extraction system depended on ignoring those limits. That said, Tiberius didn’t play by their rules. When another tribune vetoed his bill, he had him deposed… unprecedented in Roman history. He bypassed the Senate entirely and went straight to the Popular Assembly. His critics accused him of seeking tyranny and being a dictator rather than being a reformer. Maybe they were right. Maybe he was drunk on power. But his land commission was working… they were actually redistributing significant public land holdings. So, what was the establishment’s response? You get three guesses and the first two don’t count… They killed him in broad daylight on the Capitoline Hill. That was 133 BCE. It was the first time Roman politicians had been murdered for their politics in centuries. But his family wasn’t done… The sequel was better than the original… Gaius Gracchus: Round TwoEleven years later, his younger brother Gaius picked up where Tiberius left off. Gaius was smarter, which made him more dangerous. He didn’t just target land… he went after the whole extraction network: First, he undercut the elite’s control over the food supply (one of their chokepoints)… This redistributed economic security downward. Gaius introduced a lex frumentaria (grain law) that required the state to sell grain to Roman citizens at a fixed, below-market price. Think of it as a government-sponsored food program that reduced the Senate’s power… Second, he attacked the legal immunity that protected corruption. This was a system that let elites pillage the provinces without consequence. At the time, Rome’s governors extracted wealth from provinces, often extorting those populations. When accused of corruption, those governors were tried in the quaestio de repetundis (extortion court). Of course, before Gaius, senators judged senators… You know how people get away with stuff in the U.S. Senate all the time… and they get a slap on the wrist? Well, in Roman times, there wasn’t even a wrist slap… Gaius’ reform shifted jury service in these courts from the senatorial class to the Equestrian order. That group comprised wealthy businessmen, tax-farmers, and traders who were not part of the Senate. This didn’t go over well with people who were… you know… corrupt. Third, he altered provincial tax farming contracts (more on this in a minute)… which was a very big deal. So just in these three decisions, Gaius dismantled senatorial privileges and built alternative power centers - which threatened the centralized power of the Senate. Then, like a Star Wars film… the Senate fought back. They engaged in political manipulation, turned the people against him, and finally... we had mob violence on the Aventine Hill in 121 BCE. Gaius committed suicide rather than be murdered. That said, hundreds of his supporters were killed. Both brothers died, challenging the wealth extraction system. Here’s What Actually Matters...While the Gracchi were getting murdered, the Roman elite were turning this crisis into the greatest wealth accumulation opportunity in history. They learned something the brothers never understood… You don’t fight the wealth-transfer engine. You own it. Here was their playbook… and why policies like it worked… Strategy #1: Provincial Tax Farming The Roman government needed to collect taxes from conquered provinces. However, they didn’t want to build a bureaucracy. Their solution? They auctioned off tax collection rights to private bidders. Rich Romans would bid huge sums upfront for the right to collect taxes in places like Asia (modern Turkey). They’d pay Rome immediately, then go collect whatever they could from the provincials. Anything above their bid? Pure profit. As you can imagine… it led to problems… Roman law capped interest near 12%, but tax-farm profits often far exceeded that. The wealthy bought the right to tax entire regions. If you’re looking for a modern comparison… consider this… Today’s primary dealers buy government bonds at auction, then sell them to the Fed at higher prices. Same extraction model, different century. Strategy #2: Crisis Arbitrage During political upheavals (which became regular after the Gracchi), land prices collapsed. The smart money was ready. Crassus became one of Rome’s richest men by buying confiscated estates during the civil wars. He’d purchase property at fire-sale prices, often from families whose patriarch had been proscribed (killed for political reasons). His specialty? Buying burning buildings in Rome, sending his private fire brigade to save them, then rebuilding and flipping for profit. Crisis became an opportunity for those with capital and connections. A modern equivalent? How about private equity firms buying distressed assets during 2008, or Blackstone’s residential real estate buying spree during COVID? Instead of buying things on fire… just buying at fire-sale prices… and waiting for the bailouts to come… Strategy #3: Debt Collection Networks Elite wealth sat in transferable debt instruments. Legal rates hovered around 12%, but the elite could trade, transfer, and leverage these notes as if they were paper assets. They became the creditors, not the debtors. When economic pressure hit, they collected land, businesses, and other assets from defaulting borrowers. Today’s version? Alternative funds buy corporate debt at distressed prices, then convert to equity when companies restructure. What a playbook… Strategy #4: Geographic Diversification Wealthy, alert Roman families spread holdings across the Mediterranean. Land in Gaul, investments in Egypt, and mining operations in Spain. When one region faced upheaval, they had assets elsewhere. Modern parallel? Sovereign wealth funds, family offices with holdings across multiple jurisdictions, crypto, and hard assets are spread across multiple jurisdictions. They look for political stability in Finland and Switzerland, but speculate on regime change in very shaky areas as ways to make quick money… Strategy #5: Infrastructure ControlRome’s elite didn’t just own the land … they owned the movement. The Republic auctioned off toll-collection rights (portoria) for bridges, highways, and harbors. There were private syndicates… the same publicani who farmed taxes… that ran these toll booths for profit. They paid the state a fixed fee, then collected from every wagon, cart, and ship that passed. Rome owned the roads. The rich owned the revenue. From river crossings to harbor gates, public infrastructure became private cash flow… a toll economy stretching from Gaul to Asia Minor. Sound familiar? Today… it’s airports, shipping terminals, and payment rails. It’s the same extraction logic, just digitized. The Roman elite understood what modern financiers still do… If you can’t tax the people directly, own the road they have to travel. Today’s Real LessonThe Roman elite didn’t preserve wealth despite the Gracchan crisis. They preserved it by understanding that a crisis creates opportunity for those positioned correctly. Even when land redistribution worked, it barely touched private wealth. The target was public land occupancy, not private estates. The families who thrived built what I call “antifragile wealth”:

What should you do…Now, remember, I’m not claiming Rome had a Federal Reserve or that Roman tax farming is identical to quantitative easing. But the functional outcomes are remarkably consistent…. Throughout history, we see a systematic transfer of wealth from productive populations to financial gatekeepers who control essential economic infrastructure. Whether it’s Roman publicani extracting provincial wealth or modern primary dealers profiting from Fed operations, the result is the same… It’s a small group that controls the chokepoints and extracts wealth from everyone who must use that infrastructure. This is why certain wealth preservation strategies work across millennia… You should…

The Gracchi tried to reform the system through politics. They were killed. This happened a lot in history… The smart Roman families ignored politics and focused on positioning. They survived and thrived. Wealth preservation starts with understanding how extraction systems actually work, regardless of the era or the mechanism. The mechanisms change. The dynamics don’t. Next week… Julius Caesar… the man who mastered the game and still lost his life playing it. Stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "Two Brothers Against the First Great Extraction Machine"

Post a Comment