| Imagine this:

It's Monday morning…

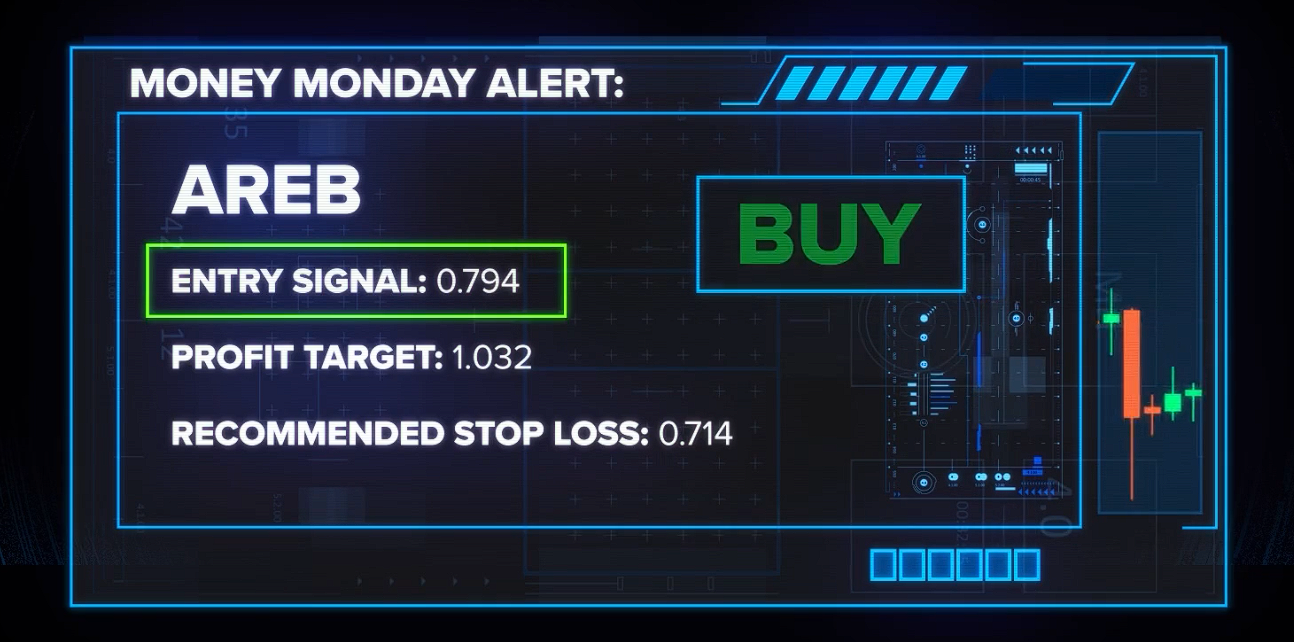

You get an email from me that looks like this:

So you place one simple trade…

Now, you know I can't promise future returns or against losses…

But imagine getting emails like that from me every Monday.

Thanks to our new Money Monday algorithm, you can.

It pinpoints a unique setup called the Money Monday trade…

And then it sends out an instant email alert with simple step-by-step trade instructions.

Simple as 1. 2. 3.

Click here to see my NEW favorite trading algorithm.

-Tim Bohen

P.S. No promises, but we think the next Monday pick could be one of the biggest yet. And if we're right, it may move FAST… So it's important that you get the details now

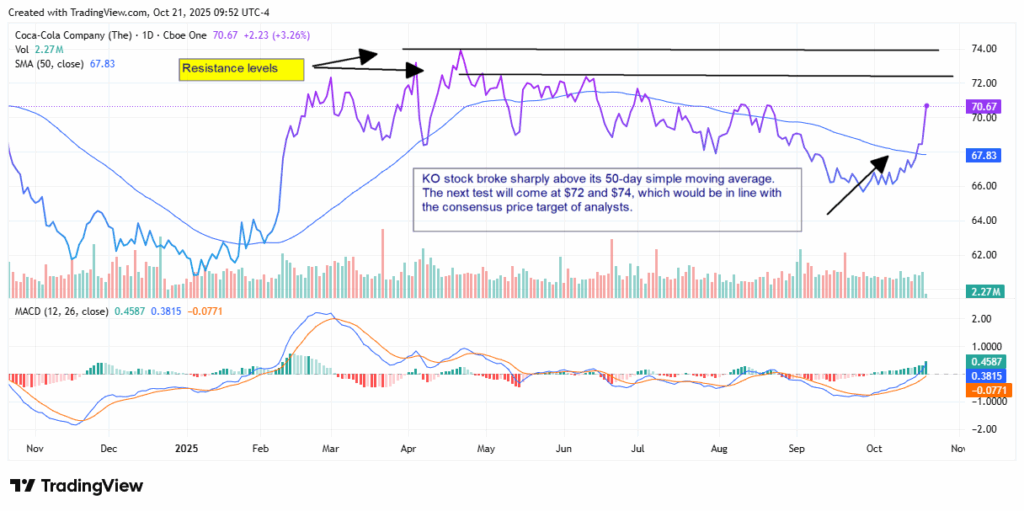

1. Results are not typical. I teach methods that have made other traders money, but that does not guarantee you will make any money. Success in trading requires hard work and dedication. Past performance does not indicate future results. All trading carries risks. Today's editorial pick for you KO stock Rises with Price Hikes and Drink VarietyPosted On Oct 22, 2025 by Chris Markoch  The Coca-Cola Company (NYSE: KO) delivered its third-quarter earnings report, and you can say investors found it to be refreshing. KO stock shot up 3.7% when the market opened after the company beat on earnings expectations. Table of ContentsFor the quarter, Coke delivered revenue of $12.41 billion, which was slightly above analysts' expectations of $12.39 billion. The topline number was also 4.4% higher on a year-over-year (YoY) basis. However, earnings per share (EPS) of 82 cents came in 5.2% higher than analysts' estimates for 77 cents and 6.4% on a YoY basis. The report showed a familiar pattern. Volumes in Latin America and North America were flat, but the company generated higher profits due to price increases. One note of caution came in the company’s full-year guidance. Coca-Cola reiterated its prior forecast of comparable EPS growth of 3% with organic revenue forecasted to improve by 5% to 6%. Coca-Cola Is Delivering the Right Product MixHeading into the report, many investors were interested to hear what Coca-Cola would say about the state of the consumer. The news was mixed. On the one hand, the company reported that it was seeing signs of the lower-income consumer continuing to be under pressure. However, Coca-Cola also noted that higher-income consumers continued to spend and could absorb the higher prices, particularly at the premium end of the company's portfolio. But here's where the report got even more interesting. The company noted that there was strength across the portfolio, depending on the channel. For example, the company saw strong dollar store sales for its core brands. That suggests that lower-income consumers are still looking for the brand as part of a broader hunt for value. These consumers are also responding favorably to the company's smaller cans and bottles. At the same time, the company saw high-income consumers spending more in restaurants, events, and other channels. These consumers were also more likely to be buying the company's premium brands. And regardless of income level, it's clear that the company's Coca-Cola Zero Sugar product is a hit. Case volume for that brand was up 14% in the quarter, easily outpacing every other product category. Will the Holiday Season Bring Cheer? History Says No Casual observers would think that Coca-Cola's fourth quarter, which includes the holiday season, should be one of the company's strongest. Yet historically, it tends to be one of its weakest for revenue. The reason comes down to seasonality and consumption patterns rather than brand strength. Coca-Cola's business peaks in the warmer months—its second and third quarters—when consumers buy more cold beverages. By the time winter arrives, demand naturally cools off, especially in North America and Europe, which still drive a large portion of its sales. The company's famous holiday marketing campaigns, from Santa Claus to "Share a Coke," boost brand visibility but not necessarily volumes. Promotions and discounts around the holidays also weigh on revenue per unit. In addition, more consumers shift to at-home consumption instead of restaurants or entertainment venues, where Coca-Cola earns higher margins. Outside the U.S., many markets don't see the same year-end lift, and currency effects can further limit reported growth. In fact, over the last five years, Coca-Cola's Q4 revenue has averaged about 7–10% lower than Q3, even in strong economic environments. A Strong Balance Sheet Puts a Solid Floor Under KO StockWhile owning a blue-chip stock like Coca-Cola may not excite growth investors, it continues to be a hit with value seekers. A key reason for that is the company's strong balance sheet. For the quarter, the company generated $8.5 billion in free cash flow (FCF), which was up from the prior year. The company also reported net debt leverage of 1.8x EBITDA, below the company's targeted range between 2x and 2.5x. KO Stock Breaks Higher, But Will the Gains Hold?KO stock just delivered a textbook bullish breakout. The stock surged 3.3% to 70.67, overtaking its 50-day moving average at 67.83 on strong volume—clear evidence of buyers stepping in with conviction. Momentum is picking up fast: the MACD just crossed positive, with the histogram rising and both lines trending north, signaling the bulls are in control.? Support now sits at the 50-day line around 68, and secondary support is nearby at 66, where the stock recently carved out a bottom. On the upside, resistance is just ahead at 72, the year's prior swing high, and then around 74, which would be slightly below the consensus analyst price target.. If KO stock can punch through this zone, there's room for a further rally, but if it stumbles, expect consolidation or a retest of support as sentiment resets.? Right now, the structure favors playing the trend, with a close eye on volume and price action near resistance. A breakout above 72–74 on heavy buy volume could signal a fresh up-leg, but watch for any failed attempts at these levels to avoid getting caught in a bull trap.  This is a PAID ADVERTISEMENT provided to the subscribers of StockEarnings Free Newsletter. Although we have sent you this email, StockEarnings does not specifically endorse this product nor is it responsible for the content of this advertisement. Furthermore, we make no guarantee or warranty about what is advertised above. Your privacy is very important to us, if you wish to be excluded from future notices, do not reply to this message. Instead, please click Unsubscribe. StockEarnings, Inc

|

Subscribe to:

Post Comments (Atom)

0 Response to "🎯 Buy This Stock Before a Monster Monday Move"

Post a Comment