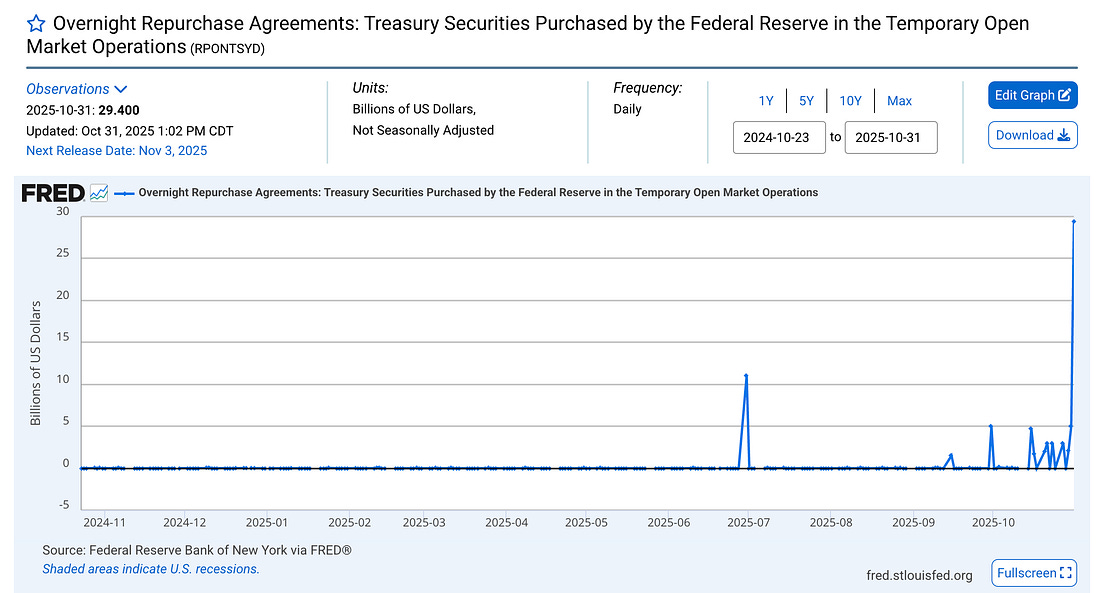

You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. The Crisis Dodgers (The Fed) Just Did $29.4 Billion in Repo Agreements... Now What?Well... that was a nerve-racking end to the World Series... Pitchers and Catchers report February 10, 2026... But let's see what our financial system looks like by then...Dear Fellow Traveler: Well, the Los Angeles Dodgers just won their second World Series in a row… Congrats to the team that actually spent money on players (more than $350 million). A lot of owners are just in professional sports for the tax incentives (funny how incentives matter) because they’re in the alternative investment business… But put an athlete like Magic Johnson in charge of something - where his entire life was winning - and you MIGHT end up with a culture and team that wants to win and does what it takes to win… (Yeah, it didn’t work out for Michael Jordan, but…) Still waiting on the Baltimore Orioles to sign a pitcher for more than four years… Okay… end of rant… It was a great series… and I appreciated the extra hour of sleep… Let’s get to the real “Dodgers” that matter, though… The ones at the Federal Reserve are trying to prevent a short-term liquidity problem… Dodge a crisis… if you will… The Fed just pumped $29.4 billion into the financial system via overnight repurchase agreements of Treasury Securities on Friday, October 31… Probably nothing, right? On its face, that suggests the central bank is active in stabilising funding markets and responding to liquidity conditions. This injection provides the financial system with more capital (liquidity)… More liquidity means easier funding, less stress, and stronger risk appetite. The problem is that someone needs cash… and the private markets weren’t meeting those needs… It doesn’t necessarily mean “everything is collapsing”, but it is a red flag… Funding is tighter, the Fed is intervening, and markets should pay attention. We’ll talk about it… at the Capital Wave Report… all week (as we’ve been warning.) I was initially wondering why famed money manager Michael Burry (The Big Short) suddenly sent a message on Twitter out of nowhere this week… Everyone… everywhere… now warning… about all things. Dallas Fed’s Lorie Logan even suggested on Friday in a speech that there’s something off… She said…

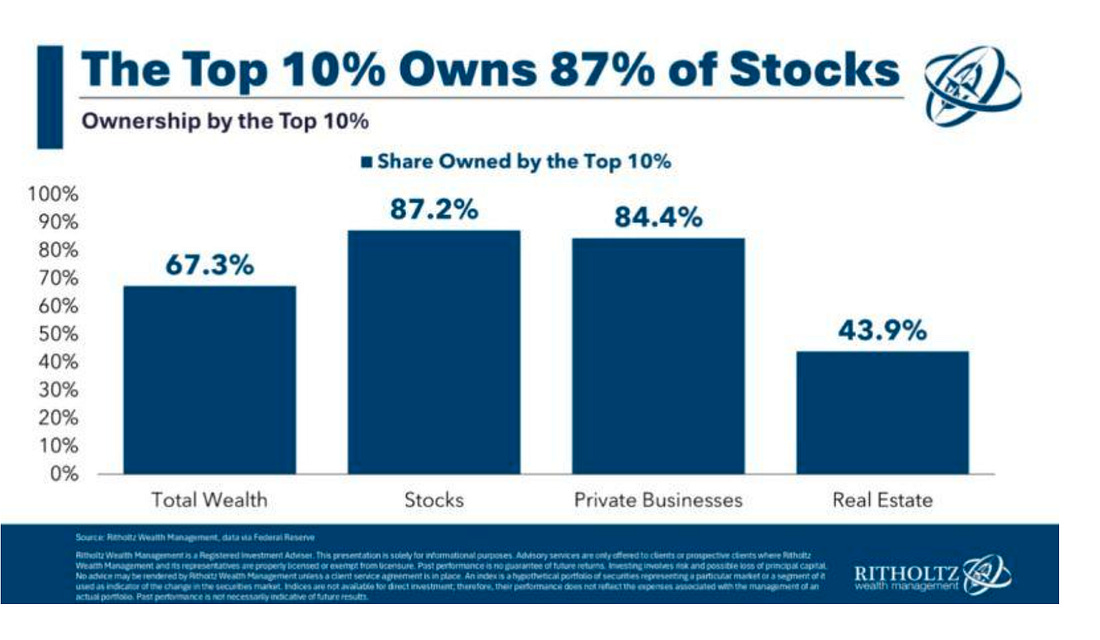

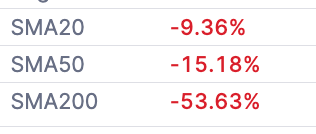

Oh… really? If only someone had been talking about this last month (and well, always.) For those in the back… the Fed buying assets again would mean that the Money Printer goes BRRRR again… and not the hidden kind of intervention. They won’t call it Quantitative Easing… They’ll call it “reserve management…” But what is it… really? It’s the never-ending support for the never-ending financialization of our economy… Protecting the leverage, justifying the waste, ensuring that leveraged hedge funds stay long our ballooning debt… All while our food manufacturers’ and consumer defensive stocks keep bleeding off… You know… the sign of a healthy economy… the sign of a healthy consumer… the sign of how higher rates impact discounted cash flows… All as inflation rears its head. These liquidity injections are not… for… you… They’re for the upper decile… because that’s what our economy has become. We’ve been out in front of this for some time… especially on the regional banking, private equity, and private credit sides. Our Russell 2000 momentum reading has bounced for two weeks… and sits red right now… The poor man’s measure is almost a 2-1 net breakdown of stocks to breakout names at the end of the performance distribution bell curves. All the while, there’s clear stress on the banking sector, given that the FAZ… is holding above its 20-day and 50-day moving averages. The onset of liquidity events has coincided with these levels on this… Most recently, the weakness in March was followed by calamity in April. But look back to August 2024 when the Nikkei crashed (and we still barely talk about it 14 months later.) The S&P 500 is still holding… But… And there’s a big but… Our intraday readings have been bouncing around, lots of sectors are seeing weakness build, and there’s extreme concentration… The FNGD hasn’t broken out - so there’s still a lot of concentration in the MAG 7 now… But breadth in the market—which was just the worst daily for a positive day since tracking started in 1990… is a clue that that feeling I’ve had for weeks isn’t off… The cockroaches are appearing in the money markets… and we’re starting to get warnings from central bankers… from the Dallas Fed to the Bank of England. I expect there will be a lot of chop this week… I’m going to take profits where I can and start building cash… Understand that these things play out… the cracks of private credit are showing now… but they really don’t manifest until the end of a cycle. These injections will be mechanical… like a toilet plunger at first… We’ll see if we can get things moving… and if they can’t… we go the Logan route… This is going to be one of the wildest markets in this century as we go from Q4 2025 through Q4 2026. All signs point to more support from central banks in the future… but the end result is what leads to stuff like this… again. More of the same… The Top 10% will own even more by the time this is over… More concentration, more Cantillon effects… and very few people seem to understand what the hell has been going on since 2008. My thoughts? Play defense… concentrate on scarce assets… and if you haven’t… remember that I’m here to help you navigate by focusing on liquidity, insider buying, and momentum… Monday, October 27When You Come for Their Financial Religion...I challenged a very good article on traditional banking with an article on the never-ending leverage system that has emerged (and is currently cracking). Well, someone didn’t like that on LinkedIn… He proceeded to tear my life apart like Matt Damon did to Robin Williams in Good Will Hunting. I don’t care… Tuesday, October 28Really Fair, Really Quickly…The leverage is real… and the concentration of risk is leading to new issues across the markets. The problem is how quickly all of this can unwind without the never-ending supply of capital… If you need to understand what the Fed’s trying to prevent (and why they’re trapped)… Wednesday, October 29We Didn’t Start the Printing...We have moved from crisis to crisis in the United States since our founding. In response, I wrote my own Billy Joel song tracking 249 years of roving financial woes… Thursday, October 30Red Russell... Banking Pressures...We had a negative reading on Thursday for the Russell, a preview of the fireworks we’ve seen with the Fed’s repo assistance. Now what? Well… we pay very close attention to the banking system… that’s what. Friday, October 31Everyone Everywhere Now Warning About AI Bubble...It’s incredible how quickly everyone starts talking about crises. But there’s a danger… it can become a self-fulfilling prophecy if we begin to panic loudly. Let’s dig into the other things that were in focus for this Maryland resident… Let’s dive in… Saturday, November 1“Money Printing” and a Saturday Chart Party...There’s always a reason for charts. There’s always a reason to party… Put them all together… you get a Chart Party. All right, everyone… have a great day. I’ll be back to discuss the Repo moves in the morning for readers of the Capital Wave Report. There’s a lot to unpack. But this is why it’s so important for readers of Me and the Money Printer to give me a chance for a month or a year at this price… Stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Home » Uncategories » The Crisis Dodgers (The Fed) Just Did $29.4 Billion in Repo Agreements... Now What?

Subscribe to:

Post Comments (Atom)

0 Response to "The Crisis Dodgers (The Fed) Just Did $29.4 Billion in Repo Agreements... Now What?"

Post a Comment