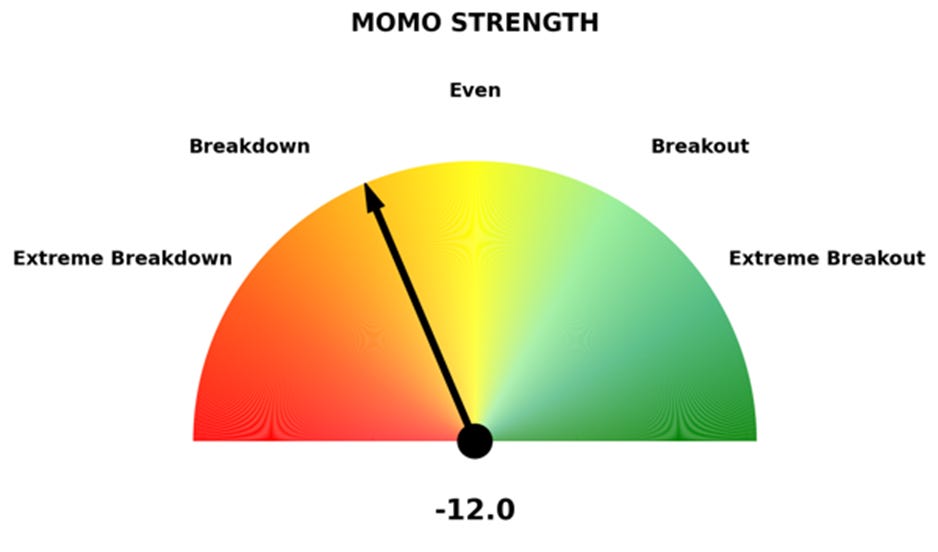

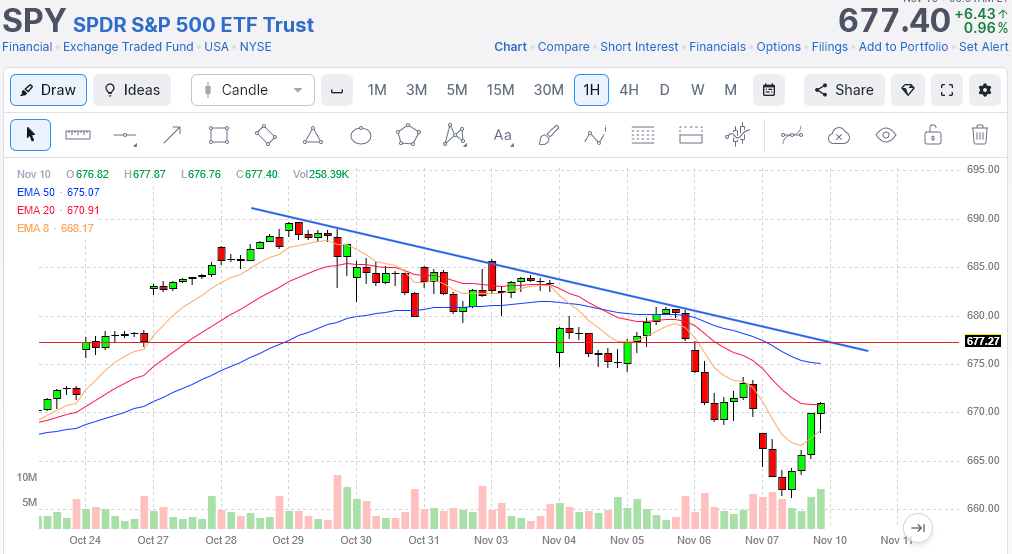

You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. Good morning… I’ll be selling a lot of put spreads today… Risk-on bias into the open, but we’re not jumping in blindly. Shutdown progress has futures higher and the tone is lighter, but we still want to see confirmation before jumping back in with both feet. Pressure has improved since Friday. The S&P moved from roughly minus 48 Friday morning to futures opening at minus 24 last night and now minus 12 this morning as sell-side pressure eases. We have seven S&P names in the “up on the month, up 5% on the week, elevated beta” bucket. Nineteen are still breaking down, so this is improvement on the sell side, not yet on the buy side. This will take a day or two to repair. If you recall, on Friday we highlighted a descending channel on the SPY. We said we needed to get back above 680.50 with conviction to confirm a change in trend. We’re not quite there yet, but futures are back above that descending channel, which is a positive sign early. Now we need follow-through. Until we see a push back above that level and some sustained strength, we’re not calling it a full-throated rally. We’re still in rug-pull territory, where any pop can fade just as fast. That said, volatility is calming. VIX futures are near 19 after a big drop from Friday. Financial stress is cooling as FAZ slips under its key averages. Our Mag7 fear gauge FNGD is opening under its 8-day. Those point to a risk-on lean, but we still have to take it easy. Headline risk remains, as has been the case all year. Continue to let the first 15 to 30 minutes play out before taking positions. If we do break through that 680.50 level, watch for confirmation across the board. The Russell remains the weak link, but if it firms and leads, it’ll help carry the squeeze. We’re waiting for news on the shutdown vote and for Treasury cash to start flowing again. That’s the catalyst that could help confirm a real breakout. For now, we stay alert, trade the ranges, and let price action prove it’s more than just a short-term pop. Market outlook:

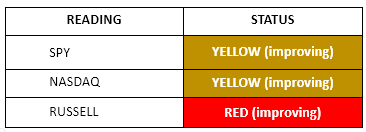

Momentum - Cautiously Optimistic Momentum is showing early signs of life as we head into the week. Futures are green across the board, with oil, metals, and gold higher, and even Bitcoin catching a bid. The market’s cheering signs that the government shutdown could finally end, lifting some of the fog around the Fed and the missing economic data. The tone has shifted since Friday, and pressure in the pipes has been improving as capital creeps back into risk assets. The S&P and Nasdaq ended the week just about yellow, but we’ll likely see them flip back positive this morning. The Russell remains negative, the damage there a little deeper, but even it’s showing signs of recovery. Across the market, about 60% of stocks are still below their 50-day averages, so the broader trend hasn’t turned yet. We’ll be watching for that to improve as liquidity comes back online this week. Energy and real estate were the only green sectors heading into the weekend, but that could change quickly if momentum continues to build. For now, we’re cautiously optimistic. Insider Buying: A Couple Big Buys

Top Insider Buys of Last 10 Days - Form 4 Documents Market Liquidity Liquidity should get a short-term boost as Washington finally moves toward ending the shutdown. Once Treasury operations restart, cash will start flowing again as agencies pay vendors, contractors get caught up, and data starts rolling in. That alone will loosen conditions for a bit, even if it’s just temporary. Under the surface, though, liquidity remains tight. The Chicago Fed’s financial conditions index shows another week of tightening, and global funding markets haven’t relaxed much. Yields are back near 4.12% on the 10-year and rising as bonds get dumped for the risk-on appetite starting to return. The dollar’s steady, suggesting stress is still there, just less visible. The Fed’s emergency window did its job last week, stepping in to calm short-term funding stress and keep markets liquid. That’s what you want to see—a system that can respond fast enough to stop a wider contagion. So far, it’s worked. Ending the shutdown helps, but the real test will come when Treasury ramps up borrowing again later this month. For now, we’ll take the breathing room. Stay positive. Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "The Great Reopening..."

Post a Comment