The Real Reason Stocks Are Selling Off By Larry Benedict, editor, Trading With Larry Benedict After a long absence, volatility is finally returning to the stock market. The S&P 500 is a little over 3% off the high, while the Nasdaq Composite has dropped by 5%. Those declines are still modest. But the pullback in some of the market’s biggest winners is growing more noticeable. That includes Palantir (PLTR), which has shed 17% in just four trading sessions. Robinhood (HOOD) is nearly 19% off the high from October. Even Nvidia (NVDA) isn’t immune to the pullback. It’s down 13% in a week. More speculative areas of the market are starting to get hit hard. And there’s one important reason why… Easy money has played a big role in driving stock prices higher. And now it is emerging as a headwind for the rally. So today, let’s look at what could finally pour cold water on the market’s incredible rally… But before we turn to that, if you enjoy this e-letter, I’d be very grateful if you recommended it to a friend. You can click here to forward it. Thank you! An Uncertain Outlook The Federal Reserve has cut interest rates by a quarter point at two consecutive meetings. But now Fed Chair Jerome Powell choked investors’ hopes for additional rate cuts. Last month, Powell commented that a “further reduction in the policy rate at the December meeting is not a forgone conclusion.” And Powell’s hardly the only Fed member to voice concerns about cutting rates again. Other central bank officials are sounding the alarm on additional cuts as well. Fed Vice Chair Philip Jefferson said recently it “makes sense to proceed slowly as we approach the neutral rate." Other officials shared similar messages, and that’s shifting the outlook for additional rate cuts. Near the end of October, market odds for a cut at the December meeting were running over 95%. Now those odds have recently dropped as low as 62%. And it’s not just the December meeting that’s suddenly in question. The entire rate-cutting cycle could be over just as quickly as it began. Here’s why that could spell bad news for the rally… Tune in to Trading With Larry Live

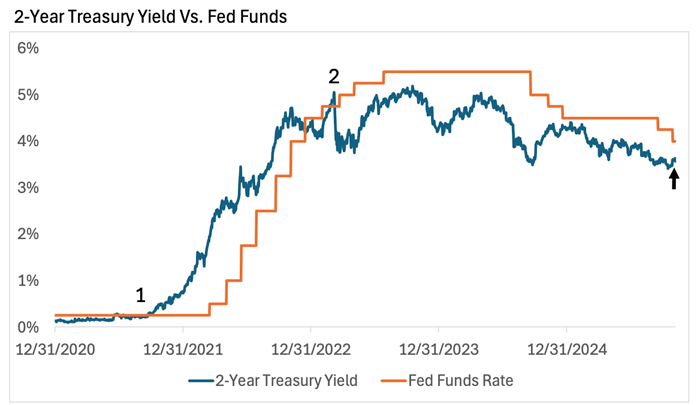

Each week, Market Wizard Larry Benedict goes live to share his thoughts on what’s impacting the markets. Whether you’re a novice or expert trader, you won’t want to miss Larry’s insights and analysis. Even better, it’s free to watch. Simply visit us on YouTube at 8:30 a.m. ET, Monday through Thursday, to catch the latest. | Easing Cycle Over? For clues on what lies ahead for the short-term fed funds rate, pay close attention to the 2-year Treasury yield. The 2-year yield tends to lead changes in the fed funds rate. Here’s a chart comparing the two:

Source: Bloomberg (Click here to expand image) You can see when the Fed started raising the fed funds rate (orange line) in 2022. Yet the 2-year yield (blue line) was already surging ahead at “1.” Then the 2-year yield dropped below fed funds back in March 2023 at “2,” which flagged the easing cycle now underway. So look at what’s happening now at the arrow. Fed funds and the 2-year yield are converging at the same level. That is the market’s way of suggesting that the Fed could cut once more… and then be on hold. And that rate outlook could come back to bite investors… Falling interest rates make future profits worth more in today’s terms, and vice versa. Growth stocks’ earnings potential is often way off in the future. So their valuations are even more susceptible to interest rate changes. That’s why the prospect of more rate cuts was boosting the market in general… particularly in speculative growth stocks. But areas of the market with excessive valuations, including technology and growth stocks, are the most exposed to a less-friendly rate outlook. These are the very stocks propping up the market. So if a shifting rate outlook causes investors to rethink valuations, there could be much more downside waiting for investors. Happy Trading, Larry Benedict

Editor, Trading With Larry Benedict P.S. Last week, I revealed how anyone armed with my calendar of "Trump’s 24-Hour Profit Windows” has a chance to pocket hundreds or thousands in ONE day… You can catch the encore presentation for a few more days. I went 20 consecutive years without a losing year. I generated $274 million for my elite clients. I even made more than $8 million in a day. All with a simple strategy I learned on Wall Street. Now traders I’ve helped use this strategy are banking amazing wins… like “seven days, my profit is $8,250”… "$40k in the past two months!" … and "$52,014 in 26 trading days." If you’d like to see how it works… Please be sure to watch before this goes offline. Free Trading Resources Have you checked out Larry’s free trading resources on his website? It contains a full trading glossary to help kickstart your trading career – at zero cost to you. Just click here to check it out. | |

0 Response to "The Real Reason Stocks Are Selling Off"

Post a Comment