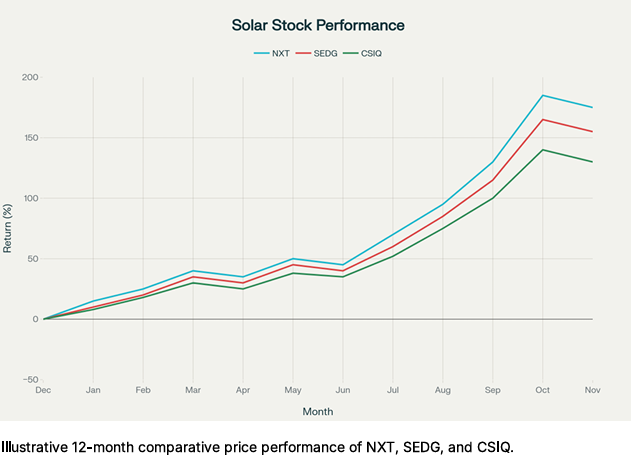

| VisionWave Holdings (NASDAQ: VWAV) has built a rare position in the advanced defense-technology landscape by combining proprietary AI radar systems with real-world validation across several allied defense programs. Its Vision-RF and Evolved Intelligence™ suites enable autonomous detection, classification, and intelligence fusion in highly contested environments—capabilities essential for counter-UAS missions, border security, and next-generation ISR operations. With more than 50 patents and multiple successful field pilots, VWAV is now transitioning from proof-of-concept testing to the early stages of procurement cycles across the U.S., Middle East, India, and Israel. To accelerate this shift into full commercialization, VisionWave has strengthened its leadership bench with high-stakes geopolitical and military expertise. The additions of Admiral (Ret.) Eli Marum—one of Israel's most accomplished naval commanders—and Ambassador (Ret.) Ned L. Siegel provide instant credibility, procurement insight, and diplomatic reach across key allied markets. Paired with UK defense policymaker Ben Everitt, the company has assembled a uniquely global advisory structure designed to help convert active evaluations into multi-year production contracts. With a clean balance sheet, a secured $50 million equity line, and rising international demand for autonomous defense solutions, VisionWave may be approaching one of the most significant growth phases in its history. See how VWAV is positioning itself at the forefront of global defense-AI transformation Today's editorial pick for you 3 Solar Stocks Ready to Shine Brightly in 2026Posted On Dec 02, 2025 by Chris Markoch  Solar stocks, like many renewable energy stocks, were supposed to crater with an administration that is sunsetting the subsidies implemented in the Inflation Reduction Act (IRA) that was passed in 2022. Table of ContentsThat hasn't been the case. Instead, the industry has shown its resilience and is now one of the best options to meet the demand for electricity from artificial intelligence (AI) and data centers. Let's start with the bad news. The subsidies will come to an end. For residential projects, the news is straightforward. The 30% federal tax credit will expire on December 31, 2025. That means you can only claim the credit if your residential solar system is fully installed by the end of the year. The commercial side of the equation is more complicated due to "start construction," "safe harboring," and other provisions that could extend the subsidies through 2029 in some cases. However, we now operate in a more favorable interest rate environment, and many companies have made significant power purchase agreements (PPAs) involving solar power. That’s why the current run in solar stocks is likely to run into 2026 and beyond. You could get exposure to the sector through the Invesco Solar ETF (NYSEARCA: TAN). That fund is up 44.4% in 2025. However, if stock picking is more your style, here are three solar stocks to consider. Solar Stocks to Buy: Canadian SolarCanadian Solar Inc. (NASDAQ: CSIQ) has a diversified, vertically integrated business model, making it one of the more fundamentally stable companies in the global solar value chain. What makes Canadian Solar especially compelling today is its growing emphasis on energy storage, one of the highest-growth segments in clean energy. Storage provides recurring revenue opportunities and improves project economics, insulating the company from module price swings. With new production capacity coming online and a balanced mix of contracted and merchant projects, Canadian Solar is positioned for steady revenue growth. As governments ease solar incentives, Canadian Solar's global reach and cost discipline make it a reliable long-term play among solar stocks. For all the positive reasons to own CSIQ stock, you may want to wait for a pullback. As of December 1, 2025, the stock was trading about 33.58% higher than its consensus price target of $18.58. The company now faces valuation concerns after a weak earnings report in mid-November that showed a strain on margins. Having said that, the stock dropped about 40% from its 52-week high of around $33 per share in mid-November. The pullback was due to a weak earnings report, but the stock found support around $21 per share. That was due, in part, from the company's announcement that it would resume direct oversight of its U.S. operations and continue reshoring manufacturing to North America. As part of that strategy, Canadian Solar plans to launch joint ventures with American companies in the solar, storage, and power industries. Solar Stocks to Buy: SolarEdgeSolarEdge Technologies (NASDAQ: SEDG) is widely recognized for its power optimizers and inverters. These are critical components that improve the efficiency and economics of solar-powered systems. The company faced a significant industry downturn over the past two years due to excess channel inventory and slowing European demand; the reset appears to be nearing completion. SolarEdge has been shifting toward higher-margin commercial and utility-scale solutions, and early signs point to improving profitability as inventory normalizes. The company's technology advantage remains its strongest differentiator. SolarEdge systems allow operators to monitor and control the performance of each panel individually, improving output and reducing maintenance costs. This capability is becoming increasingly important as solar systems scale and customers demand more predictable performance. SEDG stock is up 142% in 2025 and that includes an approximate 30% pullback from the 52-week high the stock made in November. The stock drop was in sympathy with Canadian Solar and other solar stocks, so it may present investors with a buying opportunity when bullish sentiment returns. Solar Stocks to Buy: NextpowerNextpower (NASDAQ: NXT) is emerging as a meaningful growth story in the solar sector by focusing on high-efficiency panel technology and grid-ready development projects. While smaller than the established industry leaders, the company benefits from a strategic shift toward utility-scale deployments, where demand remains strong despite broader market volatility. Nextpower's competitive edge lies in its ability to produce panels with improved energy density, which allows developers to generate more power using less land. This is an increasingly important advantage as global solar capacity expands. In recent quarters, the company has also emphasized strengthening its balance sheet and improving cash flow, signaling a move toward long-term financial sustainability. New partnerships in Europe and Asia position the company to diversify revenue and reduce reliance on any single market. Like the other solar stocks in this article, NXT stock is down over 20% from its 52-week high in mid-November. However, the stock is now trading about 10% below its consensus price target. And many analysts have been raising their price targets to levels well above the consensus price. The Final Word on Solar StocksSolar energy’s next growth phase will come from companies proving they can operate profitably without relying on subsidies. Canadian Solar, SolarEdge, and Nextpower all demonstrate that shift. Each is positioned to benefit as solar adoption rises, and investors look for renewable energy solutions that deliver reliable, near-term results.  This message is a PAID ADVERTISEMENT for VisionWave Holdings Inc (NASDAQ: VWAV) from Interactive Offers. StockEarnings, Inc. has received a fixed fee of $8000 from Interactive Offers for multiple Dedicated Email Sends, Newsletter Sponsorships and SMS Sends between Dec 03, 2025 and Dec 09, 2025. Other than the compensation received for this advertisement sent to subscribers, StockEarnings and its principals are not affiliated with either VisionWave Holdings Inc (NASDAQ: VWAV) or Interactive Offers. StockEarnings and its principals do not own any of the stocks mentioned in this email or in the article that this email links to. Neither StockEarnings nor its principals are FINRA-registered broker-dealers or investment advisers. The content of this email should not be taken as advice, an endorsement, or a recommendation from StockEarnings to buy or sell any security. StockEarnings has not evaluated the accuracy of any claims made in this advertisement. StockEarnings recommends that investors do their own independent research and consult with a qualified investment professional before buying or selling any security. Investing is inherently risky. Past-performance is not indicative of future results. Please see the disclaimer regarding VisionWave Holdings Inc (NASDAQ: VWAV) on EQUISCREEN website for additional information about the relationship between Interactive Offers and VisionWave Holdings Inc (NASDAQ: VWAV). StockEarnings, Inc |

Subscribe to:

Post Comments (Atom)

0 Response to "📈 The AI Defense Megatrend Is Here"

Post a Comment