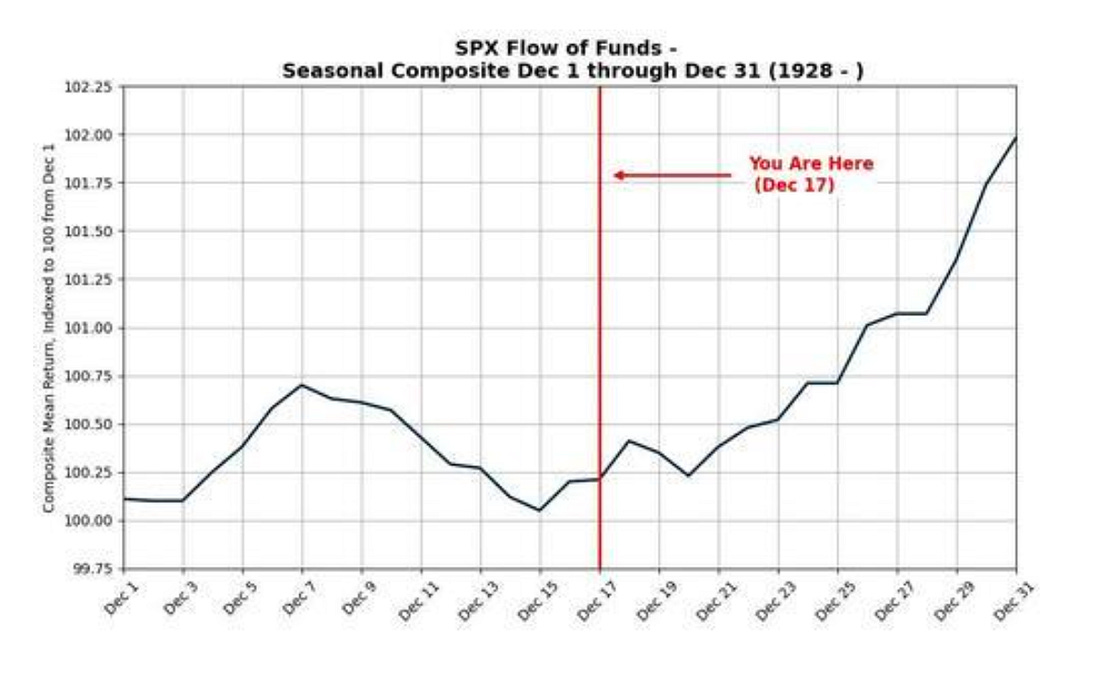

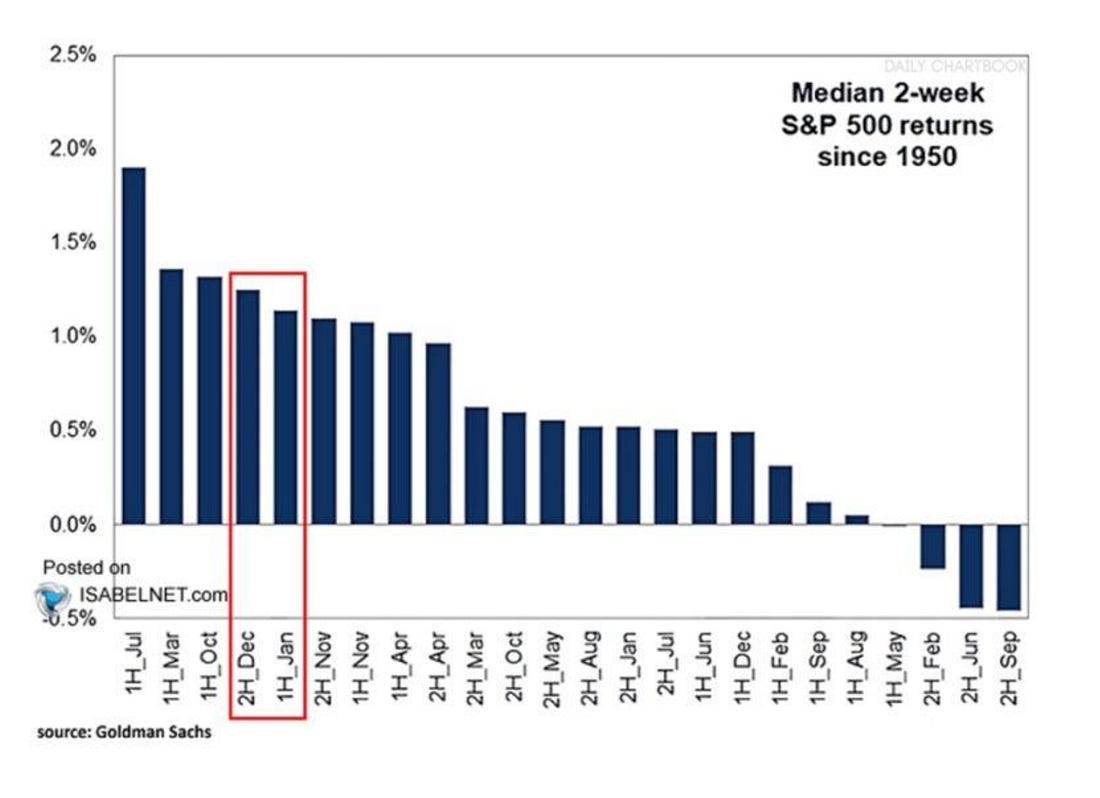

Good morning: We start the day in the trenches. I’m bullish heading into the end of the year… It’s time to pay attention to the anomalies at the end of the year. As we continue to dig out of that negative Russell 2000 momentum reading from two weeks ago, we look for contrarian activity to the upside for the next two or three weeks. Markets aren’t timeless machines. Calendars, mandates, tax rules, and human behavior govern them. But every so often, those forces line up into something persistent… An anomaly. This chart shows one of the most durable… The late-December turn higher in the S&P 500. Built from data going back nearly a century, it captures a simple structural truth. Early December is noisy. Mid-month softens. Then, around the final stretch of the year, the curve tilts upward with surprising consistency. This isn’t optimism. It’s really just an absence of volatility and selling. By late December, tax-loss selling is largely finished. Institutional books are closed. Risk managers stop tightening. Volumes fall. Marginal sellers disappear. When selling pressure collapses, prices don’t need good news to rise. They drift higher because nothing is leaning against them. That’s the Santa Rally stripped of folklore. Not cheer. Not hope. Just flows, plumbing, and probability. And historically, this is when the calendar stops fighting the tape. Don’t be shocked if we’re green across the board by January 1… But there’s something else that investors have to watch… We know that the Fed is providing support to the global markets… Japan is doing everything it can to not rock the boat. But we can’t leave out China. ... Continue reading this post for free in the Substack app |

Subscribe to:

Post Comments (Atom)

0 Response to "Morning... Green (SPY) and Rising Energy"

Post a Comment