| Dear Reader, If millionaire investor Brad Thomas seems familiar, that could be because you've seen him before... He's been on Bloomberg, Fox & Friends, Barron's, CNN, Kiplinger, NPR, MSNBC, and Forbes. He's invested in and negotiated over a billion dollars in deals with companies like Walmart and McDonald's. He's interviewed well over 100 CEOs, business leaders, and billionaires - folks like the late Sam Zell, Kyle Bass, and Kevin O'Leary... He was even selected as a key advisor to President Donald Trump... and became a close personal friend. But now, he's focusing on something even bigger. He's revealing a new opportunity he calls "President Trump's real estate deal for America"... According to him, it could allow regular Americans to collect legally mandated payouts, set to benefit from a new Executive Order signed by the President. Click here to get the full details. Regards, Van Bryan

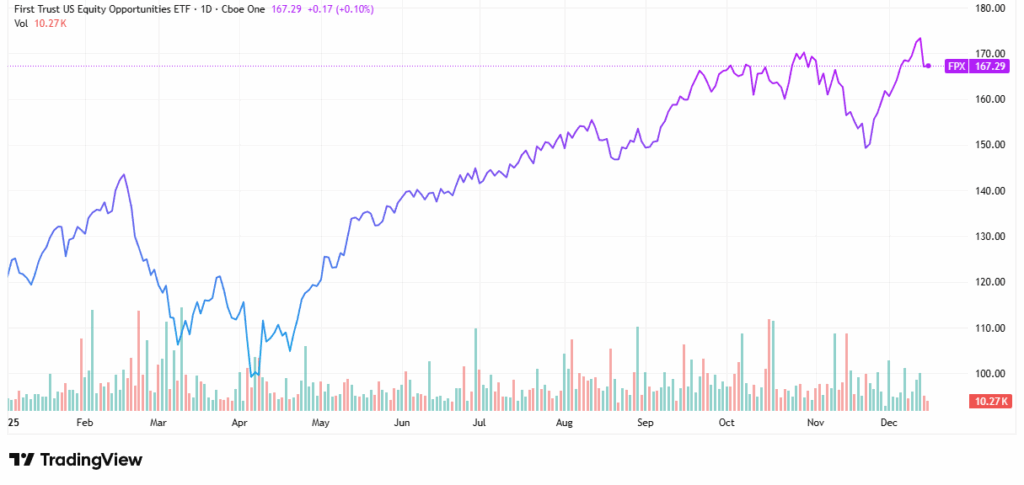

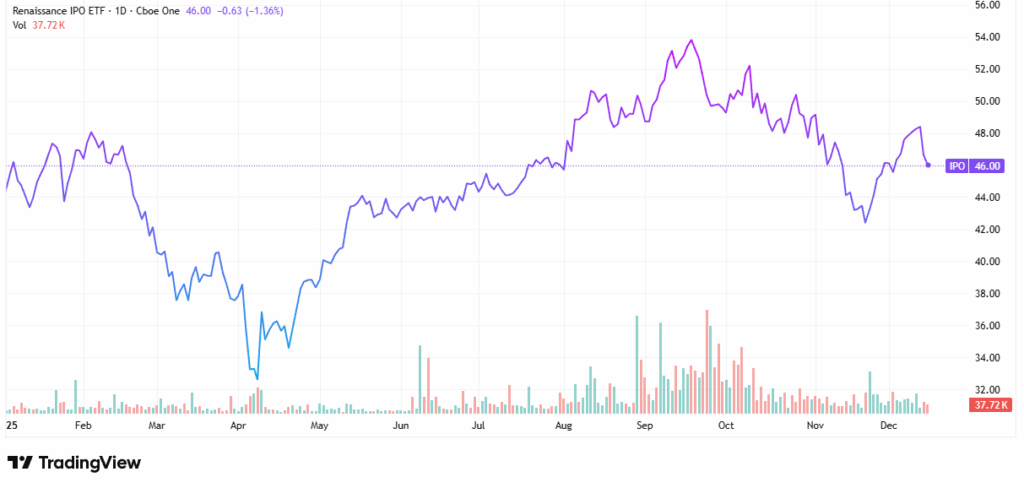

Today's editorial pick for you How to Trade SpaceX Without Trading SpaceXPosted On Dec 15, 2025 by Ian Cooper Many owners would love a chance to own a piece of SpaceX. That explains the enthusiasm from Elon Musk’s announcement that he plans to go public sometime in 2026. According to Bloomberg, the initial public offering (IPO) may take place in "mid-to-late 2026," or it may slip into 2027. Table of ContentsHowever, the SpaceX news is also a reminder that one of the best ways to invest in an IPO is by not investing in an IPO at all. That's because investing in IPOs is a coin flip. One of my favorite flops was the Ferrari IPO flop in 2015. Here was a $12 billion IPO rolling on to the showroom floor, oversubscribed 10 times over. Investors were excited. Anticipation was high. The press noted it could be a hot runner even though the company had just said net profits fell 34%. Unfortunately, the IPO was a flop. Shares would plummet from $60 to $33 in days. Millions of dollars were wiped out. However, investors can also find examples of Amazon-type IPOs that just explode out of the gate and keep running. So which one of these scenarios is more likely for SpaceX? There's the potential for Elon Musk's SpaceX to raise more than $25 billion in 2026, and would reportedly include Starlink, SpaceX's satellite-based broadband service, and continued progress in its ambitious Starship program aimed at lunar and Mars missions. Unfortunately, it's that coin flip that makes IPO investing terrifying for many investors. While you can always take your chances with a bet on an IPO, there are easier ways, particularly with fund investing. Here are two exchange-traded funds (ETFs) to consider. First Trust US Equity Opportunities ETFOne, invest in the First Trust US Equity Opportunities ETF (NYSEARCA: FPX). With an expense ratio of 0.61%, the FPX tracks hot IPOs, giving investors access to new stocks during their initial, most crucial days on the market. By buying it, not only can you avoid paying gobs of money for IPOs that may or may not work out, but you're also being exposed to multiple hot IPOs at the same time at a lesser cost. In fact, even with some of the most obnoxious IPO failures, the ETF managed to run from a 2009 low of around $11 to a recent high of $171. It's a safer alternative than risking your hard-earned money to another potential coin flip. With the FPX, it doesn't matter if the stock is hot or a dud; the excitement surrounding IPOs continues to send the FPX to new highs.  Renaissance IPO ETFAnother option is the Renaissance IPO ETF (NYSEARCA: IPO). With an expense ratio of 0.6%, the ETF provides "investors with the largest, most liquid US-listed newly public company stocks in one security, reducing the risk of single-stock ownership while avoiding overlap with major core indices for optimal diversification across markets and time," as noted by Renaissance Capital. Since November 2023, the ETF rallied from a low of about $30 to its current price of $48. From here, we'd eventually like to see the ETF rally back to $60 a share, which it last tested in 2022.  Here’s Why the SpaceX IPO MattersThe SpaceX IPO matters not just because of Elon Musk's star power, but because it highlights how emotionally charged IPO investing can become. When a company captures public imagination—whether it's Ferrari, SpaceX, or the next tech disruptor—valuation discipline often takes a back seat. That's when risk quietly rises. For most investors, the lesson isn't to chase or avoid IPOs entirely, but to rethink how they participate. IPO-focused ETFs offer exposure to innovation, momentum, and growth without tying your financial outcome to a single launch or failure. If SpaceX ultimately delivers a successful IPO, these funds can still benefit. If expectations fall back to Earth, diversification helps soften the blow. In the long run, managing risk often matters more than catching headlines. This is a PAID ADVERTISEMENT provided to the subscribers of StockEarnings Free Newsletter. Although we have sent you this email, StockEarnings does not specifically endorse this product nor is it responsible for the content of this advertisement. Furthermore, we make no guarantee or warranty about what is advertised above. Your privacy is very important to us, if you wish to be excluded from future notices, do not reply to this message. Instead, please click Unsubscribe. StockEarnings, Inc

|

Subscribe to:

Post Comments (Atom)

0 Response to "Trump’s “real estate deal for America” explained"

Post a Comment