Sharpen Your Trading Edge By Larry Benedict, editor, Trading With Larry Benedict New traders can waste a lot of time and energy. They try to analyze a stock… but fill their chart with all sorts of noise from too many different indicators. They chase hot stocks… and end up jumping from one trading strategy to another. And they don’t establish clear risk parameters for their trades… and wind up kicking themselves when things go against them. I say this as a voice of experience. Over my 40-plus years of trading, I’ve made every rookie mistake you can think of. Early on, I blew up my own account more times than I care to recall. That’s why I know it’s vital to nail down certain factors if you want to be a successful trader. Once I discovered the power of having a disciplined approach, I went on to deliver 20 consecutive profitable years to my hedge fund clients. Being disciplined comes down to a couple of things. One of the most important is determining how you are going to select trades. Think of it as your trading edge. Successful traders are obsessive about developing their edge. They stick to a formula that works for them… and they don’t change on a whim. So today, let me pull back the curtain on how to find your edge… Developing Your Edge Most experienced traders fall under one of two categories when it comes to developing their edge: trend following and mean-reversion. Trend following is exactly what it sounds like. Traders attempt to spot a price trend and get in as soon as possible. Think of it like a surfer catching a wave. Trend followers try to catch the wave as it starts emerging and ride that wave for as long as possible. On the other side, mean reversion looks for a price trend that has gone too far in one direction and is ready to reverse course. A mean-reversion trader wants to profit as the wave starts to crest and roll over. A sudden change in direction is a profit opportunity. Most of my trades fall under the mean-reversion category. Knowing when a trend is about to reverse course is a trading edge that has served me well. That’s because I know how to leverage big gains in a short period of time from a change in price direction… up or down. Let me show you how I used my edge to bag an 87% gain in just six days on a rebound in beaten-down oil prices. Tune in to Trading With Larry Live

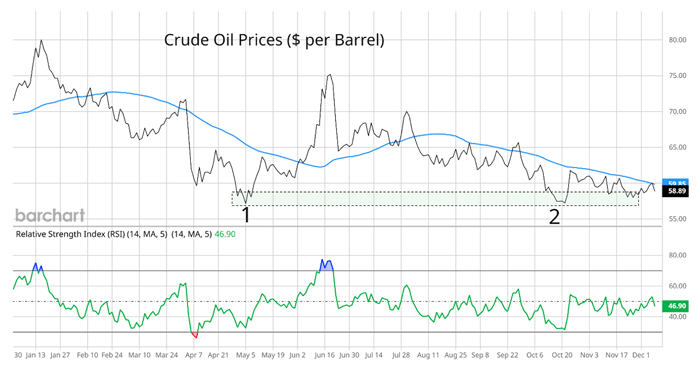

Each week, Market Wizard Larry Benedict goes live to share his thoughts on what’s impacting the markets. Whether you’re a novice or expert trader, you won’t want to miss Larry’s insights and analysis. Even better, it’s free to watch. Simply visit us on YouTube at 8:30 a.m. ET, Monday through Thursday, to catch the latest. | Oil’s Sell-Off Was Too Extended Since late 2023, oil prices have been stuck in a downtrend with a series of lower highs and lower lows. That pushed oil near the lowest levels seen over the past four years. But in late October, oil approached a critical level that saw prices reverse higher earlier in the year. Here’s the chart of oil below.

(Click here to expand image) Back in May, oil prices staged a rebound off the $57 level at “1.” In October, oil came back to test the $57 area at “2.” That test is where the potential for a mean-reverting move developed. Not only was the $57 level price support, but oil prices were extended far below the 50-day moving average (blue line). The Relative Strength Index (RSI) was also showing signs of being oversold on oil’s test of $57. The RSI measures underlying price momentum, and it was falling toward the 30 level that marks oversold territory. The RSI has only been more oversold on just one occasion this year. The combination of price support along with oversold conditions helped spark a rebound in oil prices. I recommended call options on the United States Oil Fund LP (USO), which tracks oil prices, to subscribers in One Ticker Trader on October 17. Call options are designed to gain in value when the price of an underlying security is moving higher. In just six days, the rally in oil prices allowed us to walk away with an 87% gain. That’s just one example of trading a mean-reversion setup. And it shows how options can magnify price movements into much larger gains. Whether you decide to specialize in mean reversion or any other trading strategy, the important thing is to find your area of focus and hone your edge until you can pinpoint trading opportunities just like this one. Happy Trading, Larry Benedict

Editor, Trading With Larry Benedict P.S. As we reach the end of 2025, most of us will start to look at the year ahead. One of the best ways to get your 2026 off to a good start is by joining One Ticker Trader and taking advantage of my trading expertise. As of this writing, we’ve maintained an 85% win rate. Even if you only traded one contract for each of the recommendations this year, you could have made $1,956 in profits. If you traded two contracts, you’d be up $3,912… and so forth. And I’m incredibly excited about the year ahead of us. I believe volatility is going to create an environment where savvy traders can thrive. If you’d like to learn more about how One Ticker Trader works… and get a great deal for trying it out… then simply check out my recent presentation here. Free Trading Resources Have you checked out Larry’s free trading resources on his website? It contains a full trading glossary to help kickstart your trading career – at zero cost to you. Just click here to check it out. | |

0 Response to "Sharpen Your Trading Edge"

Post a Comment