Below is an important message from one of our highly valued sponsors. Please read it carefully as they have some special information to share with you.

The #1 AI Investment

Elon + Nvidia =

Dear Reader,

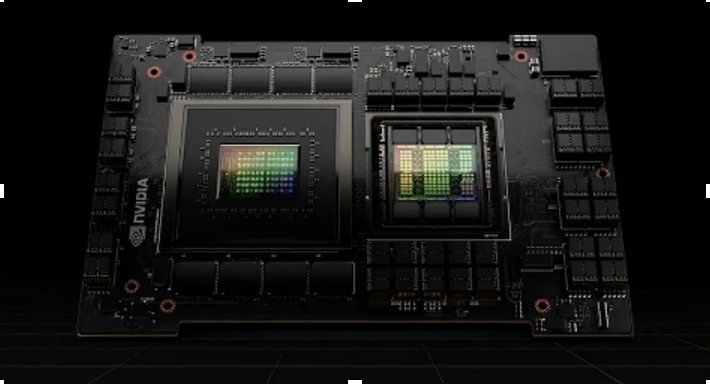

Do you see this weird looking device?

This is Nvidia’s holy grail.

It contains over 3 terabytes of memory…

80 billion transistors…

And can perform over 60 trillion calculations… per second.

This single computer chip goes for $25,000 a pop.

And now…

Elon Musk…

The world’s richest man…

Alongside Nvidia’s CEO Jensen Huang…

Are about to crank it up to 1 million.

At a remote facility in Memphis Tennessee…

You two of them have teamed up with an emerging tech titan…

To build the most advanced AI machine on the planet…

Powered by 1 million of these advanced AI chips.

This Will Unlock the TRUE Power of Artificial Intelligence!

But before you rush out to buy shares of Tesla or Nvidia…

There’s another investment you must consider.

You see, there is ONE company…

That Elon … and Nvidia…

And 98% of the Fortune 500…

Are ALL working with…

To prepare for AI 2.0.

Nvidia’s CEO has even said – this company is ESSENTIAL to their ongoing expansion.

>>>See how you can invest in this revolutionary company today.

Elon is expanding this project RAPIDLY…

And just announced a second AI computer…

That will need this company in order to build.

This may be the single greatest way to build wealth from the AI bull market.

But you must take action immediately.

AI is quickly becoming one of the MAIN focuses in Trump’s new administration…

And once Wall Street sees what this AI can really do — it will be too late.

>>>Go here to learn how to invest in Elon new AI venture.

Regards,

James Altucher

Editor, Paradigm Press

Just For You This ETF Caught a Major Tailwind After the Fed's Rate CutBy Jordan Chussler. Article Posted: 12/20/2025.

Quick Look- The financials sector is up 4.18% over the past month and may use the Federal Reserve’s final interest rate cut of the year to carry momentum into 2026.

- Banks and other lenders are likely to see net interest margin gains as a result, which will act as a boon heading into the new year.

- The Vanguard Financials ETF holds a basket of top-rated companies operating in the sector, ideal for investors who want broad exposure.

After finishing 2024 with the third-best performance of the S&P 500's 100 sectors, the financial sector is closing out 2025 with strong momentum that could carry into 2026. Over the past month the sector has risen 4.18%. After the Federal Reserve enacted its third and final interest-rate cut of the year, banks, insurance companies, credit-service firms, fintechs and payment processors that make up the financials sector are well-positioned for a strong start to 2026. A former hedge fund manager known for cutting through market noise is briefly opening access to his flagship trading strategy. In a short demo, he explains how his "One Ticker" approach works — and how readers can access the full service for a year at a steep discount. Watch the brief demo here For investors seeking broad exposure, the Vanguard Financials ETF (NYSEARCA:VFH) is an all-in-one fund worth considering. Rate Cuts and the Market's Rotation Are Bullish for FinancialsOverall, the financials sector has marginally trailed the S&P 500 this year, rising nearly 13% versus the S&P 500's gain of just over 14%. With a gap of less than two percentage points, financials have remained resilient even as investors poured money into the tech and communication services sectors, which include the Magnificent Seven and many pure-play AI stocks. As the market rotation accelerated after valuation and AI bubble concerns peaked in late October, the financials sector has been a cyclical beneficiary. On Dec. 17, billionaire investor Ronald Baron told CNBC's "ETF Edge" that investors should look across market caps and sectors for the best opportunities — including a rotation out of tech and into value, which can be found in financials. "There are so many companies that are interesting right now with everyone focusing on technology," Baron said. After the Federal Reserve cut interest rates at its December Federal Open Market Committee (FOMC) meeting, many of those opportunities now fall into the financials sector. The sector should benefit from increased lending as lower rates reduce borrowing costs. While steeper cuts can compress net interest margins, higher loan volumes can offset that and improve profitability. This dynamic is likely to play out over the coming quarters as rates move lower following the Fed's December cut. Annual percentage yields (APYs) on banking products — including high-yield savings accounts, money market accounts and certificates of deposit — have already declined since the FOMC meeting concluded on Dec. 10. Another reason the Fed's rate cuts are bullish for financials: lower rates typically reduce debt burdens and, in turn, decrease default and delinquency levels for financial institutions. VFH: Breaking Down the FundThe Vanguard Financials ETF is broadly diversified across the sector. Banking (28.1%), capital markets (24.5%), insurance (21%) and diversified financial services (15.9%) make up the bulk of the fund's weighting. That produces a balanced allocation, with the ETF's top 10 holdings including: JPMorgan Chase (NYSE: JPM), Berkshire Hathaway (NYSE: BRK), Mastercard (NYSE: MA), Bank of America (NYSE: BAC), Visa (NYSE: V), Wells Fargo (NYSE: WFC), Goldman Sachs (NYSE: GS), American Express (NYSE: AXP), Morgan Stanley (NYSE: MS), and Citigroup (NYSE: C). Just outside that group are Charles Schwab (NYSE: SCHW), BlackRock (NYSE: BLK), and Blackstone (NYSE: BX). VFH's net expense ratio of 0.09% is modest compared with its dividend yield of 1.54% (about $2.05 per share annually). The fund has $13.36 billion in assets under management, and based on 493 analyst ratings of the 24 companies in its portfolio, the ETF carries an aggregate Moderate Buy rating. What Wall Street Thinks About the VFH for 2026Institutional investors have shown conviction in the Vanguard Financials ETF, contributing $1.42 billion of inflows over the past 12 months versus $715 million in outflows. Perhaps most telling, however, is how few short sellers are betting against the fund. Current short interest in VFH stands at a minimal 0.37%, or roughly 375,011 shares.

|

0 Response to "Nvidia x 1,000,000"

Post a Comment