You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. Twelve Hours of Constant Thought...We finish the year with a lot of new friends... Warren Buffett's departure from Berkshire... metals trading like cryptocurrency... and my desperate need for a nap today.Good morning: Right off the bat, thank you to Josh Brown and his great team at the Compound last night. A few hundred people have signed up for this Substack in the last 11 hours… so I want to welcome you all to this community… That said… I want to inform you that this email this morning is the Paid Letter of “Me and the Money Printer.” It’s called the Capital Wave Report… It’s a daily morning letter that covers pre-market updates, our momentum signals, updates on insider buying, and liquidity measures. You’ll get it… pretty quickly… If you want to sign up for a month, please do so right here. No pressure. Me and the Money Printer is free and typically arrives in the afternoon and weekends. You’re already signed up and you don’t need to do anything. Postcards runs on weekends. Yes, I create a lot of financial content… as I’m constantly doing research… I felt it necessary, however, to welcome you all this morning and give you a preview of the Capital Wave Report (which is complimentary for today and a few times a month). To “get started” with the Capital Wave Report - I’d recommend you read this article… It runs through the various elements with citations and the worldview. If you’d like a longer explanation of what we’re trying to accomplish - which is risk management, looking for momentum reversals, and aiming to time tops and bottoms - then please watch this video called How the Stock Market Works… which fuses the concepts of Howell’s Liquidity, various momentum signals, and my insider buying research… plus a focus on policy, insurance stock signals, and much more… I will gladly admit that I’m not 100% right about what I’m preaching here… but the mission remains the same… and the letter has helped a lot of people save money during periods of sharp downturns… and avoid panicking. After 17 years of research across four universities and thousands of hours of live shows… I’ve concluded that this best fits my risk management style and has delivered me significant success. Across all publications, my purpose remains the same… “to uncover how markets truly work and translate that knowledge so people can protect themselves, seize opportunity, and think independently in a system that rewards confusion.” Finally… if you watched the show last night, I was operating largely on one leg and one lung. I’d been traveling to see New York before the Bolshevik Revolution (I’m kidding…). I think everyone in New York had the flu or a respiratory infection. That didn’t help, as I’ve had this nasty off-and-on cough that comes after a lung collapse last year (as you’ll find I was writing from my hospital bed). It hit really hard last week… and has continued… so I’m trying my best to take it easy. As a result, sleep didn’t come last night. In fact, for 12 hours, I had every thought imaginable, which is common after a larger public appearance. I thought a lot about what I wanted to clarify and things I wished I’d said last night… just how I am. Those clarifications and additional thoughts will come in today’s Money Printer issue… Then, I thought extensively about my friends in New York, the outlook I need to write for 2026 by Friday, Quality Momentum strategies… and my daughter’s year ahead. So… I have to go live - again - in 45 minutes. Sleep will hopefully follow… But first… let’s get you set up for today’s market session. Trader’s FocusMarkets are wrapping up a third straight year of double-digit gains. The S&P is up around 17% for 2025, but everything’s just coasting into year-end. Futures are down 0.2% this morning (7:15 am), with tech getting hit again. Nothing’s really moving… except for some more wild swings in the metals. Intraday pressure on the S&P has been stuck at zero for two days straight. One stock breaking out, one breaking down. Same names both days - Micron (MU) on the positive side, First Solar (FSLR) on the negative. Volatility’s mostly been chopping between 13.50 and 15. Not really going anywhere, just sort of range-bound there. The Russell is weakening. Slipped below its 20-day Tuesday and the 8-day is breaking down over the 20. Most of that’s probably retail tax harvesting, which had to be done by the 30th to settle in 2025. Now that’s behind us, we might drift a little higher today just from that selling pressure lifting. Next week is when things matter. Real money comes back, positioning resets, and we’ll see if momentum builds or if we’re testing lower levels. For now, this is just year-end doldrums. Metals are trading like crypto. Silver swinging 11% in a session, platinum moving 10%. Gold’s been the most stable of the bunch. Bitcoin ticked up 1% overnight. There’s a clear divergence happening. Metals are acting like a canary in the coal mine while crypto and the volatile stuff take a hit. That’s what it looks like when capital gets more expensive. Markets are closed tomorrow. Friday should be interesting with options expiration, but volume will probably stay light. For today, make any last adjustments you need to. Tax harvesting is done. Start thinking about what you want to do in 2026… and we’ll talk about Quality Momentum stocks that could benefit from any rotation to start the year. I’ll be live on Market Masters at 8:45 AM to talk through how we’re setting up for January. You can click here to join the show. Market Headlines

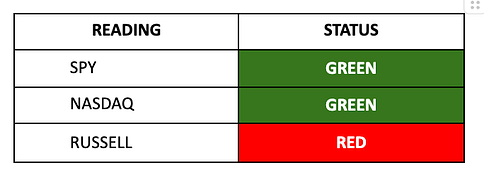

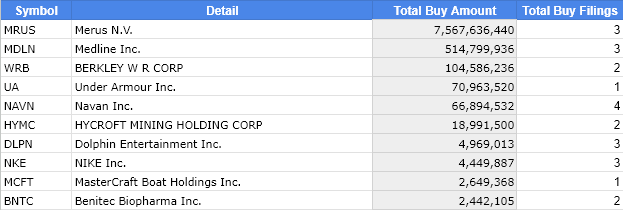

Momentum - Russell Pressure RemainsMarkets are shopping around with no real conviction. The S&P slipped another 0.1% Tuesday for its third straight down session, but the weakness is showing up unevenly. The Russell dropped three-quarters of a percent while the S&P and NASDAQ held up better. The Poor Man’s Intraday pressure on the Russell closed Tuesday at -26. SPY and QQQ are still hovering near even. Capital isn’t rushing out, but it’s not coming in either. Programs are set to maintain through year-end, and with volume at 55% of normal, there’s nobody around to change that. Momentum readings confirm the split. The Russell turned red while SPY and QQQ held green. Eight sectors weakened yesterday, leaving just four with positive readings: Materials, Communication Services, Healthcare, and Real Estate. Everything else is yellow or red. This is a holiday week. A lot of desks aren’t staffed, and that continues through Friday. Maintenance mode until real money comes back next week. Insider Buying: Massive Healthcare Buy

Top Insider Buys of Last 10 Days - Form 4 Documents Market PlumbingThe Fed continues providing support behind the scenes. Repo activity has picked up in recent days, with overnight purchasing agreements running around $12 billion and reverse repo operations adding another $10-12 billion. Add in the $40 billion monthly in purchases, and the plumbing is churning… but is something nasty happening behind the scenes? Some silver analysts are sticking to the thought that certain banks are under pressure… I haven’t confirmed anything… FOMC minutes released Tuesday confirmed most officials expect additional rate cuts if inflation continues to slow. But the divisions among policymakers were clear. Traders are now pricing two 25-basis-point cuts in 2026, down from three earlier in December. As Josh said last night… there really wasn’t anything exciting there… Treasury yields climbed on Tuesday. The 10-year is sitting around 4.12%. The dollar is having its worst year since 2017, down almost 10%. China’s yuan strengthened past 7 per dollar for the first time since 2023 as capital flows shift. Don’t worry… It’s just a matter of time before China chooses a weaker currency against the dollar and yen… The setup heading into April looks range-bound. The Fed isn’t stepping back, but there’s no signal they’re accelerating support either. Liquidity should be sufficient to keep the system functioning. What’s missing is the catalyst to push things materially higher from here. Stay positive. Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "Twelve Hours of Constant Thought..."

Post a Comment