You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. Things I Should Have Said.When you're not thinking at 100%... you sometimes wish you could have added some more color... Here are some followup points to my conversation with Josh Brown last night.Dear Fellow Traveler: I still haven’t fallen asleep. I‘d thought it might be the result of my ongoing battle with a respiratory illness. But maybe I was thinking about the conversation I had with Josh Brown on his show, What Are Your Thoughts. We covered a lot of ground in an hour, and I greatly appreciate everyone’s feedback and the Compound team’s hospitality. It’s been a whirlwind of a few days, and as I said… I’m 44 now, which means I should nap after opinions. Maybe I’ll rightfully pass out after this column. That’d be great for me. And everyone in my house... But then again, I just read that “Banks tapped a record ~$26 billion from the NY Fed’s Standing Repo Facility amid year-end liquidity pressures,” according to FinViz. Which, I realize, sounds boring unless you know what it means. In which case, it’s terrifying. So, maybe I’ll stay up. Anyway… I wanted to follow up on some points from last night. Here are the three things I wish I had gone deeper on in our conversation yesterday. Thing No. 1: On Inequality and Money PrintingI think that the clear line of the night goes to Josh. He noted that the ongoing Fed’s efforts to create stability in the economy - a theme of the last 17 years - have made greater instability.

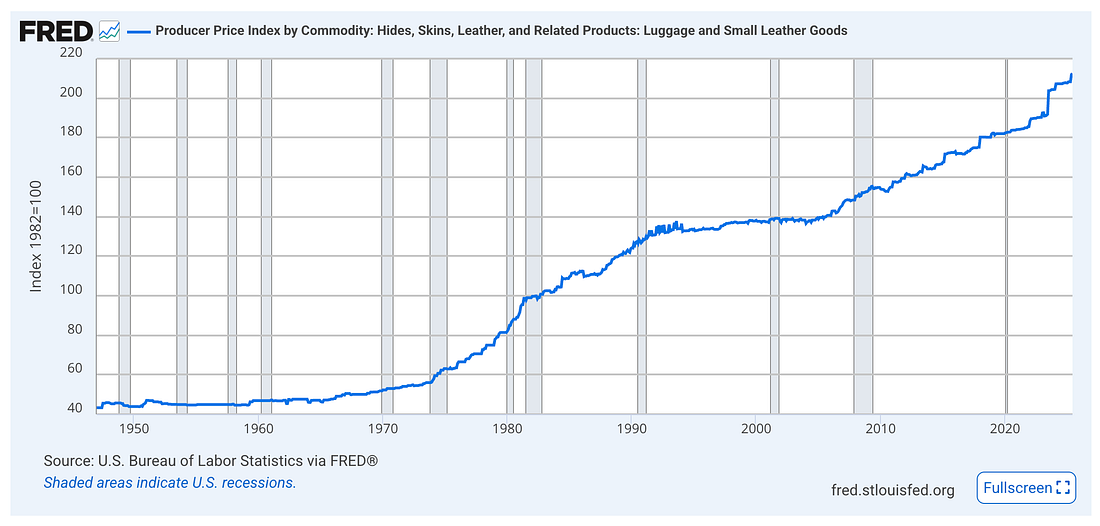

Now, it’s important to note that this figure came from Michael Howell at CrossBorder Capital. He’s tracking the Shadow Monetary Base as part of his Global Liquidity Index. Some people might find that figure too high… depending on how you measure global balance-sheet expansion and fiscal backstops. I find it explains quite a bit about what’s been happening in equity markets over not only the last two years… but the last four years (especially), and certainly in the post-2008 financial environment. But it’s Josh’s second sentence that really matters. The rich have gotten richer, and the pursuit of financial instability has led to clear political instability. A critic might argue - yes, but what’s the cost of no financial stability? That was a question and a lesson from 2008… and it still holds: a Depression would be very bad. Economists agree. So do people. That said, America has moved from crisis to crisis… And that further instability is where my attention has turned. What have people owned in periods of dramatic political instability in global history? Not just in America during the Depression. This has been the historical issue I've been focusing on in Postcards from the Edge of the Earth. That wealth has focused on the things that matter… the historical chokepoints… the things people need. And as I’ve shown, it’s fueled by that extraction concept, which has emerged as a growing theme of the economy, one that goes back through history to the times of Caesar and Jesus of Nazareth. It makes immense sense to own the chokepoints and the extraction sources in an economy that seems to take just a little more. I argue that so much of it is tied to challenges in the financial plumbing, the timing of recoveries, and the access to capital held by certain people via a modern version of the Cantillon Effect. I’ve explained this as best I can… but the rehypothecation and the ongoing injections of liquidity at the front of the curve have, indirectly, created new incentives. It’s not a grift. No one had to coordinate this. That’s the impressive part. It’s just a constant feeling that money is constantly going out the door because of chokepoints in the economy. Also, because companies CAN do it (see Amazon’s payment processing to its vendors and new vendor policies) All this Fed and Treasury activity has pushed up rent, food, and the things that matter. But people who bought a home in 1980 still lecture a kid in college about pulling themselves up by the bootstraps and all that, usually from a house that now costs nine times what they paid for it. The actual cost of small business bootstrapping has increased for small ventures over the last 17 years by an incredible amount. Estimates range from double to triple the costs for startup capital in a bootstrapped environment… Then there’s the actual cost of bootstraps… for boots. You know the ones to hike up? That went up too. Turns out “pull yourself up by your bootstraps” is also subject to inflation. Thing No. 2: In the 1990s and ExpertiseJosh had read a passage of mine from a few weeks ago in which I told readers that we’re really in an unprecedented time… and that it was best to react. There was a bit of a line in there that is a tad condescending - as if I’m the guy with all the answers. But I will say that I had taken a jab at myself as well with that line. When noting that everyone still operates with a 1990s mentality on the markets, there are three things that I want to stress. It was a self-critique and a list of things I learned, only to have a “holy shit” moment when I realized my assumptions were very confident and very outdated. One is the focus on earnings. There is still this vibrant argument that it’s earnings that fully drive equity prices. But the chart we noted was a combination of liquidity flows and valuation expansion, which couldn’t pinpoint its earnings. Something else has happened… and not just in the post-2008 era. I think that inflation targeting and the explosion of passive flows in the 1990s also played a major role in the valuation expansions (and ultimately compressions) of the mid-2000s. I went through all the courses. I believed firmly in the earnings element. And then, sometime around 2018, my perspective changed when I started evaluating cross-border capital flows… Thank you, Forest Reinhart and Chris McKee, for that. That analysis immediately changed my perspective on domestic valuations… and why I don’t really care about price-to-earnings. I care about how much money is sloshing around… because a guy running an ETF that’s tracking the S&P 500 isn’t that stressed about the PE ratio. It’s the Expense Ratio that matters… Second is the historical reflections. How many charts do we see that state: Since 1928, the S&P 500 has done “X” five times… or Since 1971, stocks go up when THIS HAPPENS… That is really at the heart of my statement about the way things have changed and the unprecedented nature of our markets. Consider that the Bank for International Settlements said in April that last year’s implosion of the Nikkei truly highlighted banks' transmission issues. (I wouldn’t be reading these things without great professors like Elie Canetti at Hopkins.) Page 63 of that Report states plainly:

That sentence feels to me like a bomb that went off without anyone hearing it. Which is impressive, considering how loud markets usually are. It was the starting point for six instances in the last 15 months in which the S&P 500 Volatility Index fell by 40% in less than 2 weeks. Before 2011, it had never happened before. That showcases the speed and efficiency with which central bank coordination or actions are happening. Before 2008, a crisis was slow… policy moved slower… now we can be in and out of a 33% decline in a month… and everyone forgets about it. That’s not a big confidence boost for equities as an investment in a business. This isn’t Warren Buffett’s market. It’s something completely different. It’s no coincidence that the Fed is going full bore on Repo at the same time Japan just announced $117 billion in stimulus… all while their inflation levels are elevated… Third is how the markets have changed. It’s no longer a “value-driven” market. Leverage and passive flows dominate. But once again… if you use market timing… and if you follow liquidity… and insiders… You can identify where those flows are going - into which stocks - and focus on the equities that all three major buyers (value arbitrage, passive, leveraged buyers) want. As this liquidity cycle peaks, I’m not sure it's the best strategy for long-term investing… but it will treat traders who follow momentum very well. These are the results of conversations with many people over the years who were willing to challenge my thoughts… and give me grace and guidance… not a lecture. So, that’s a theory that I plan to test in 2026… the list of stocks is pretty simple… Most of them are tied to AI because that’s the big trend in trade. But I imagine we’ll learn which names are more popular in the next week or so. Thing No. 3: On Economic ConditionsI mentioned early on:

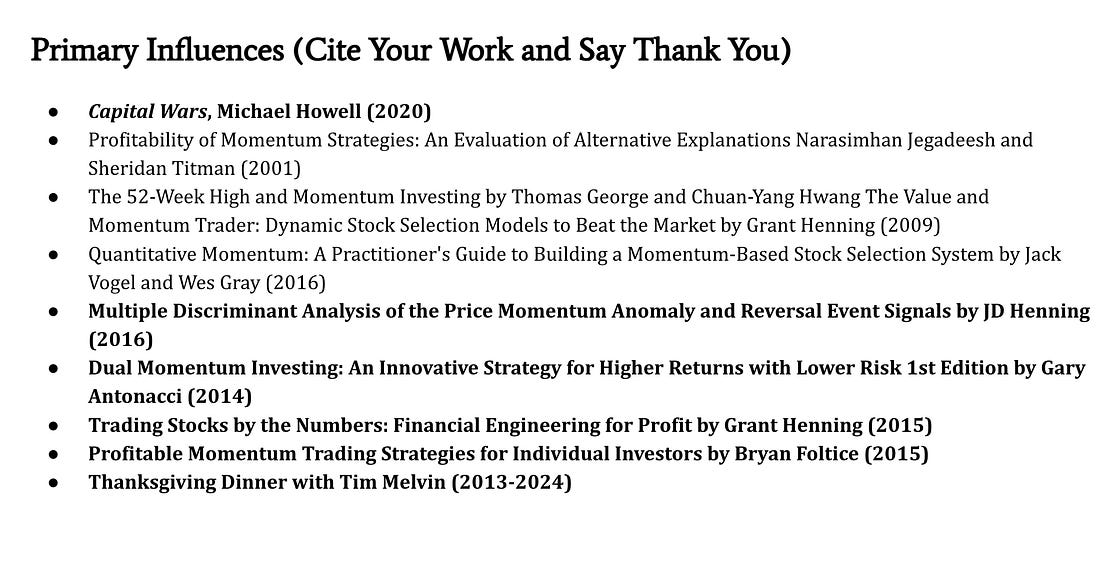

Here’s that combination of images… Take this as you will. And I invite feedback on this observation. I’ve said that the markets are front-running liquidity expectations. You might need to squint a little bit. Hey… causation/correlation… and all that. I could be wrong. But it’s wild to look at and a reminder that despite all the rate hikes and “Quantitative Tightening” we’re operating in some of the loosest economic conditions since the months following COVID. And that’s been good for equities since the 2022 downturn. Wrapping It UpI hope that everyone got a chance to see the interview, and I want to welcome the many new readers who joined us this week. I’m highly committed to continuing my studies, analysis, and theories on the markets and testing them. I long suspected that what I was taught across various schools was somewhat incomplete… or had been undercut by monetary and fiscal forces that we’re still trying to understand honestly. So, I started to fuse a lot of things together… You can see a lot of the sources I’ve fused together over the years right here… Or in that How the Stock Market Works (The Wave Speech) presentation. And I think this has been the year when more people than ever have seen the markets for what they are. What Howell has noted is that it’s a refinancing machine that does very well for momentum-based strategies. And people are paying attention, given his rank on Substack. Timing those strategies has been the highlight of the last five years of my work with people like Tim Melvin, Scott Dunn, and others and studying the collective works of these individuals. Given that I believe all roads will continue to lead to more debt and monetary inflation, I will trade these strategies until they break… but also continue to explore other ways for people to build and protect their money - hence the focus on the extraction strategy over at Postcards. Finally, I will be back on Friday with my 2026 Outlook. It will be much different than the ones we have done in the past - covering the big themes that include…

I’ll circle back with you then. Thanks again for a great year. Oh yeah… Stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "Things I Should Have Said."

Post a Comment