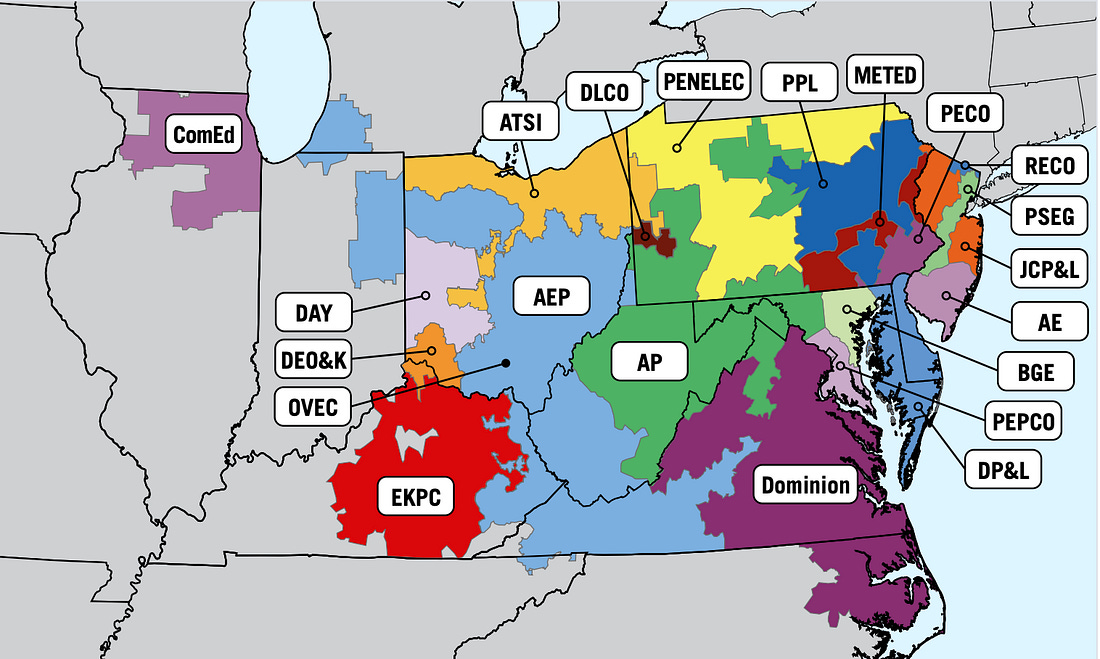

You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. Big Tech Gets the Electric Bill (And The Morning Update)The Trump administration is shifting its focus to a massive midterm issue: Electricity costs.On Third Friday, I want to provide a complimentary issue of the Capital Wave Report (our morning article that is part of the paid subscription to Me and the Money Printer) I feel that today’s story is worthy of your attention… and given that we have monthly options expiration… It’s important to think hard about the subject for this morning. If you like what you see… please consider supporting the publication right here. Good morning: The AI boom finally hit a wall… and it can’t code around this one. It’s not regulators or antitrust issues. It’s the thing we’ve talked about for two years: Questions about the electric grid. I live in Maryland, and I’ve watched as hyperscalers speed to build massive data centers across my market. We live in the PJM Interconnection region, which spans 13 states from the Atlantic Ocean to parts of Illinois. Overall, PJM serves 67 million households… who should be prioritized in electricity generation. But prices have exploded in recent years. Google is spending about $25 billion in this region. Amazon, Meta, and Microsoft have made similar plans. This was predictable… and electricity costs surged… demand outstripped supply, and utilities haven’t been able to generate new sources. Auction prices keep moving higher, followed by big moves in household bills. It’s a story about inflation, structural demand, and rent-seeking by many of these companies that passed off the new infrastructure costs to those 67 million customers. I covered it in Postcards. American electricity costs are soaring… up 7.4% on the year. Here in the PJM footprint, prices are up more than 10% a year (and that’s not factoring in additional fees I notice from time to time). So… what can be done? The White House has made a pretty stunning, unprecedented intervention. Bloomberg and Reuters suggest that the Trump Administration will tell PJM to hold emergency reliability auctions. Here, data center operators would have to bid on 15-year contracts for a new power supply. They’d be paying for the capacity whether they use it or not, but such an auction could fuel up to $15 billion in new power plants. Households, technically, would get some relief (but let’s not expect electricity prices to go down in the era of BRRRR…). Tech giants, meanwhile, would absorb the infrastructure costs as their growth accelerates. This should not be confused with price controls. Instead, it’s a reallocation of costs dressed up as energy policy. The midterms are coming, and surging electricity costs are a severe liability. But structurally, shifting these costs onto trillion-dollar tech firms that have benefited immensely from decades of stealth Treasury and Fed easing policies is a clean way to tell voters that they’re listening… After all, not everyone asked for their utility rates to subsidize ChatGPT. So… who wins and who loses? Winners From my 30,000-foot view, independent power producers are getting an interesting underpinning for their bottom line. They’ve dealt with volatile price auctions and questions about generation. A 15-year contract underpinned by a hyperscaler changes its model. They suddenly have predictable revenue, and their financing stress eases. The risk profile for new projects falls significantly. Look at Vistra, Constellation Energy, and NRG Energy. Natural gas infrastructure benefits immediately. New gas-fired plants will receive priority. It’s going to take 15 years before nuclear comes online (if it ever does). And there aren’t any renewables at scale that can handle the baseload supply for data center scaling. So, we need more pipelines and turbines… so remember that we turned our focus to Kinder Morgan, Williams Companies, and the MLPs. There’s ALWAYS money in the midstream. Finally, we’ll see Oklo and NuScale get the attention they deserve. They’ve struggled with financing due to the lack of long-term revenue and stable contracts. If they get these new long-term deals, it changes their financial equations. Losers This is going to put some pressure on second-tier AI infrastructure companies. That’s names like CoreWeave, Nebius, Lambda, and the army of VC-backed GPU cloud startups that are already on razor-thin margins. They won’t be able to pass electricity costs onto customers as big names such as Amazon and Google can. This could kill some of these players. This could slow down the hyperscalers. They’re not going to collapse, but they'll probably be more patient in assessing their locations. CFOs will scrutinize site selection, capex timelines, and return thresholds more carefully. Companies can no longer build first and ask questions later. This will have an indirect impact on Nvidia. It’s really a question of how the infrastructure buildout goes. If it slows down, chip demand follows. The backlog remains massive, but the narrative of infinite demand, which was a hallmark of the last earnings call, will be a much harder sell for the company. Let’s get to the rest of our market updates… Traders FocusIntraday pressure has pulled back to start the morning, but you wouldn’t know it from futures. We’re up across the board, with the Nasdaq out in front. Tech is leading early on a lift from Micron, up 5.5% in premarket, and AMD is up 2.8%. Micron’s move came after an insider bought shares. A director paid $337 each, spending $7.8 million. This is the first insider buy since 2022, which is a positive sign. If you’re looking for a trade, this is where you start eyeing a put credit spread under that director’s buy. The 330/320 spread is interesting. It’s not going to be cheap, but if you can squeeze out our usual 20% return on risk with an 80% shot at profit, it’s worth taking a shot. Monthly options expire today. That creates opportunities. Options have no time decay left so that moves can exaggerate in either direction. If an early push gets challenged, reversals can happen fast. Watch for VWAP setups and keep your sizing tight. The VIX came back down after creeping higher earlier in the week. We’re now sitting at the bottom of that rising trend we’ve been tracking. When we expanded out the top two days ago, we said watch for a crush back down. It happened. Now we’re at the low end of the range again, suggesting volatility could build back up today. This lines up with that elevated FNGD we keep mentioning. Something is off. We can’t just blindly pile into the highest-beta names when there’s tail risk underneath. The rug could get pulled at any point. So be careful. If you usually risk one to make three, try risking one to make two instead. Use tighter stops. Take good setups as they come, and don’t expect every trade to bring huge wins. Keep trading momentum, but control your risk. When the 8-day crosses the 20-day and price moves above key levels, that’s your signal. Enter the trade, set your stop, and let it play out. Tech, industrials, energy, and communication services are out front this morning. If the market holds this positive lean into the close, great. If it turns over, we’ll be ready to adjust. For now, we look constructive heading into the session. Market outlook

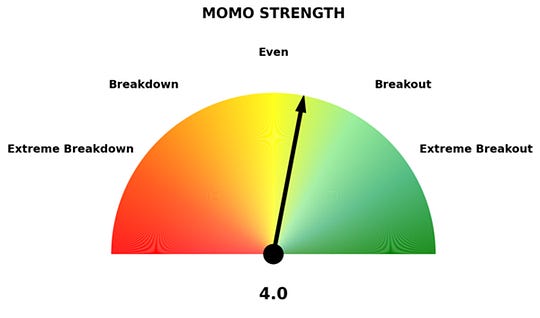

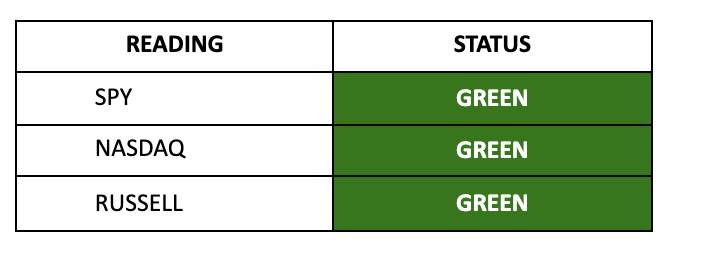

Momentum - Russell Still LeadingThe Russell closed higher for the tenth straight session on Thursday, extending the streak that started right after New Year’s. The S&P has been green on our broad momentum signal for 34 days now, since around Thanksgiving. Intraday pressure is holding. The S&P and Russell are still positive, and the NASDAQ is sitting flat. All three indices remain green on the main signal, indicating capital is still flowing in, even if the pace has slowed from earlier in the week. Thursday brought some volatility into the close. The S&P and NASDAQ pulled back late in the session, while the Russell held up better. Semiconductors powered most of the upside after Taiwan Semi delivered a strong quarter, and the US-Taiwan trade deal added $250 billion in manufacturing commitments. Sector rotation is staying active. Industrials have been scorching, up nearly 4% for the week, along with consumer defensive and basic materials leading the charge. Real estate is trying to get into the game and rotate alongside utilities and technology, which added three-quarters of a percent Thursday. Healthcare, energy, and communication services lagged. The major indexes are still down for the week despite Thursday’s bounce. Insider Buying: Sprott Buys HYMC at $33 (Blackouts)

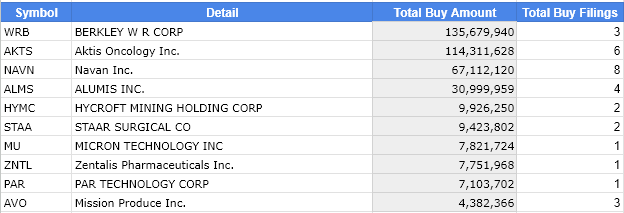

Top Insider Buys of Last 10 Days - Form 4 Documents Market Liquidity Global liquidity hit $186 trillion last week, according to Michael Howell. The Fed's buying of the short end and the dollar's continued weakness are doing the heavy lifting. That’s offsetting the Bank of Japan’s tightening, which meets later this month and is expected to hold rates for now. Credit markets are functioning. Spreads are tight, and funding conditions stayed stable after year-end repo pressures flared and got managed. Financial conditions have loosened even though the Fed isn’t cutting rates yet. Markets aren’t pricing a real chance of a cut until June. Next week’s FOMC meeting should confirm that. But the pace of liquidity expansion is slowing. We’re approaching peak liquidity, which means the easy part of this cycle is behind us. When growth in the money supply starts topping out, volatility tends to pick up, and correlations shift. The move into hard assets reflects that. Central banks are adding gold, while industrial buyers scramble for silver and copper needed for the energy transition. When capital rotates this aggressively into finite resources, it’s pricing expectations that fiat currencies keep losing purchasing power even as liquidity growth slows. Stay positive. Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "Big Tech Gets the Electric Bill (And The Morning Update)"

Post a Comment