| Dear Reader, I just uncovered the craziest – and most astonishing — thing I've ever seen. It's a new Tesla patent that could rock the world. In this new patent, Elon describes a new "keyhole surgery-like process" for powering technology. Sounds bizarre — until you realize what it actually means. It means Elon may have just solved the biggest problem facing America right now. If I'm right, this breakthrough could ignite a $3 trillion industrial revolution — and make Elon Musk the most powerful man on the planet. We got a clue when Tesla's board offered Musk a $1 trillion contract… the biggest in corporate history. Wall Street still hasn't connected the dots. January 28th — I believe Elon will make this breakthrough public. According to my research, a handful of tiny companies that I believe are tied to his secret project could skyrocket. The gains could be historic. I've never seen anything like this in my 30 years in tech and finance. I put the story together in a short video as fast as I could right here… so you could see it before the rest of the world does.

Regards,

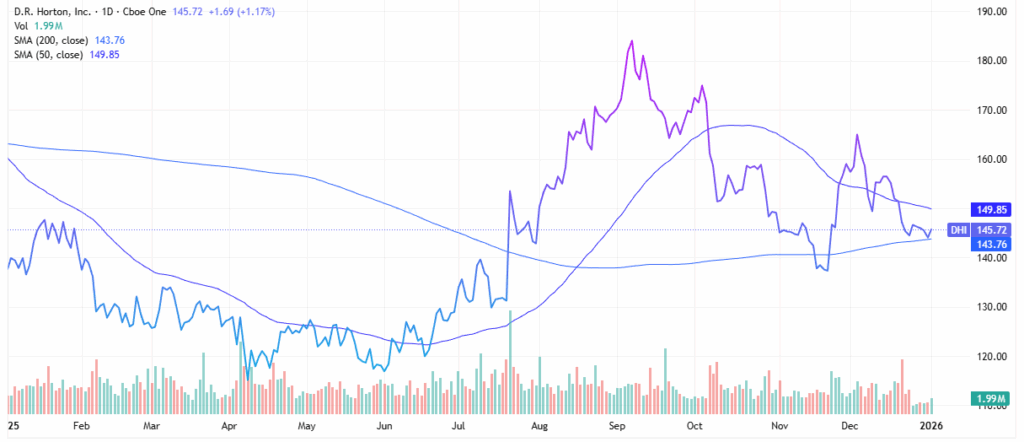

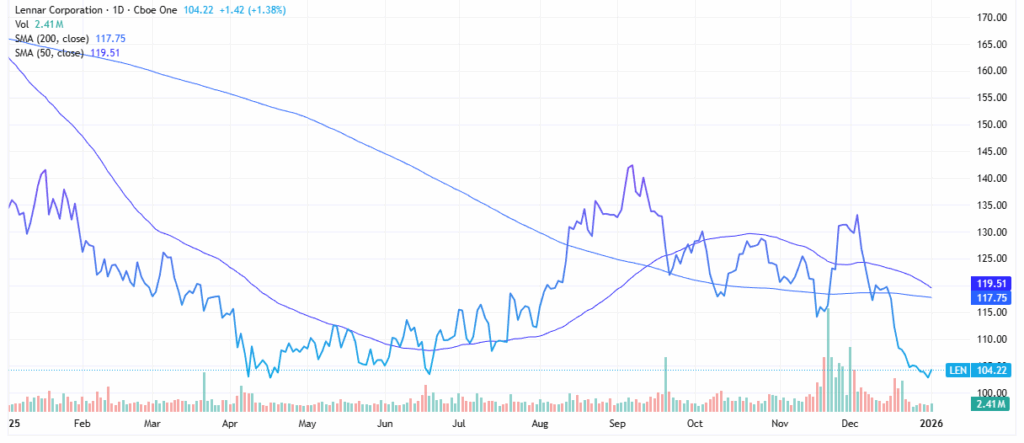

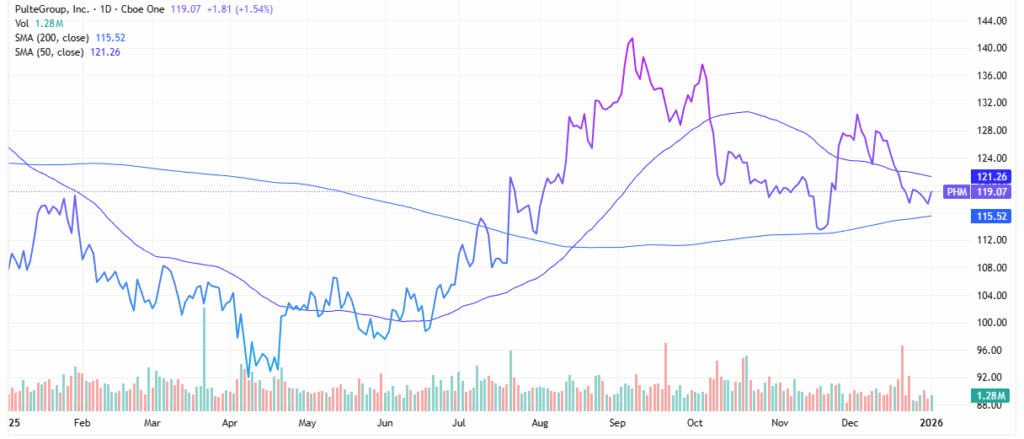

Ian King Chief Strategist, Strategic Fortunes This ad is sent on behalf of Banyan Hill Publishing. P.O. Box 8378, Delray Beach, FL 33482. Today's editorial pick for you 3 Homebuilder Stocks to Sell in an Uncertain 2026Posted On Jan 05, 2026 by Chris Markoch Homebuilder stocks are among the most closely watched stocks heading into 2026. Unfortunately for investors, the start of 2026 is coming with a consumer who’s more cautious than one year ago. That makes it hard for me to recommend homebuilder stocks for investors with a low risk tolerance. Table of ContentsHeading into 2025, there was optimism about a “soft landing” for the economy. The belief was that buyers would get lower mortgage rates fueled by lower interest rates. That policy shift would be enough to thaw a relatively frozen market. However, as the year wore on, the same issues continued to weigh on housing stocks: elevated prices, which kept affordability on the front burner, and a labor market that showed signs of putting the housing market on hold. Historically, housing upcycles need both cheaper financing and buyers' confidence in income prospects. Right now, fragile buyer confidence means any slight dip in mortgage rates isn’t large enough. Against that backdrop, some large-cap builders have a lot of optimism embedded in their valuations. Technical indicators for several leaders already show fading momentum and rising downside risk as markets reassess how quickly demand can reaccelerate. For investors, this mix of macro uncertainty, stretched sentiment, and deteriorating technicals suggests it may be prudent to lock in gains and rotate out of select homebuilder names before volatility in 2026 tests the sector. Some Homebuilder Stocks Have Done WellThat doesn’t mean you would be hurting by investing in homebuilder stocks. But it’s been a stock picker’s sector. For example, the SPDR S&P Homebuilders ETF (NYSEARCA: XHB) was flat in 2025. However, some of the individual holdings in the index did much better. That said, past performance doesn’t ensure future results. And that’s where the story gets uncertain for homebuilder stocks. There is a bullish view being bantered about for 2026. This view holds that the provisions of the Trump administration’s One Big Beautiful Bill stimulate the economy and trigger a massive growth cycle. There’s also a loud chorus of market bears who suggest that inflation will remain sticky and may even move higher with continued interest rates. There’s also growing concern about the labor market and the potential need for more stimulus, which could signal more inflation. However, there’s also a chance that 2026 could feel a lot like 2025. In that case, a lack of conviction will stall demand. That’s why investors should be wary of some of the largest names in the sector. Homebuilder Stocks at Risk: D.R. HortonD.R. Horton Inc. (NYSE: DHI) has been in an uptrend in the last five years. However, recent data show softening momentum and a tilt toward bearish technical signals. For example, in the last year, DHI stock hit a record high, but has been in a downtrend marked by lower highs and lower lows. The stock has found support at its 200-day moving average, yet shorter-term price action has slipped versus the 50-day, hinting at a maturing trend.  Fundamentals remain solid for now. Analysts expect year-over-year (YoY) earnings growth of around 10%. However, sentiment is mixed and even at around 12.5x earnings, DHI stock is trading at a slight premium to its historic average. In an environment where housing demand may not re-accelerate meaningfully until the back half of 2026, that combination leaves DHI vulnerable to multiple compression and profit-taking Homebuilder Stocks at Risk: LennarLennar Corp. (NYSE: LEN) trades near its 52-week low after dropping over 20% in 2025. Much of that sell-off happened in December 2025 when the company’s mixed earnings report couldn’t quell investor uncertainty. LEN stock is trading well below its 50- and 200-day simple moving averages.  From a fundamental perspective, Lennar still faces the same affordability and rate overhang that could slow new orders if the labor market weakens or mortgage spreads stay sticky. Analysts project over 20% YoY earnings growth in the next 12 months, but the stock still trades for a slightly elevated premium. With the stock already discounting a relatively smooth transition to lower rates and sustained demand, any disappointment in 2026 order growth, backlog conversion, or pricing power could trigger downside. For investors who rode the prior leg of the homebuilder rally, Lennar now appears to be a candidate to sell into strength, as its technicals remain near extended levels. Homebuilder Stocks at Risk: Pulte GroupPulteGroup Inc. (NYSE: PHM) enters 2026 with an impressive multi-year performance record, but technical signals are mixed. PHM stock has seemed to find a base of support at its 200-day SMA, but is still trading below its 50-day SMA.  Analysts have a mixed picture, but do suggest that PHM stock could see earnings growth of around 10% in the next 12 months. The stock also appears to have an appropriate valuation. With the broader housing backdrop still constrained by affordability and macro uncertainty, PulteGroup's risk-reward into the first half of 2026 appears skewed to the downside despite an arguably undemanding valuation. Where My Thesis Could Be WrongThe main risk to my bearish stance on homebuilder stocks is if housing demand snaps back faster and stronger than expected. For that to happen, inflation would need to cool more decisively, which could prompt the Federal Reserve to deliver quicker rate cuts. That combination could drive a sharper drop in mortgage rates and reignite buyer interest ahead of the second half of 2026. That plays to the strength of builders like D.R. Horton, Lennar, and PulteGroup that wield significant pricing power and land optionality, enabling them to use incentives, rate buydowns, and product mix shifts to sustain volumes even in a choppy macro environment.? Technical setups can also flip rapidly: oversold or fear-driven readings in sentiment and momentum indicators sometimes mark strong buying opportunities rather than breakdowns, especially in structurally undersupplied housing markets. Additionally, if investors conclude that 2026 will merely be a "pause before the next leg up," these stocks could re-rate higher on any positive surprises in orders, margins, or macroeconomic data, rendering a "sell" call premature. Homebuilder Stocks Won’t Have a Boring YearFor investors concerned about an uneven 2026, D.R. Horton, Lennar, and PulteGroup now embed meaningful expectations for a smooth housing recovery that may not fully materialize in the first half of the year. Technical indicators across these names point to fading momentum, elevated volatility, and, in some cases, outright bearish signals, all against a backdrop of affordability challenges and slowing earnings growth. While long-term structural housing tailwinds remain intact, risk-aware investors may want to treat recent strength as an opportunity to harvest gains and re-enter the sector later in 2026 if fundamentals and technicals reset to more attractive levels.? This is a PAID ADVERTISEMENT provided to the subscribers of StockEarnings Free Newsletter. Although we have sent you this email, StockEarnings does not specifically endorse this product nor is it responsible for the content of this advertisement. Furthermore, we make no guarantee or warranty about what is advertised above. Your privacy is very important to us, if you wish to be excluded from future notices, do not reply to this message. Instead, please click Unsubscribe. StockEarnings, Inc

|

Subscribe to:

Post Comments (Atom)

0 Response to "Elon Just Filed a Shocking Patent That Could Change Everything"

Post a Comment