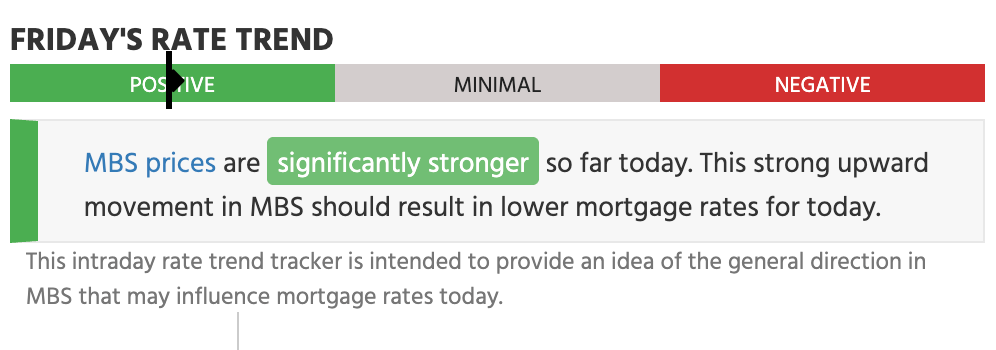

You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. Money Printer 105: What Do You Mean by the Cantillon Effect?We wrap up our "From the Beginning" coverage of the financial system by asking a very simple question: Who Benefits?Dear Fellow Traveler, Well… It’s very fitting that I’ve spent the week talking about the Liquidity Loop… only to have the government give us a live demonstration of everything we’ve explored... Last night, Trump announced that Fannie Mae and Freddie Mac would purchase $200 billion in mortgage-backed securities (MBS). The goal was to drive down mortgage rates and boost housing affordability before the U.S. midterms. Let’s be very honest about this. Now, we didn’t improve zoning… we didn’t increase supply, we didn’t spend the week figuring out how to get rid of Red Tape. We did what we do best: We created liquidity for the housing market… FHFA director Bill Pulte, yes, that Pulte, confirmed it could happen quickly because both agencies have the cash on hand. This is Quantitative Easing in function, not in branding. Call it QE, call it “housing stimulus,” call it Uncle Sam with a Home Depot gift card. The mechanism is the same. It is government-directed asset purchases designed to tighten spreads and lower borrowing costs in a specific market. The mechanism is identical to that used by the Federal Reserve from 2008 to 2014 and again from 2020 to 2022. A government-backed entity buys securities to push prices up and yields down. But who really benefits? It’s actually not homebuyers… It is the people who work in the economic plumbing. Let’s dig into who gets the money first and how that benefits a small group through a modern-day version of the “Cantillon Effect.” A Reminder: What is the Cantillon Effect?The Cantillon Effect holds that new money changes prices in the order in which it enters the system. Whoever touches it first wins. Everyone else buys the inflated leftovers. Think of it like opening a fire hydrant. The kids closest to the curb get drenched first. Everyone else gets whatever mist is left once the pressure drops. Richard Cantillon was an Irish-French economist who died in 1734. He observed something that economists have been trying to ignore ever since. When new money enters an economy, it does not spread evenly. It enters through specific channels. The people closest to those channels benefit the most, while everyone else pays higher prices later. This was true when monarchs debased coins in the 18th century. It was true when central banks printed money in the 20th century. And it is true when government-sponsored enterprises buy mortgage bonds in 2026. The mechanism never changes. Only the tools do... Step One: The AnnouncementWithin hours of Trump’s Truth Social post, spreads between mortgage bonds and Treasuries tightened. That means the price of mortgage-backed securities rose immediately. Not because Fannie and Freddie had bought anything yet… simply because ust because traders knew they would. The markets liked it… LoanDepot jumped 24% today. Rocket Companies popped 7.6%. Companies popped 8%. The SPDR Homebuilders ETF (XHB) jumped 4.4% in a steady momentum burn higher... This is the first Cantillon Gate. The people who were already positioned in MBS, mortgage lenders, and homebuilder equities captured gains overnight. They didn’t have to do anything. They simply owned the assets that were about to receive government support. Now, what about the family in Ohio trying to save for a down payment? They woke up to the same unaffordable housing market they went to sleep with. Nothing changed for them yet. In fact, it might get a little trickier for them in the next few months… Step Two: Purchases Compress Spreads FurtherWhen Fannie Mae and Freddie Mac begin executing the $200 billion in MBS purchases, they will be buying mortgage bonds from the institutions that currently hold them. That means primary dealers, banks, asset managers, mortgage REITs, and anyone else sitting on agency MBS inventory. Congrats to those people too… They’ll receive cash in exchange for their bonds. They will then have a choice. They can sit on that cash or redeploy it into other assets. Historically, they redeploy it because holding cash is a career risk. Deploying cash is career insurance. That cash flows into equities, corporate credit, private credit, real estate, and other risk assets. This is the second Cantillon Gate. The institutions that sell MBS to the GSEs receive fresh liquidity. They use that liquidity to bid up other assets. The asset inflation ripples outward from the point of injection. Meanwhile, the teacher in Baltimore is still checking Zillow and wondering why everything costs $500,000. We’ll see if there’s any benefit to them yet… Step Three: Mortgage Rates Fall, But Housing Prices RiseThe stated goal of this program is to make housing more affordable by lowering mortgage rates. That will likely create problems for the would-be buyer. Yes, mortgage rates are falling. If the spreads compress enough and the Treasury market cooperates, the 30-year mortgage rate could make waves. It just fell under 6% for the first time in about 3 years. But what happens when mortgage rates fall? Demand for housing increases. More buyers will qualify for loans and enter the market as we head into the busy spring season. And… when more buyers chase the same supply of homes, prices rise. Bidding wars ensure. The people who saw that they have less interest to pay might now be willing to jack up the principal in a price battle. This is not a theory. This is what happened during the last round of MBS purchases. From December 2019 to June 2022, U.S. home prices rose 42%. That was the fastest increase ever recorded. Mortgage rates fell to historic lows, and housing prices exploded. The policy intended to make housing affordable actually makes it more expensive. Lowering financing costs increases demand, and higher demand against constrained supply means higher prices. So who benefits? The people who already own homes see their equity rise. The people who own homebuilder stocks see their share prices rise. The people who own mortgage REITs and MBS portfolios see their holdings appreciate. The lenders who originate mortgages see their volumes increase and their servicing rights become more valuable. The first-time buyer in Phoenix who was priced out two years ago? Sorry bud… You’re gonna be priced out. Maybe they can afford a slightly more expensive house because the monthly payment is lower. But the sticker price is higher, and they’ll compete against investors, cash buyers, and institutions who also see the opportunity. This is the third Cantillon Gate. The policy intervention first flows to asset holders. The benefits to consumers, if they arrive at all, are diluted by the asset inflation that precedes them. Step Four: The Institutions Lever Up AgainHere we go… the part that people don’t see… because they don’t know the outcomes and incentives in this system… When Fannie Mae and Freddie Mac buy $200 billion in MBS, they’re not destroying those securities. They are adding them to their retained portfolios. The GSEs will hold those bonds on their balance sheets, collect the interest payments, and use them as collateral for their own funding operations. Meanwhile, the institutions that sold those bonds now have $200 billion in cash. What do they do with it? They lever up. That cash becomes the equity base for new trades. A bank that receives $10 billion from selling MBS to Fannie Mae does not put that money in a savings account. It uses that $10 billion to support $100 billion in new lending, trading, or investment activity. The leverage ratios at major financial institutions mean that every dollar of liquidity injected at the top of the system multiplies throughout the system. This is how $200 billion becomes $1 trillion in market impact. It’s not a result of “money printing.” It’s done through the expansion of balance-sheet mechanics. A single policy announcement can and will move every asset class. And this is why the people closest to the injection point benefit the most. They get the first use of the new money. By the time it trickles down to wages and consumer prices, the asset inflation has already occurred. And - what’s worse - the use of the capital is usually in the form of an interest payment… So, interest payments risk with more expensive assets… That’s what happens at the end of the consumer “new liquidity” supply chain. Step Five: The Narrative Breaks Before the Math DoesPresident Trump framed this as a housing affordability measure. He said it would drive mortgage rates down, monthly payments down, and make the cost of owning a home more affordable. Math is not political. The narrative always is. If mortgage rates fall 50 basis points and home prices rise 10%, the monthly payment on a median-priced home stays roughly the same. The buyer is no better off. They are just paying more principal and less interest. If mortgage rates fall 50 basis points and home prices rise 15%, the buyer is worse off than before. The financing got cheaper, but the asset got more expensive faster than the financing benefit. This is exactly what happened during the last round of MBS purchases. Rates drop, prices go up, and affordability doesn’t pan out… The people who were supposed to be helped ended up further behind. The only winners were the people who already owned assets. That is the Cantillon Effect. How Money MovesAgain… new money enters through a very small number of doors. The Treasury’s issuance calendar. The Federal Reserve’s balance sheet operations. The shadow banking system’s collateral transformation. The GSEs’ retained portfolio purchases. Fiscal backstops and guarantees. Each door leads to an institution that gets first access to the liquidity. That institution then uses its access to acquire assets before prices adjust. By the time the money reaches consumers, in the form of lower mortgage rates, cheaper credit, or marginally higher wages, the assets have already repriced. The purchasing power has already been extracted. This is why people feel squeezed. Not because they are lazy. Not because avocado toast is destroying their finances. It’s because the modern financial system raises the price of every chokepoint that matters before their wages catch up. The things that matter… Housing. Energy. Food. Healthcare. Education. Childcare. Insurance. These are not random categories. These are the things that people cannot avoid buying. And because they cannot avoid buying them, these are the extraction points where asset owners capture the gains created at the top of the system. What Thursday Night Taught Us The Trump MBS announcement is not unique. Usually, this process happens quietly. The Fed adjusts its balance sheet, and the Treasury shifts its issuance mix. The GSEs tweak their retained portfolios, and the shadow banking system expands or contracts. Nobody announces it on social media, and nobody explains who benefits first. But on Thursday night, we got to see it happen in real time. A policy was announced… stocks moved andspreads compressed. The institutions captured the gains, and the consumers who were supposed to benefit have not yet seen a single dollar. That is the Cantillon Effect. This is the structural reality of how money moves. The people closest to the new money get the best prices, the best access, and the earliest advantage. Everyone else receives whatever is left after the machinery has processed the flow. You don’t have to like this system. You only have to understand it. Because once you understand it, you stop looking at the surface. You follow the pipe, follow the flow, and follow the incentives. Because in this system, proximity is not a privilege. It is an operating advantage. Tomorrow, I’ll talk a little more about housing before turning my attention to the micro side of this insight. If you have any questions… please ask. Stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "Money Printer 105: What Do You Mean by the Cantillon Effect?"

Post a Comment