Market at Record Highs. Your Account Isn't. Here's Why.

Dear Trader, Are you watching the market hit record highs... while your account stays flat? While others are bragging about their gains, most traders are paralyzed, terrified of buying at the top, scared of corrections, waiting for the "perfect" entry. So they wait. And wait. And the profits slip away. But what if you could pinpoint stocks set to surge BEFORE the crowd rushes in? That's exactly what our A.I. does, and you're about to learn how it works. While everyone else is guessing, you'll know which stocks are positioned to move. While they're buying peaks, you'll catch the valleys. While they panic during volatility, you'll capitalize on it. Here's the truth: 2026's best opportunities won't wait. The Fed could shift policy overnight. The easy money could vanish. But traders with a SYSTEM, with an EDGE, will still be standing. Learn the A.I. that pinpoints 2026's first winning trades. Get the confidence to trade with precision. Stop guessing. Start knowing.

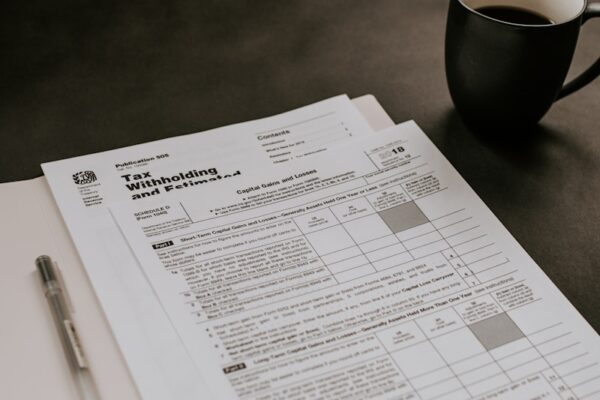

Lane Mendelsohn, President 1-800-732-5407 U.S. & Canada © 2026 Vantagepoint AI, LLC. All rights reserved. Today's editorial pick for you Why Tax Software Stocks Like HRB and INTU Tend to Surge Before AprilPosted On Jan 08, 2026 by Ian Cooper Tax time is almost here again. For many Americans, that means facing one of the least enjoyable annual rituals: handing over more of their hard-earned income to the government. But for investors, this predictable seasonality can create an opportunity to profit from tax software stocks. Table of ContentsCertain tax preparation stocks and tax software stocks tend to attract attention every year as filing deadlines approach, driven by rising consumer demand and increased visibility in the financial media. The bull case for tax software stocks is simple. These days, far fewer people are willing to do their taxes manually. Instead, they rely on trusted tax professionals or easy-to-use software platforms to avoid mistakes with filing status, dependents, capital gains, and deductions. That makes companies that dominate the tax-prep market particularly valuable during the first half of the year. While most investors focus on earnings growth or long-term innovation, seasonal trends can also offer tactical opportunities. Historically, leading tax-service firms often see heightened interest between January and April, sometimes extending into May. For investors looking for reliable, recurring catalysts rather than speculative growth stories, two tax software stocks stand out every year: H&R Block (NYSE: HRB) and Intuit (NASDAQ: INTU). Both benefit directly from tax season, yet in very different ways. The Go-To Source For Many TaxpayersH&R Block is a no-brainer during tax season. The company's nationwide network of tax professionals makes it the go-to choice for filers who want human assistance rather than a fully digital experience. This "high-touch" model may seem old-fashioned in a tech-driven market, but it remains extremely relevant for households with complicated returns, small business owners, and anyone uncomfortable navigating tax law alone.  From an investment standpoint, HRB has developed a clear seasonal pattern. In recent years, the stock has often strengthened as tax season gains momentum. In 2024, HRB bottomed near $44 in January and later tested a high of $53.55 shortly after taxes were filed. In 2025, the pattern repeated, with shares rising from around $50 to a May high near $63.05. While past performance never guarantees future results, these moves show how predictable demand can translate into trading opportunities. Today, HRB trades near $43. That level reflects broader market volatility more than any deterioration in the company's core business. With millions of returns processed annually, strong brand recognition, and a loyal customer base, H&R Block remains one of the most resilient players in the tax preparation space. Investors also receive a dividend yield near 3.9%, which helps offset short-term price fluctuations. Looking ahead, the thesis is straightforward: as tax season intensifies, traffic to physical offices and online filing platforms should increase. If the stock follows its historical trend, a move back toward the low $50s between now and May would not be surprising. For income-focused investors, the dividend provides a cushion, while for tactical traders, the seasonal momentum offers potential upside. In a market that often chases the next big technology theme, HRB stands out as a dependable, cash-generating business tied to an unavoidable annual event. The Digital Future of Tax PreparationIf H&R Block represents the human side of tax preparation, Intuit embodies the digital future. The company's TurboTax software has become a household name, dominating the do-it-yourself tax market. For millions of filers, TurboTax is the default choice. Its intuitive design, automated error checks, and step-by-step guidance make it accessible even to users with limited financial knowledge.  At roughly $650 per share, INTU is priced very differently from HRB, but its seasonal behavior is just as compelling. In 2024, the stock traded near $597 ahead of the tax deadline before rallying to approximately $670 shortly afterward. In 2025, shares rose from around $530 to a high near $657 by May. These moves highlight how demand for digital tax tools ramps up sharply during filing season. What sets Intuit apart is that tax preparation is only one part of a much broader ecosystem. Beyond TurboTax, the company owns QuickBooks, Credit Karma, and other financial platforms that serve individuals and small businesses year-round. That diversification gives INTU a growth profile that extends well beyond April, making it attractive to long-term investors as well as seasonal traders. At its current level near $651, the stock reflects both its premium valuation and its strong competitive position. Looking forward, a move toward the mid-$700s by late spring is plausible if historical trends hold and broader market conditions remain supportive. Unlike many high-growth technology stocks, Intuit's business is tied to a recurring, legally mandated process. Every year, regardless of economic conditions, people must file taxes. That inevitability provides a level of demand stability that few other software companies can match. Tax Software Stocks: A Seasonal Strategy for InvestorsTax season may be dreaded by consumers, but it creates a recurring opportunity for investors. Tax preparation stocks like H&R Block and tax software stocks such as Intuit benefit directly from an annual surge in demand that is both predictable and unavoidable. HRB offers income and a historically reliable seasonal bounce, while INTU provides premium growth exposure within a dominant digital platform. For those looking to add tactical positions early in the year—or simply diversify with businesses tied to essential services – these two names remain among the most compelling ways to invest in tax season. This is a PAID ADVERTISEMENT provided to the subscribers of StockEarnings Free Newsletter. Although we have sent you this email, StockEarnings does not specifically endorse this product nor is it responsible for the content of this advertisement. Furthermore, we make no guarantee or warranty about what is advertised above. Your privacy is very important to us, if you wish to be excluded from future notices, do not reply to this message. Instead, please click Unsubscribe. StockEarnings, Inc |

Subscribe to:

Post Comments (Atom)

0 Response to "Market at Record Highs. Your Account Isn't. Here's Why."

Post a Comment