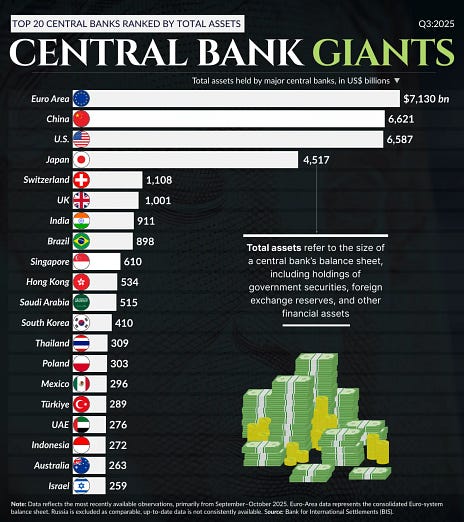

You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. Dear Fellow Traveler, On January 28, 2026, the General Manager of the Bank for International Settlements (BIS) received an honorary doctorate in Madrid. Nobody covered the speech he gave. We’ve seen nothing in Bloomberg or the Financial Times. That’s telling because what the man said wasn’t good for confidence. Pablo Hernandez de Cos already runs the central bank of central banks in the BIS. He’s also one of the favorites to soon run the dumpster fire that is the European Central Bank. He used his speech to admit that central banking is operating beyond the edge of its own maps. He used a nautical metaphor to explain, because who doesn’t own their own yacht in this era of never-ending monetary expansion? For him, a clear mandate is the anchor. Central bank independence would be the hull. And accountability is the mast. But the ship also needs “sails, a rudder, a compass, and maps.” Central bankers reach for metaphors when precision fails them, and if accountability is the mast, then that explains why we’ve been drifting at sea since 2008. He listed the forces battering the vessel… deglobalization, aging populations, technological change, and “high and rising public debt.” These forces are increasing uncertainty about “some of the basic variables for effective monetary policy formulation.” He basically admits that the policy rate… the one number the entire financial system is built around… is a guess. And they’re telling us the margin of error just got wider. What Is Reality?Then came the word that matters most in the entire speech. Realism. It wasn’t hallmark words of central banks like “confidence” or “forward guidance.” It wasn’t that “we have the tools” to prevent a crisis. He said, “Realism.” Which is what institutions call it when they’re lowering the bar so failure looks intentional. Central banks should “focus on what they can foresee and deliver.” He said “forecast errors” will be high. So, don’t bother doing that work, I guess. Instead, central banks should only pursue objectives “for which it is well equipped to achieve.” Anything beyond that “would increase reputational risks and undermine their credibility and independence.” That’s the head of the BIS telling his own profession to narrow the mission before someone narrows it for them. The Balance Sheet ConfessionThen he turned to the balance sheets. He said the design of asset purchases must “facilitate a rapid reduction once the reasons for their implementation have disappeared, to minimise concerns about financial stability and unwanted side effects.” The balance sheets of every major central bank is still bloated, as evidenced by the chart tracking their assets at the end of the third quarter of 2025. [Note: The chart accurately shows balance-sheet totals, but it mixes national central banks with the consolidated Euro Area.] Now, he’s admitting that central bank balance sheets were not designed for a clean exit. That the unwinding creates financial instability. The Fed went from $900 billion to $8.9 trillion and is now trying to shrink while the government issues record debt. The money printer was easy to turn on. But turning it off is the part nobody really planned for. Same Song, Different PodiumThen came the same complaint of people who don’t have the bravery to do their jobs. “We must also be aware of the limitations of what monetary policy can achieve on its own,” he said. He’s saying that central banks were forced into this role because politicians refused to do theirs. And he’s saying… we can’t carry that weight anymore. This is the same confession former Fed Chair Arthur Burns made in Belgrade, Yugoslavia, in 1979. The world ignored Burns, and what followed was 13% inflation and the most painful rate-hiking cycle in American history. Burns called it “the anguish of central banking.” Hernandez de Cos, 47 years later, is calling it “realism.” It’s a different timeframe, but it’s the same surrender. The money printer operators are telling you, in the most diplomatic language possible, that the machine is less reliable than advertised, the maps are outdated, and they can’t do this alone. When the people who run the system start managing expectations downward… what usually follows is policy failure or regime change. But probably both. Buy the chokepoints of the economy… Stop speculating on profitless junk. And stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "A Quiet Confession from the BIS"

Post a Comment