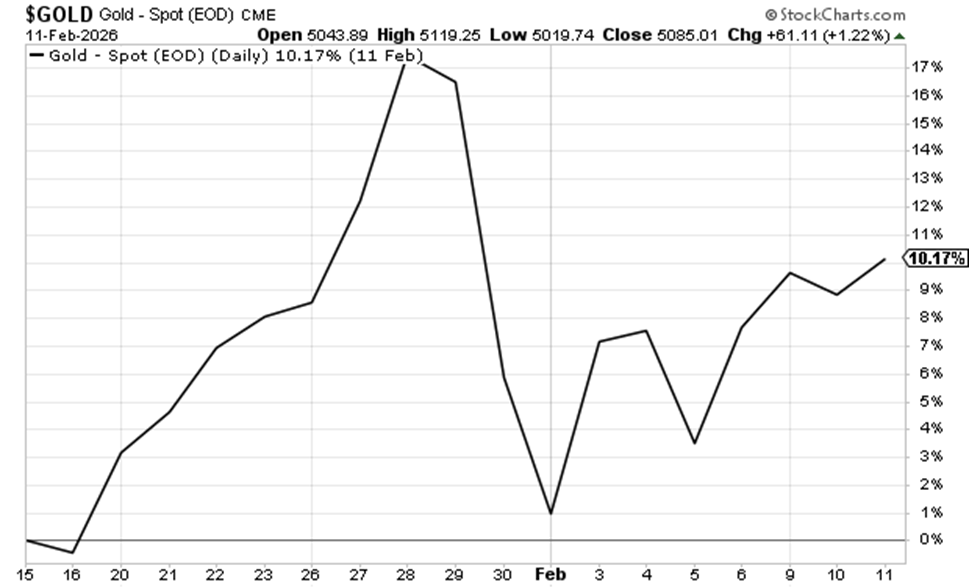

What history suggests is next for gold... horrific forecasts of government fiscal excess... a moonshot trade idea from Jonathan Rose... Marc Chaikin's warning to investors today VIEW IN BROWSER Gold and silver have been on a rollercoaster over the past month… We’ve seen sharp rallies, swift pullbacks, and more day-to-day volatility than we’re used to seeing from this “boring” corner of the market. The chart below shows gold’s violent price action since mid-January (check out those percentage swings).

For an asset that’s historically known for stability, the recent action has felt almost crypto-like. So, where do we go from here? To answer that, let’s go to Tom Yeung and his analysis from last week. For newer Digest readers, Tom is Eric Fry’s lead analyst in Investment Report. Tom begins with a helpful reminder of why we own precious metals in the first place: Physical assets like gold and silver have survived far longer than virtually any other store of wealth. They are both unlikely to go to zero… He contrasted that durability with Eric’s recent discussion of Bitcoin’s shorter, more speculative history: Actual gold has served humanity for millennia as the ultimate store of value and refuge from financial crisis. Bitcoin has not… Whatever Bitcoin’s virtues may be, defending a portfolio from harm is probably not one of them. That distinction matters because what we’ve seen in recent weeks is a kind of “bitcoinization” of precious metals – faster moves, bigger swings, more speculative energy. Historically, that’s not how gold behaves. In fact, Tom points out that prior to the recent selloff, gold had fallen more than 12% over two trading days just once in the last 30 years. Clearly, the degree of gold’s recent volatility is rare. Back to our question, what does the recent price action mean for gold looking forward? Tom tells us that history shows recoveries tend to be measured – not explosive. Looking at the nine times since 1998 that gold dropped more than 12% over a 30-trading-day window, the average rebound over the next 120 days was “quite modest.” Gold and silver are stable assets – they typically take time to heal. But stretch the timeline to 360 days, and the picture improves dramatically. Tom notes that over longer holding periods, both metals have historically regained their prior highs within about a year – and then added roughly another 8% on top. The key is to remember why you own gold We don’t own it because we expect moonshot returns. That’s for “me too” leveraged traders who jump aboard purely for overnight speculative gains. Rather, we own gold because it anchors a portfolio. It’s there to stabilize, hedge against lingering inflation, and offset the consequences of relentless fiat printing. In other words, it’s there to do what it has done for millennia… Protect our purchasing power and steady the ship for the long haul. So, where is gold likely to go from here? Modestly higher – in time. Which is fine for longer-term investors. Back to Tom for our action step: Sit tight on your remaining precious metals holdings for now. There’s no immediate need to double down on selloffs… Nor is there a need to sell into the panic. After all, gold and silver are not cryptocurrencies. To get all of Tom’s and Eric’s gold analysis as well as their specific recommendations as an Investment Report subscriber, click here to learn more. Meanwhile, yesterday brought another reason to hang onto your gold position If the recent volatility reminded us how gold behaves, a headline from yesterday reminded us why we own it. The Wall Street Journal reported that the U.S. budget deficit will remain massive in the near term, and then widen substantially over the next decade: The budget gap is forecast to increase over the course of the next decade as the costs of the country’s debt load, aging population, and healthcare obligations outpace tax collections. Debt held by the public is forecast to cross the 100% of GDP threshold this year and surpass the post-World War II record by 2030. By 2036, the annual deficit will exceed $3 trillion, or 6.7% of GDP, according to CBO. After World War II, that is a level that the country exceeded only in the aftermath of the 2008 financial crisis and during the Covid-19 pandemic. The most troubling line in the entire report? Interest costs. As the WSJ notes, “As a share of GDP, federal interest costs are about to be higher than any year since at least 1940.” By 2036, interest payments alone will consume 26% of federal revenue, up from 19% today. In other words, more than a quarter of every one of your tax dollars could soon go toward servicing past borrowing – not defense, not infrastructure, not healthcare… Just interest. CBO Director Phillip Swagel put it bluntly: Our budget projections continue to indicate that the fiscal trajectory is not sustainable. Now, remember, when governments face unsustainable fiscal paths, there are only a few levers to pull They can raise taxes… cut benefits… or print more money. None of those outcomes is particularly friendly to your purchasing power. Higher taxes hit your wallet directly. Money creation quietly erodes the value of every dollar you save. And even if growth temporarily improves the picture, CBO notes that faster growth can create inflationary pressures and higher interest rates, which ironically make the deficit worse because of the government’s enormous debt load. This is precisely the kind of long-term backdrop where gold remains a no-brainer in your portfolio. Bottom line: When fiscal math starts looking increasingly strained, having a portion of your portfolio in an asset that has survived every prior debt cycle in history just makes sense. But if you want to complement your gold position with a potential moonshot homerun, Jonathan Rose has an idea As regular Digest readers know, Jonathan is incredibly bullish on copper, in large part due to enormous demand from the AI data center buildout. However, that demand is so enormous – and urgent – that “copper alone” presents a problem. But this could be a huge opportunity for a stock that Jonathan just recommended to his Masters in Trading: All Access subscribers. Here’s Jonathan with more: Copper creates heat. Heat demands power. Power is becoming the constraint inside modern data centers. The solution the industry is racing toward is optical interconnect — moving information with light instead of electricity. Faster, dramatically more efficient, and far cheaper at scale. That’s where POET Technologies Inc. (POET) comes in. POET is a fabless semiconductor company that designs and develops high-speed optical engines, light source products, and custom optical modules. It specializes in integrating electronics and photonics onto a single chip to enable faster, more energy-efficient data communication in datacenters. Back to Jonathan: This isn’t theoretical anymore. Marvell Technology validated the space with a multibillion-dollar acquisition of Celestial AI, whose tech is built on POET’s platform. Big players are positioning for deployment… At today’s valuation, we’re looking at a company worth under a billion dollars sitting in the path of trillion-dollar AI infrastructure spending. If adoption materializes as Jonathan believes it can, this is a multi-bagger opportunity. So, consider yourself in the know, and take a look at POET if you’re in the market for a high-octane AI trade. By the way, a quick “congratulations” to Jonathan and his followers who have been taking advantage of his free Masters in Trading recommendations. Here’s Jonathan with the recent performance of this free portfolio: The results speak for themselves: - 30% win rate

- 91% average gain per position

- 86% annualized return

Those numbers aren’t accidents. They come from a repeatable method grounded in the same principles as every other trade I recommend – risk control, structure, and patience. To learn more about this “repeatable method,” check out Jonathan’s Masters in Trading Options Challenge. That’s where he takes everything you see in the daily live episodes and turns it into a clear, step-by-step process you can apply. You can learn more right here. Finally, if you've ever walked past the old Barneys New York flagship on Madison Avenue... Then you probably remember what it represented: luxury, status, permanence. For decades, Barneys looked untouchable – the kind of brand you assumed would be around forever. And then one day, it wasn’t. The iconic store didn’t shut down because of a scandal or a sudden collapse in demand for fashion. It was something far more common – and far more dangerous… Barneys didn’t adapt quickly enough when the world changed. E-commerce exploded. Brands went direct-to-consumer. Foot traffic dried up. Costs rose. And a business that once seemed “too iconic to fail” became a case study in what happens when you keep using yesterday’s playbook in a new era. That’s the story that Wall Street veteran Marc Chaikin just told his readers – and the reason we’re excited to introduce him to the Digest audience. Marc has spent more than 50 years studying what’s really happening beneath the surface of markets – not just the headlines. He’s best known as the creator of the Chaikin Money Flow indicator, a tool that’s now built into trading platforms used by investors around the world. And his message today is simple… Markets evolve. Most investors don’t. And that’s where the trouble starts. Marc believes we're heading into a stretch where the "obvious" trades could get a lot less comfortable And where investors will need better tools to identify which stocks are worth your investment dollars…and which are starting to crack. That’s why Marc will be hosting a free live market briefing next Tuesday, February 17 at 10 a.m. Eastern, where he’ll break down what he sees coming next – and show investors how to spot both opportunities and risks before the crowd catches on. He’ll also share a new tool you can try for yourself, along with two free stock recommendations. I’ll bring you more on this over the new few days, but to learn more about Marc’s briefing and reserve your seat, just click here. Have a good evening, Jeff Remsburg |

0 Response to "Here Is Where Gold Goes Next"

Post a Comment