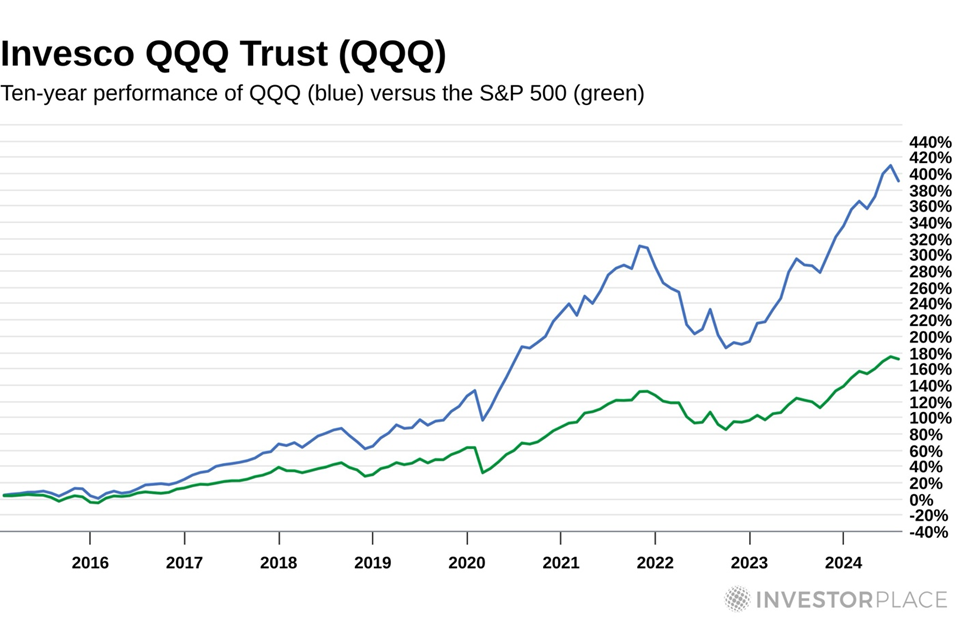

Old champions won’t drive future market returns VIEW IN BROWSER Tomorrow, the New England Patriots and Seattle Seahawks will vie for the NFL Championship in Super Bowl LX (60 for those who don’t regularly use Roman numerals). But you might not know that it was called “The Super Bowl” only in 1969, for the third annual game. It was originally called the AFL–NFL World Championship Game. The game was created as part of the merger between the National Football League and the competing American Football League to determine a single champion for the two different leagues. Even today, both teams are already champions. The Patriots are the American Football Conference champions, and the Seahawks are the National Football Conference champions. Every year, the Super Bowl brings together two teams that have already proven themselves champions. They survived a long season. They beat elite competition. And yet, when the final whistle blows, only one walks away with the trophy. That’s the part most fans forget: By the time the Super Bowl kicks off, both teams are winners. But in the final stage, past success matters far less than execution, matchups, and preparation. One champion advances. The other is left watching history from the sidelines. The stock market is entering a similar moment right now – especially in technology. For years, simply owning tech stocks was enough. The entire sector surged, and nearly every name benefited from the rising tide. But that easy phase is over. Today, tech is no longer competing against the rest of the market. It’s competing against itself. And just like the Super Bowl, this next phase won’t reward popularity or past dominance. It will reward selectivity. Precision. And owning the right champions – not just yesterday’s winners. So, how can investors stay on the richer side of this new technochasm? I’ll share insight today from legendary investor Louis Navellier, one big winner he has already found, and how it is all reflected in his Stock Grader system. | Recommended Link | | | | Renowned Futurist, Eric Fry, has been seen on CNBC repeatedly recently voicing a highly contrarian call. “Nvidia, Amazon and Tesla are ticking time bombs in investors’ portfolios,” he says. Instead, he’s sharing three NEW stocks positioned to take over as the tech kingpins of tomorrow. Get Eric’s full “Sell This, Buy That” list right here. |  | | A New Phase for an Old Market Trend My colleague Jeff Remsburg and I have written a lot in the Digest about the “technochasm.” That's the idea that the stock market created a new wealth divide. Folks who invested in technology stocks accelerated their wealth, while those who did not were likely to end up on the wrong side of a divide and worse off. Just looking at the technology-focused Invesco QQQ Trust (QQQ) ETF versus the overall S&P 500 over the past decade shows how much better tech stocks have treated investors.

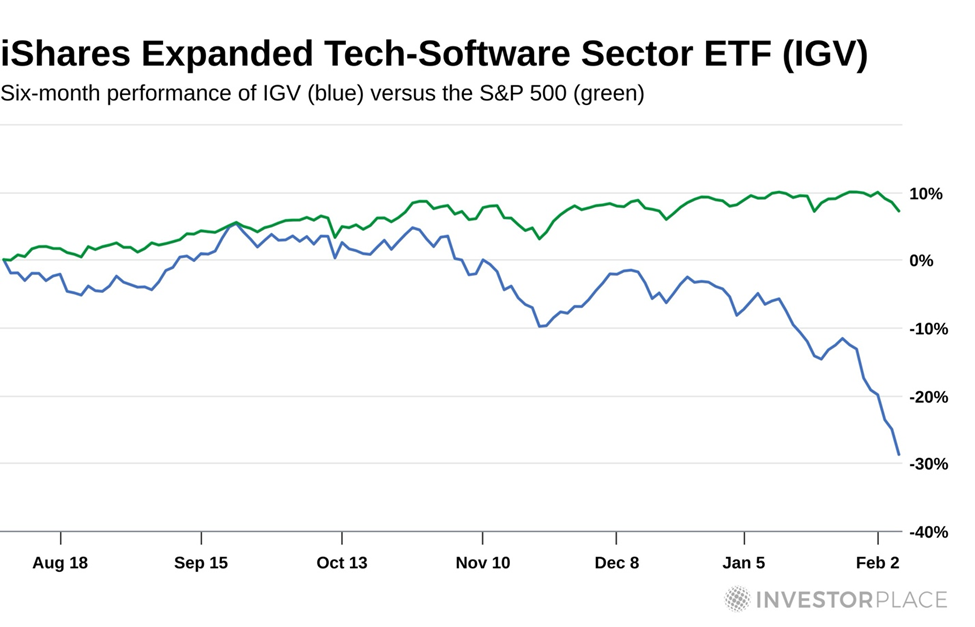

This week’s software meltdown shows that even tech stocks are now feeling the AI disruption. One glance at the iShares Expanded Tech-Software Sector ETF (IGV) compared to the general market over the last six months shows a new market reality.

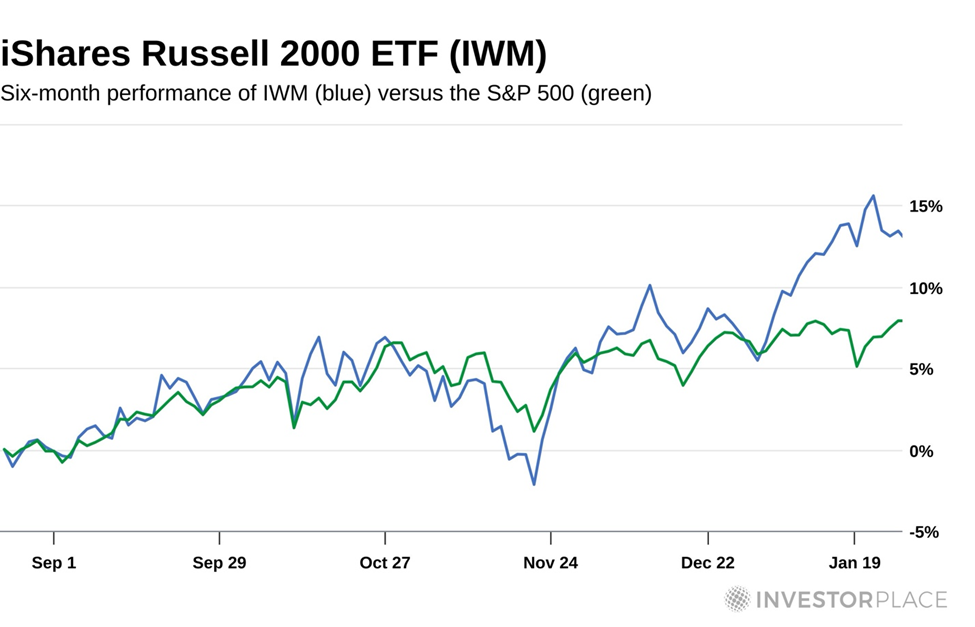

When markets transition from one phase of growth to the next, leadership changes – and often it changes quickly. Large, well-known stocks tend to dominate early in a cycle. Stocks such as Nvidia Corp. (NVDA) and Amazon.com Inc. (AMZN) grab all the headlines and buying pressure in the market. But as confidence builds and earnings momentum broadens, smaller, faster-growing companies begin to assert their market leadership. Louis believes that rotation is underway. Over the last six months, small-cap stocks moved decisively higher. The Russell 2000 surged almost 14%, far outpacing the S&P 500’s 8% gain.

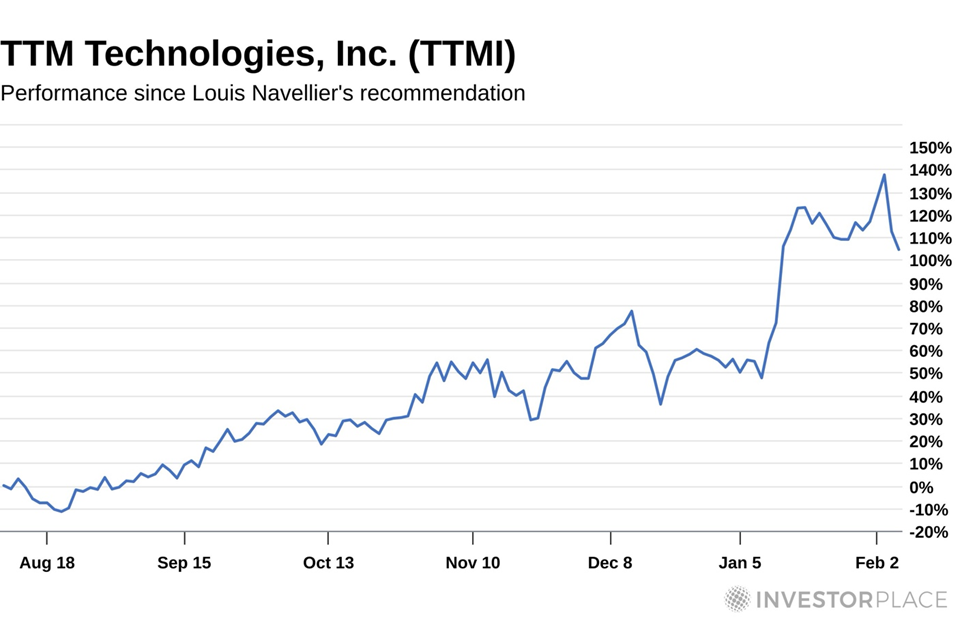

Here is what Louis wrote about why this is happening now. Small caps tend to be more domestic in nature, which means they benefit directly from U.S. economic growth. They also tend to move first when investors begin looking beyond yesterday’s winners and toward where the next phase of growth is likely to emerge. One example is Louis’ recent recommendation of TTM Technologies Inc. (TTMI). TTM is a top-tier manufacturer of advanced printed circuit boards (PCBs) and radio frequency (RF) components essential for AI data centers, networking, and high-speed computing infrastructure. The company is experiencing significant demand growth driven by AI-related hardware needs, positioning it as a key supplier in the AI technology supply chain. And it’s current market cap is below $10 billion. Since Louis’ recommendation in his Breakthrough Stocks service last August, the stock is up more than 100%.

Now, Louis isn’t saying it’s time to buy small caps indiscriminately. But market leadership is changing, and companies positioned on the right side of this change are beginning to be rewarded. The AI Dislocation Is Coming Louis believes the markets are experiencing what he calls the “AI Dislocation.” The first phase of the AI boom rewarded a narrow group of mega-cap leaders. Those gains were powerful, but obvious. Everyone knew the names. Everyone crowded into the same trades. And expectations rose accordingly. That was Stage 1. What’s happening now is different. As scrutiny increases and capital spending intensifies, the market is beginning to look deeper into the AI ecosystem – toward the smaller companies building the power systems, networking infrastructure, and enabling technologies that make AI scalable and profitable. That’s Stage 2 – where the next wave of opportunity is taking shape. This AI Dislocation isn’t the end of the AI boom. It’s a changing of the guard. How to Position Yourself for What’s Next Louis is using his time-tested Stock Grader to help him identify the stocks best positioned to benefit from this market transition. These are not obvious names from Phase 1 of the AI megatrend, such as Nvidia and Microsoft Corp. (MSFT). Louis is finding smaller companies – companies most investors have never heard of. These little-known small caps are positioned not only to survive a potential shakeout around February 25, but to thrive in the aftermath. He has recorded a special briefing to walk through what he sees coming in the markets and to describe the opportunity it presents to investors right now. Here’s how he describes the event. These are the kinds of setups that historically produce the biggest gains – not because the companies are flashy, but because expectations are still low while fundamentals are improving rapidly. I’ll also show you how I’m positioning ahead of that shift, using my system to focus on fundamentally superior companies with the potential to deliver outsized gains as this next phase unfolds. If you want a clearer roadmap for where the next AI-driven opportunities could come from – the market champions of the future, not the past – go here now for more details. Enjoy your weekend, Luis Hernandez

Editor in Chief, InvestorPlace |

0 Response to "How to Find the Next Market Champions"

Post a Comment