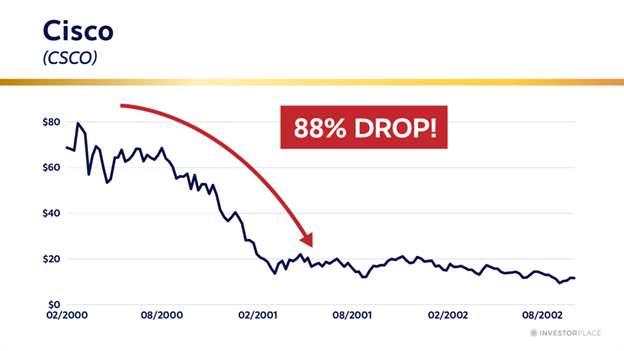

The AI Shakeout Has Started – Are You in the Right Stocks? VIEW IN BROWSER In the 1980s, Bill Walsh, head coach of the San Francisco 49ers, had a clear edge. His West Coast offense was revolutionary. The whole idea was based on timing and precision. Short, high-probability passes lulled defenses to sleep – and then, at just the right moment, the 49ers would strike downfield. For a time, it worked beautifully. It confused defenses and made the 49ers nearly unbeatable. But that edge didn’t last forever. Other teams studied the system. They copied elements of it. Defensive schemes evolved. The West Coast offense didn’t disappear, but the 49ers’ overwhelming advantage did. The same thing happens in the stock market. Certain stocks enjoy periods where they sit at the center of a powerful trend. Capital pours in. Expectations rise. And for a while, they seem unstoppable. But as more investors crowd into the same names and competition intensifies, that edge dulls. The stocks don’t suddenly become bad. The story doesn’t collapse. But the easy gains are gone. That’s when leadership changes – and it’s also when you and I need to start looking elsewhere. See, this is often where investors make their biggest mistakes. They assume that if yesterday’s winners stop leading, something must be wrong with the broader trend. In reality, the trend is just maturing. The market is adapting. And new edges are being created somewhere else. That’s exactly what’s happening in AI today. You’ve probably noticed that some of the most prominent tech names – particularly in software – have been selling off sharply. So, in today’s Market 360, I want to walk through what’s really going on beneath the surface… what could go wrong during this transition… And how to prepare for – and profit from – what comes next. | Recommended Link | | | | Luke Lango, who was once voted America’s Top Stock Picker, just released his #1 AI investment right now… he’s even giving this recommendation away for free. This AI company is positioned to take over a $1.9 trillion industry that has yet to be disrupted. The incredible thing is... not too many people are paying attention to this company right now (you’ll see why here )… And that’s why Luke says this stock — trading around $8 right now — could be the next big 1,000% AI winner. Click here to get the name and ticker symbol right now. |  | | What's Behind This Week's Tech Selloff Over the past week, shares of U.S. software and data-services companies have been hit especially hard. The S&P 500 software and services group has fallen sharply over that period, erasing roughly $1 trillion in market value since late January. Some of the biggest casualties have been names like ServiceNow Inc. (NOW), Salesforce Inc. (CRM) and Microsoft Corp. (MSFT) – companies that dominated enterprise software long before AI became a buzzword. These are former market leaders that investors once viewed as nearly untouchable. What changed? As AI tools advance rapidly, investors are starting to question whether these legacy software models can hold up when new AI-driven alternatives can replicate — or outright replace — key functions faster and cheaper. For example, earlier this week, Thomson Reuters Corp. (TRI) suffered a record one-day decline of nearly 16%, even after reporting results that were largely in line with expectations and raising its dividend. The selloff came as investors grew concerned that fast-improving AI tools could eventually encroach on core parts of Thomson Reuters’ legal and information businesses. Those concerns intensified after Anthropic, the company behind the Claude AI model, announced new capabilities for its Cowork tool aimed at legal, finance, and marketing workflows. The fact that these tools can be customized and deployed broadly has only heightened questions about pricing power and long-term defensibility across the sector. That’s the key point. These stocks aren’t falling because AI demand is slowing. They’re falling because AI is becoming good enough, fast enough, and flexible enough to challenge business models that were built for a pre-AI world. This is what a “Stage 1” to “Stage 2” transition looks like. As markets move into a more selective phase, some stocks continue to thrive. Others stall. And investors who assume yesterday’s leaders will automatically dominate tomorrow often learn that lesson the hard way. As I said earlier this week here, I see a significant dislocation taking shape in this market. It’s not a collapse. It’s not the end of the AI boom. But a shakeout is coming, and you need to be ready. From Stage 1 Internet to Stage 2 To understand what’s happening now, it helps to think back to the early days of the internet. In the late 1990s, telecommunications companies spent staggering amounts of money building the backbone of the internet. In just a few short years, well over $100 billion was poured into laying fiber across the United States alone. Following the Telecommunications Act of 1996, total investment surged – some estimates say north of $500 billion – and much of it was financed with debt, as companies raced to add switches, expand wireless networks, and blanket the country with capacity. The spending wasn’t limited to the U.S. Globally, companies rushed to connect cities, countries, and continents. Tens of billions of dollars were spent laying undersea fiber-optic cables. Cable operators invested heavily to upgrade their networks in anticipation of explosive demand. At the time, those companies looked unstoppable. They were essential to the internet’s growth. And investors assumed that would translate into lasting dominance. It didn’t. Far more capacity had been created than could be profitably monetized in the near term. Pricing power evaporated. Returns disappointed. And many of the companies that defined Stage 1 of the internet failed to dominate Stage 2. For example, Cisco Systems Inc. (CSCO) was the most valuable company in the world at the height of the dot-com bubble. Yet its stock collapsed by 88% and took decades to recover.

Now, Cisco remained a profitable business in the early 21st century. But its stock was repriced. Other companies – like Google and Facebook (now Alphabet and Meta Platforms) – came along in the late days of Stage 1 to take the reins in Stage 2 of the internet boom. We all know what happened next. Those companies created a fortune for early investors. The same pattern has repeated itself across technological cycles for more than a century. And it’s happening again. From Stage 1 AI to Stage 2 The first phase of the AI boom was about proving the technology worked. A small group of mega-cap technology companies pioneered the tools that brought AI to the masses. The market rewarded that leadership handsomely. Stocks surged as investors piled into the most obvious AI pioneers, much like they did with the early internet leaders in the 1990s. Being first mattered. Being big mattered. And for a time, simply being associated with AI was enough. That was Stage 1. What we’re seeing now is the market recalibrating how value is created as AI moves from novelty to infrastructure and practical application. The spending numbers make that clear. According to Bloomberg, Alphabet Inc. (GOOG), Amazon.com Inc. (AMZN), Meta Platforms Inc. (META), and Microsoft are projected to spend roughly $650 billion this year alone, with the vast majority of that money earmarked for data centers, chips, power, networking, and the physical systems required to scale AI. That represents an estimated 60% increase from just a year ago. The problem? The market is starting to change the definition of what it cares about right before our eyes. The question is shifting from “can this be built?” to “who earns an attractive return once it is built?” Consider this: Those same four companies have collectively lost more than $950 billion in market value this week as I write this. How We Should Respond Now, I don’t bring this all up to bring the mood down. The fact is, every era is marked by change. Bill Walsh’s 49ers in the ’80s gave way to Jimmy Johnson’s Dallas Cowboys in the ’90s. And so on. By the same token, as Big Tech AI stocks waver, another group of stocks has been moving higher during this earnings season. I’m talking about the smaller companies that make the equipment, components, and infrastructure required for AI computing – and the firms that are applying AI efficiently inside profitable businesses. This is exactly how a Stage 1-to-Stage 2 transition unfolds. That’s exactly why I recently recorded a special briefing on what I call the AI Dislocation. In it, I walk through this shift from Stage 1 to Stage 2 in the AI boom, and why that transition could become unmistakable as soon as February 25. I also explain how I’m positioning ahead of that shift using my proven system to identify fundamentally superior companies. These are not the obvious mega-cap names that led the first phase. They’re smaller, under-the-radar companies helping to power, connect, and profit from the next phase of AI. In my view, these could be the next market leaders as we enter Stage 2. If you want a clearer roadmap for how to position yourself, go here to watch my free briefing now. Sincerely, |

0 Response to "Must Read: The AI Shakeout Has Started – Are You in the Right Stocks?"

Post a Comment