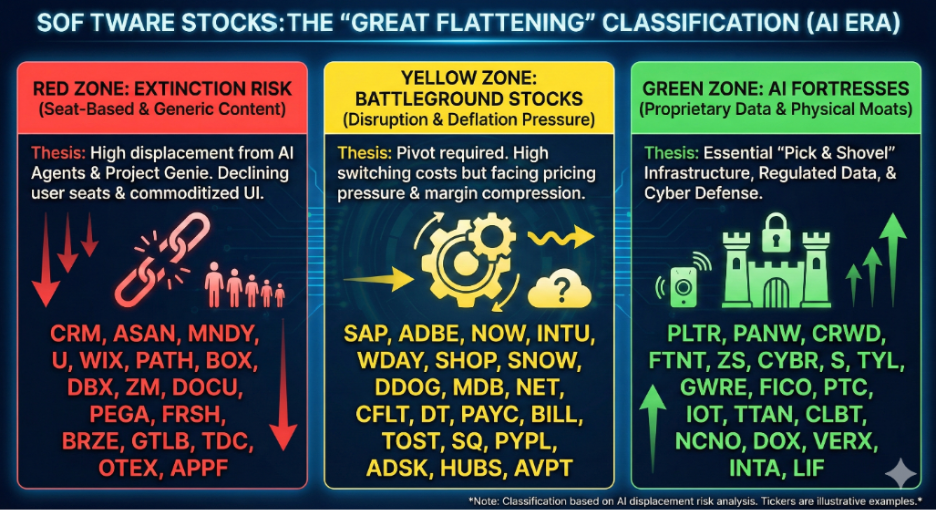

Sell… Sell… Sell… Another Eight Companies Insiders Are Exiting VIEW IN BROWSER Tom Yeung here with your Sunday Digest. Last week, I warned that insiders in two key industries were selling unusual amounts of their company’s stock. Data centers. The phenomenal growth story is now facing margin compression as cloud customers begin to cut back. Insiders at Oracle Corp. (ORCL) and CoreWeave Inc. (CRWV) sold an unusual number of shares, and we learned this week that Berkshire Hathaway Inc. (BRK) dumped 75% of its Amazon.com Inc. (AMZN) holdings last quarter. Airlines. American consumers might finally be pulling back. Several executives at Delta Air Lines Inc. (DAL) sold large chunks of stock in early February, a historically bearish signal. After all, airline tickets are often bought well in advance. Shares of the three firms have since fallen 4% on average, compared to a slight gain in the S&P 500 index. Insider sales have continued this week. Market fears are spreading to other industries, and many “smart money” investors are getting out while they still can. Rolling 90-day buy-sell ratios among insiders have further declined to 0.30, down from 0.32 last week. (That means for every seller, there are now only 0.3 buyers.) That’s why I’d like to remind you that Wall Street legend Marc Chaikin is presenting a free live broadcast where he outlines his predictions going into a volatile March-April period. He believes markets are ready to rupture, and that only a tiny portion of companies will be spared from a deep selloff. Some of these fears are already proving true. On Wednesday, shares of the Magnificent 7 stocks briefly dipped below their 200-day moving average, a psychological level that traders increasingly care about. Then on Thursday, Walmart Inc. (WMT) cut its guidance for 2026, citing an uneven K-shaped recovery among customers. Delta Airlines nosedived 5% in response, validating the insider sales reported here last week. To get the details, you’ll have to tune into Marc’s presentation, which will be available until Monday, February 23. In the meantime, I’d like to highlight another eight companies where insiders are selling. And show why today’s market might not be as robust as some believe… | Recommended Link | | | | This technology could solve the world’s greatest scientific mysteries… Treat or eradicate hundreds of deadly and rare diseases… Reduce farming costs by $50 billion a year… And create new generation of AI millionaires. ONE company is at the center of it all. Click here to get its name and ticker symbol. |  | | Another Canary in the Consumer-Demand Coalmine Much like airlines, cruise operators can “see” future demand with unusual clarity. Most cruise companies aim to sell tickets 6 to 18 months in advance, so future customer demand shows up long before hard numbers are officially reported to investors. Besides, high-priced vacation spending is entirely discretionary. If a family is short on cash, then their $5,000 Bahamas cruise might be the first thing to get axed. That’s why recent insider sales at Royal Caribbean Cruises Ltd. (RCL) are so worrying. Over the past two weeks, we’ve seen: CEO: Sold 7,854 shares 2 Directors: Sold 281,385 shares Chief Accounting Officer: Sold 4,442 shares Chief Financial Officer: Sold 51,131 shares 2 other executives: 54 shares Each share of Royal Caribbean is worth over $300, meaning that these sales amounted to an astounding $166 million. The sums getting liquidated are enormous. Now, some of the selling could be motivated by price. My own calculations show that RCL is roughly 30% overvalued after its 150% surge over the past two years. Some might even point out that cheaper rivals Carnival Corp. (CCL) and Norwegian Cruise Line Holdings Ltd. (NCLH) have seen no recent insider selling. But these explanations are not particularly satisfying. Royal Caribbean insiders didn’t sell when valuations were even higher last summer. Something is different this time around. And as for Carnival and Norwegian… both are in pre-earnings “quiet periods” that prohibit insiders from getting out. In addition, a recent Bank of America study found that middle-income families are now falling down the bottom leg of America’s “K-shaped” recovery. While upper-income household spending rose 2.5% in January, spending increases among middle-income and lower-income families rose just 1% and 0.3%, respectively. That’s bad news for companies that serve America’s middle class. Tightening wallets not only means less demand… but also more competition from rivals dropping prices. And if insider sales at Delta Air Lines and Royal Caribbean are any guide, investors should tread carefully as more American households join the bottom leg of the K-shaped recovery. Trucking: Coming to a Rolling Stop Shares of trucking companies have been on a tear in recent months. Truck maker PACCAR Inc. (PCAR) is up 26% since October, while trucking firm Ryder System Inc. (R) is up 30%. There are two reasons for the jump: 1. Emissions Standards. Last week, the Trump administration rescinded a key policy that previously allowed the U.S. Environmental Protection Agency (EPA) to regulate motor vehicle greenhouse gas emission standards under the Clean Air Act. As the EPA stated in its official press release: As a result of these changes, engine and vehicle manufacturers no longer have any future obligations for the measurement, control, and reporting of GHG emissions for any highway engine and vehicle, including model years manufactured prior to this final rule. This removes the federal EV mandate for Class 8 trucks, meaning that diesel equipment can remain in place. (A separate 2027 NOx emission standard will remain in effect.) 2. Improving Trucking Demand. The industry is now digging out of a terrible 2025, where sales of Class 8 trucks plummeted 13.4% as buyers waited to see the effects of tariffs and the upcoming 2027 NOx emissions rules. The industry should see a return to 5% growth this year thanks to catch-up demand. However, insiders seem to believe that the good news is now baked into prices. Over the past two weeks, insider sales at Ryder have included: Director: Sold 32,230 shares Chief Marketing Officer: Sold 6,000 shares EVP: Sold 871 shares Three other insiders sold their stock options immediately after they vested. Meanwhile, PACCAR insiders sold a combined 166,000 shares across 10 separate transactions by cashing out of vesting stock units. This includes sales by the CFO, several presidents, and a director. I see this as a strong sign to get out. By my calculations, shares of Ryder now sell 30% above their justified long-term value, while PACCAR trades 50% higher. Trucking is a highly cyclical market, and both firms have historically underperformed after reaching new peaks. (By their very nature, cyclical stocks that go up must eventually come back down.) And so, trucking executives are cashing in their chips despite Wall Street bullishness. You should consider it, too. Artificial Intelligence: Separating Winners from Losers Three weeks ago, I recommended investors buy shares of two beaten-down software companies: Both firms were pummeled by “SaaSpocalyspe” fears that AI would destroy their businesses… and I believed the selloff had finally gone too far. ServiceNow has seen early signs of a stock recovery, while Reuters has stopped falling. However, not every software company is safe from AI – a point InvestorPlace tech stock analyst Luke Lango highlighted in a recent Hypergrowth Investing article: For 15 years, the Software-as-a-Service business model was like the ultimate profit hack. Build an attractive dashboard, connect it to a database, and charge companies $30 to $100 per month, per human, to use it. The more workers those client companies hired, the more money SaaS providers made. But now, the market has realized that AI is beginning to erode the human input in that cash equation – and it’s happening faster than most investors expected. He identifies several “Red Zone” companies at particular risk. These include firms that either compete directly with AI agents or have business models that are sensitive to AI competition. For instance, project management software firm Monday.com Ltd. (MNDY) is already seeing do-it-yourself customers move to chatbot alternatives. In fact, CNBC reporters managed to build a working Monday.com clone in under an hour using Anthropic’s Claude Code AI tool earlier this month.

It should therefore come as no surprise that insiders at several of these “Red Zone” firms have been liquidating shares. Some sales in the past two months include: Salesforce Inc. (CRM) Director: Sold 3,893 shares Unity Software Inc. (U) Director: Sold roughly 174,000 shares Pegasystems Inc. (PEGA) Chief Product Officer: Sold 7,000 shares GitLab Inc. (GTLB) Director: Sold 334,827 shares Teradata Corp. (TDC) 10% Owner: Sold 61,990 shares That’s particularly concerning because insiders are selling on the way down instead of buying the dip as they previously did. That’s a very negative sign that suggests margins still have a long way to fall. The 20%-plus return on equity (ROEs) percentages commonly seen in the SaaS business might soon become a thing of the past. And so, I highly recommend you examine your software holdings to see which ones are seeing insider sales… and which are getting bought up by “smart money” investors. The Illusion of an Unbreakable Business The divergence between “Green Zone” and “Red Zone” software stocks can be illustrated by a story that Marc Chaikin wrote last year. In that piece, he noted how Barneys New York was once seen as an unbreakable business. The store often featured in the hit HBO series Sex and the City, whose lead character, Carrie Bradshaw (played by Sarah Jessica Parker), considered Barneys one of her favorite places to shop. But on February 23, 2020, Barneys New York closed… And so did the company's other stores in New York, along with those in San Francisco and Beverly Hills. All its branches closed, all on the same day. The reason was simple: The internet came along, and “direct to consumer” shopping took off. Brands could use the internet to sell products directly to their customers, cutting out middlemen like Barneys. The Carrie Bradshaws of today use their phones to buy clothing, order food, and hail an Uber ride somewhere besides an upscale department store. Software companies are now facing the same reckoning. Formerly “unbreakable” businesses like Salesforce and GitLab are now facing an existential threat from artificial intelligence. Their fat margins are under attack from a product that’s almost free… and insiders are selling even as shares go down. Not all of them, but many of these “Red Zone” firms will disappear just like Barneys New York. Marc Chaikin calls this a part of a rupture that will shake markets this year. However, he believes a select group of companies will survive… and even thrive in this new reality. To learn more about these elite companies he’s identified, you can rewatch his free presentation here for a limited time. I’ll see you here next week, Thomas Yeung, CFA

Market Analyst, InvestorPlace |

0 Response to "Sell… Sell… Sell… Another Eight Companies Insiders Are Exiting"

Post a Comment