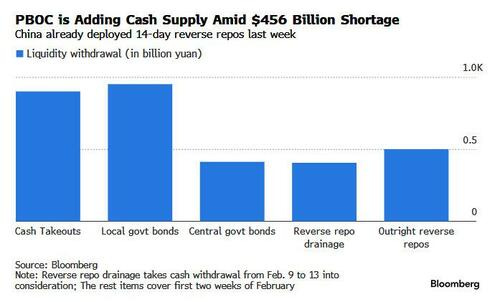

The BRRR Is Real... Here's Looking at You Silver...Oh look... China is injecting a half trillion dollars in Yuan into its markets... Strange.Good morning: Welcome to our many new members who joined us over the weekend. We cover a lot of ground here - but we’ve started to add some visual components to this, so take what you will… and leave the rest. When I say the word… “BRRR,” I’m referring to stimulus and looser monetary conditions. We keep a close eye on economic conditions and apply them where necessary. Well… I’ve said that China was due for a BRRR. And here it comes… In U.S. figures, the pump flowing out of Beijing is about $500 billion. Remember when we used to flinch at these numbers? They’re not messing around. Like the U.S., China is dealing with liquidity gaps. This should be bullish for resources… but I’m not gonna be shocked if Weibo (WB) finds its legs. Silver is back above $80 per ounce, and gold at $5,000. I have a feeling that they’re getting ready to break out once again - despite our deeper concerns about momentum at the moment. In late 2025, the Fed reversed course from tightening to balance sheet expansion, buying $40 billion a month in Treasuries to keep the system liquid. Japan is running fiscal dominance under a regime that guarantees continued yen debasement. Its sweeping election tells us that Japan will spend at all costs and run it hot, despite the threat of inflation and rising food costs. There’s a lot to unpack from that election. Yes, the Nikkei is at an all-time high, but this ongoing printing comes at a cost. It means we’re going to see… again… problems from Japan that affect the plumbing of the U.S. financial system. This has been a problem since at least July 2024… although some people can’t pick the island nation of Japan out on a map… Here’s Japan… Or is it? No… that’s Madagascar… Meanwhile, China is pouring stimulus into solar, EVs, and infrastructure that consume silver by the ton. And other resources should capture a bid as a result of printing. If you paid attention to my piece about debasement, the rule goes that we need to focus on scarce assets - not abundant ones. Don’t speculate on food… focus on silver, gold, and things that matter. Meanwhile, the physical silver market is flashing stress signals not seen in years. COMEX registered inventory is at historic lows. London lease rates just spiked. Delivery demand is accelerating on a trajectory that would have been unthinkable two years ago. Paper claims on silver vastly exceed the physical metal available to back them. Something has to give. Welcome to Groundhog Day. Speculation in commodities will dominate 2026. Now, let’s get to the Capital Wave Score… And our list of breakout and breakdown stocks... Continue reading this post for free in the Substack app |

Subscribe to:

Post Comments (Atom)

0 Response to "The BRRR Is Real... Here's Looking at You Silver..."

Post a Comment