You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. Dear Fellow Traveler: Pitchers and catchers report today… and we can put all the chatter about the NFL season to bed. I’m still waiting for the Baltimore Orioles to find a frontline starting pitcher, but I guess we’ll just keep doing what we do. Watch other people sign pitching… and then maybe see if Bartolo Colon wants to come out of retirement. The S&P 500 (currently Yellow in our reading, even at highs) is trying to crack that 6,980 level. A push above that spot could offer a view above the clouds. The odd part is that this is a lower volume day… Feels like a lot of people want to sell… will they suck the volume back into the market? This trading day has been marked by further optimism about stimulus - the BRRR kind and the deficit-run one. China is pumping about 3.2 trillion Yuan ($500 billion) into its economy as the Lunar New Year takes place. It seems they, too, have a massive liquidity gap that needs some support. Add that to Japan’s stunning snap election, and we see a world where easing ain’t done. But as we’ve said, many policies aim to be supportive… not necessarily the “we’re going to print and drop money from helicopters.” Economist Lyn Alden has called this the “Gradual Print.” She notes the initial $40 billion per month in reserve management purchases, tapering to a structural baseline of $20–25 billion per month. This is not QE in the classic, crisis-response sense. It’s basic plumbing and maintenance… designed for QE-like outcomes... The Fed is keeping reserves “ample” so the repo market does not hiccup and SOFR does not drift above IOER, as we saw during the late-year liquidity squeeze. This is really just a dull debate between sparkling wine and champagne. It’s base money growth versus duration-suppressing QE. Alden says that relative to a $6.5 trillion balance sheet, even $220 million to 375 billion in growth is modest. In percentage terms, it barely registers compared to prior QE waves. And her framing that the Fed will likely expand roughly in line with deposit growth or nominal GDP growth makes sense. The system now requires structural liquidity just to stand still. Where I lean harder is on the structural deficit angle. She notes that sustained fiscal dominance and high debt levels create a mild upward force on assets and a mild dollar headwind. I think that “mild” becomes cumulative. It’s not explosive, just persistent. Liquidity stretches across time and rarely rings a bell. Her conclusion to own high-quality, scarce assets and rebalance away from euphoric areas aligns with our playbook. This is exactly what we discussed yesterday in Postcards from the Edge of the World. Thing I Think No. 2: It Was Hidden in Plain SightAn interesting catch… I saw it last night but didn’t think much of it at the time… But Grey Rabbit Finance called out that suspicion this morning. Last night, America divided itself over a musician I barely recognize. With all the drama… this image appeared appeared in the set… A man with watches and jewelry… And this sign. “Compro Oro y plata. Solomente efectivo” That translates: “I buy gold and silver… Cash only.” For all the focus on social issues, this economic one sat hidden in plain sight. A world where a man wants real assets… gold and silver… paying in cash… It was subtle. Everything else was loud… This just sat there in the background. But it was there. Nothing on that stage was done without purpose. Think I Think No. 3: All That GlittersThis morning, we had a shift to Yellow in our Capital Wave figure… But the big noise came out of our ETF screens. The VanEck Gold Miners ETF (GDX) saw only 0.6x relative volume today… but still popped nearly 5%. It hit our tape at around 10 am and has been steadily running today. But the LEVERAGED MicroSectors Gold Miners 3X Leveraged ETN (GDXU) absolutely roared, popping nearly 15%. The message remains the same. There were obviously stimulative forces at play. But the story creeping under the radar was that China has advised its banks to curb exposure to U.S. Treasuries. All while Treasury Secretary Scott Bessent said that the odd price activity in gold is coming from China.

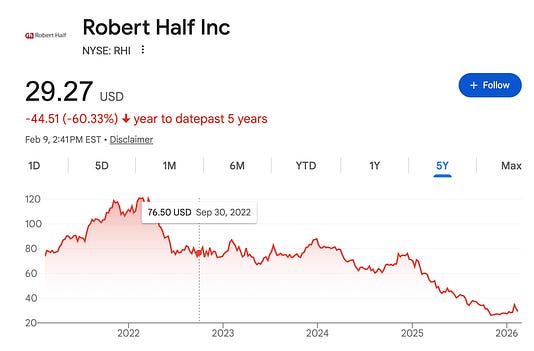

Remember that Capital War that Ray Dalio said we’re on the brink of? Pay attention. We’ve been here for a while… This is going to keep ramping up. Feels like we’re about to experience another round of speculation… Think I Think No. 4: There Are Good People in the WorldI saw my parents last night. During the game, my mother told me a story that seemed too wild to be true. A few years ago, my father gave her a diamond ring, something that meant a lot to her. But a while back, she misplaced it. She couldn’t figure out where it was and assumed she’d packed it away with the Christmas decorations. She’d hopefully find it… But didn’t this past season. She gave up hope on finding it. A few days ago, she received a package in the mail. It was from Home Shopping Network… owned by Qurate Retail Group (QVCGA). She opened it… and it was the ring. There was a note. She’d returned something a while ago, but there wasn’t any phone number or email attached. And the ring was somehow in this box. It’s worth a few thousand dollars. And someone took the time to mail her ring back. No one would have known. My mother certainly didn’t know. But there it was… A small action that will have a ripple effect. There are still very good people in the world… you just have to keep your eyes open. Thank you to that worker and to Qurate Retail Group - as such actions likely reflect your culture and values. Thing No. 5: And Finally.. Don’t Hold the BagFinally, a word of advice. I noted yesterday that software stocks still have a long way to fall if they’re trading at 8 times revenue on the aggregate, and a few outliers are holding this sector up. The average software stock fell 40% from its peak by early February. The market understood that if AI agents can write and ship code, the companies selling developer tools are worth less. That repricing was fast and accurate. A reader asked me the other day what other sectors are at risk… Here goes… Staffing and recruiting firms like Robert Half exist to supply human beings for cognitive work. AI agents flip that demand equation. Since ChatGPT launched on November 30, 2022, the stock has cratered. This is important because shares already took a beating from the top of the liquidity cycle in late 2021 to that date (coinciding with a broader market downturn). Since ChatGPT, it lost a lot more. Business process outsourcing companies like Concentrix and TTEC employ hundreds of thousands of people to handle calls and paperwork. That is exactly the kind of rules-based labor that AI handles best. Advertising holding companies like WPP and Omnicom face clients who can now produce creative, media plans, and analytics in-house. Insurance carriers face automation of underwriting, claims, and pricing. Professional services firms like Thomson Reuters and H&R Block built moats on “proprietary data plus smart people who interpret it.” AI compresses the second half of that equation. The AI legal element hammered that space last week. Finally, real estate brokerages are sitting on a 3% commission model that assumes a human is required to justify it. Research suggests up to 80% of a typical agent’s work run on AI by 2030. So… why isn’t Goldman interested in these sectors? Why isn’t someone calling the bottom in any of these stocks? My hunch is Occam’s Razor. You think there’s a lot of private credit lending to staffing agencies? Probably not… One of the panic points has been credit for many high P/S stocks with questionable ability to refinance or repay debt, as their businesses face extinction moments, amid a massive refinancing wall in late 2026. Remember… the AI impact is exponential… And it’s coming like a missile… Stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "Things I Think I Think... (There Are Good People In the World)"

Post a Comment