| On Behalf of Power Metallic Mines

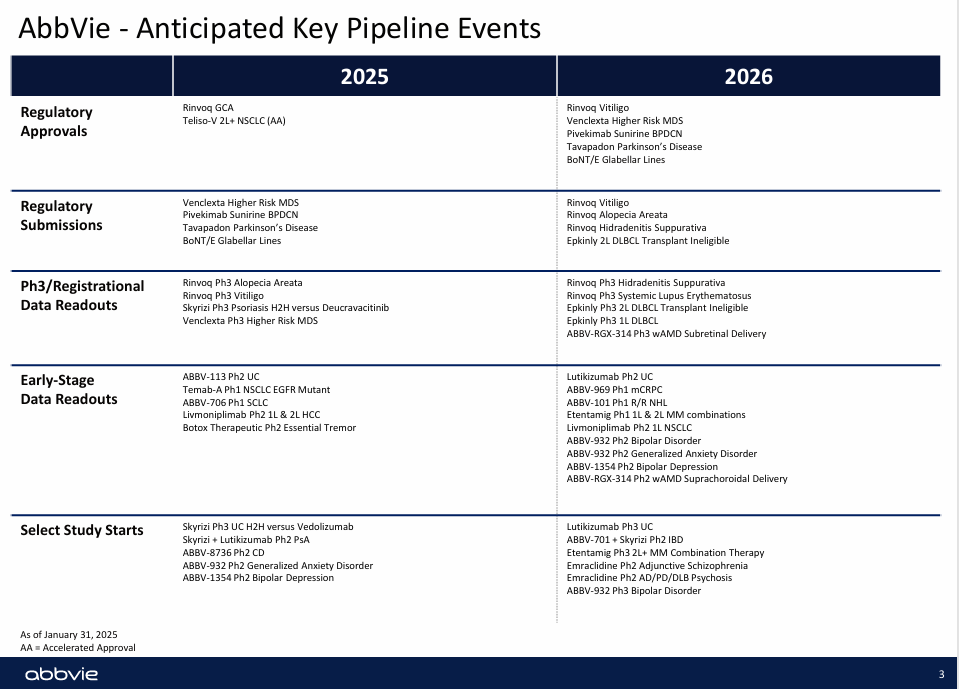

Winners are built in quiet periods and revealed by catalysts. Copper is entering a loud period. The energy transition is not a press release. It is wire. It is motors. It is heat sinks. All of it eats copper. Quebec just put another pin on the copper map. A polymetallic discovery with meaningful grades is advancing with money in the bank and drills ready for 100,000 meters. Big investors are not romantic. Robert Friedland and Rob McEwen want scalable geology and repeatable results. They're multiple time investors. The playbook is simple. Stack assays. Expand the system. Convert attention into institutional interest. Rinse and repeat as the grid buildout accelerates. You have seen this movie. The first act introduces the deposit. The second act proves continuity. The third act invites a rerating as the market connects the dots. Do not wait for the crowd to explain it to you. Be the investor who recognized the pattern first. Unlock the full details and the symbol now. Today's editorial pick for you 3 Big Pharmaceutical Stocks for Every Investing StylePosted On Nov 04, 2025 by Chris Markoch There are two camps when it comes to investing in pharmaceutical stocks, and they couldn't be more different. On one side, you'll find investors who love to speculate on small-cap biotech and pharma names. These stocks often trade for $10 or less. However, many are not profitable and have little to no revenue. Their success or failure hinges on the outcome of a single clinical trial or FDA decision. Table of ContentsThese stocks can generate life-changing returns, but they also carry enormous risk and volatility. The kind of risk and volatility that isn't suitable for risk-averse investors. On the other side are the large-cap pharmaceutical stocks with decades of success, broad product portfolios, and recurring revenue streams. These companies generate consistent profits, invest heavily in research and development (R&D), and reward shareholders through dividends and buybacks. For investors who prefer the latter category, three large-cap pharmaceutical stocks—Pfizer Inc. (NYSE: PFE), AbbVie Inc. (NYSE: ABBV), and Amgen Inc. (NASDAQ: AMGN)—stand out for their strong fundamentals. However, despite their obvious similarities. Each caters to a different type of long-term investor. Pfizer: The Rebound Value Play Among Pharmaceutical StocksPfizer was a standout stock in 2021, when its COVID-19 vaccine and antiviral pill generated tens of billions in sales. But as the pandemic receded, so did Pfizer's revenue and stock price. Shares are now trading near decade lows, making the company a potential turnaround story for patient investors. I say “potential” because PFE stock has been dead money for several years despite many analysts claiming the stock was a logical turnaround candidate. The challenge is clear but will take time. That is, Pfizer needs to replace declining COVID product sales with growth from the company's core portfolio and pipeline. Management has launched an aggressive cost-cutting program and expects to realize $4 billion in savings by the end of 2025. More importantly, Pfizer is betting on new products in oncology, immunology, and rare diseases to reignite growth. Several of these new drugs, including the migraine treatment Nurtec ODT and the RSV vaccine Abrysvo, are already gaining traction. The company also completed its acquisition of Seagen, adding a suite of cutting-edge oncology therapies that could become long-term revenue drivers. Investors willing to wait for that growth to materialize can collect an attractive dividend while they do. Pfizer's dividend yield of over 5% is one of the highest among large-cap pharmaceutical stocks. The payout is well-supported by cash flow and reflects management's commitment to returning capital to shareholders even through a period of transition.  Investor takeaway: Pfizer represents a classic value opportunity—an industry leader trading at a discount with a clear plan to restore growth. For investors who prioritize income and patience, PFE stock could offer meaningful upside in the next two to three years. AbbVie: Dividend Royalty Among Pharmaceutical StocksAbbVie is a favorite among income investors, and for good reason. After its 2013 spin-off from Abbott Laboratories, AbbVie was grandfathered in as a Dividend Aristocrat. Since then, the company has built an impressive record of dividend growth all its own, earning its place among the S&P 500 Dividend Kings. With a yield of around 3.25%, AbbVie is a cornerstone for dividend portfolios. For years, AbbVie's success revolved around Humira, the blockbuster immunology drug that once accounted for more than a third of the company's revenue. When Humira's U.S. patent expired in 2023, many feared a steep decline. Instead, AbbVie executed one of the smoothest transitions in big pharma history. Its next-generation drugs, Skyrizi and Rinvoq, are now well-established and are expected to more than offset Humira's losses by 2025. AbbVie has also diversified with acquisitions in neuroscience (Allergan, maker of Botox) and oncology, building a broader and more resilient pipeline.  Beyond the fundamentals, AbbVie's consistent cash flow and disciplined capital allocation make it a strong choice for investors who value both income and stability. Even as it invests heavily in new R&D initiatives, the company maintains a conservative payout ratio and continues to deliver total returns well above sector averages. Investor takeaway: AbbVie is tailor-made for dividend investors. It offers a reliable yield, a growing payout, and a proven ability to navigate industry headwinds. Amgen: An Innovative Growth Play Among Pharmaceutical StocksAmgen rounds out the trio as the innovation-driven growth play. The company has built one of the most diverse portfolios in the industry, spanning oncology, inflammation, bone health, and biosimilars. Unlike many peers, Amgen has maintained steady growth while continuing to return capital to shareholders through dividends and buybacks. The acquisition of Horizon Therapeutics in 2023 adds a new layer of growth potential in rare diseases, particularly in conditions like thyroid eye disease and gout. Amgen's R&D pipeline remains robust, supported by strong cash generation and an emphasis on next-generation biologics. Amgen is also embracing technology to improve efficiency and accelerate drug discovery. The company is integrating artificial intelligence into its clinical and R&D processes, which could lead to faster and more targeted therapy development. With a dividend yield around 3.2%, Amgen offers income alongside growth—a balance that's increasingly rare in the healthcare sector. The stock has also outperformed peers over the past three years, underscoring investor confidence in management's strategy.  Investor takeaway: Amgen appeals to investors seeking growth with stability. Its innovation engine, strategic acquisitions, and shareholder-friendly policies make it one of the most balanced large-cap pharma plays available. Get the Reward Without the RiskWhile small-cap biotech stocks may offer bigger short-term excitement, large-cap pharmaceutical companies like Pfizer, AbbVie, and Amgen deliver steady growth, dependable income, and resilience through market cycles. Each caters to a different investing style:

Together, they represent a diversified way to gain exposure to the pharmaceutical sector without taking unnecessary risk. For investors looking to blend safety, yield, and growth, these three big pharma stocks could make a healthy addition to any long-term portfolio. This message is a PAID ADVERTISEMENT for Power Metallic Mines Inc (TSXV:PNPN | OTCQB:PNPNF) from Market Jar Media Inc. StockEarnings, Inc. has received a fixed fee of $4000 from Market Jar Media Inc for multiple Dedicated Email Sends, Newsletter Sponsorships and SMS Sends between Nov 04, 2025 and Nov 10, 2025. Other than the compensation received for this advertisement sent to subscribers, StockEarnings and its principals are not affiliated with either Power Metallic Mines Inc (TSXV:PNPN | OTCQB:PNPNF) or Market Jar Media Inc. StockEarnings and its principals do not own any of the stocks mentioned in this email or in the article that this email links to. Neither StockEarnings nor its principals are FINRA-registered broker-dealers or investment advisers. The content of this email should not be taken as advice, an endorsement, or a recommendation from StockEarnings to buy or sell any security. StockEarnings has not evaluated the accuracy of any claims made in this advertisement. StockEarnings recommends that investors do their own independent research and consult with a qualified investment professional before buying or selling any security. Investing is inherently risky. Past-performance is not indicative of future results. Please see the disclaimer regarding Power Metallic Mines Inc (TSXV:PNPN | OTCQB:PNPNF) on TradingWhisperer website for additional information about the relationship between Market Jar Media Inc and Power Metallic Mines Inc (TSXV:PNPN | OTCQB:PNPNF). StockEarnings, Inc |

Subscribe to:

Post Comments (Atom)

0 Response to "🎯 Timely Multi-Metal Trade Idea To Watch Now"

Post a Comment