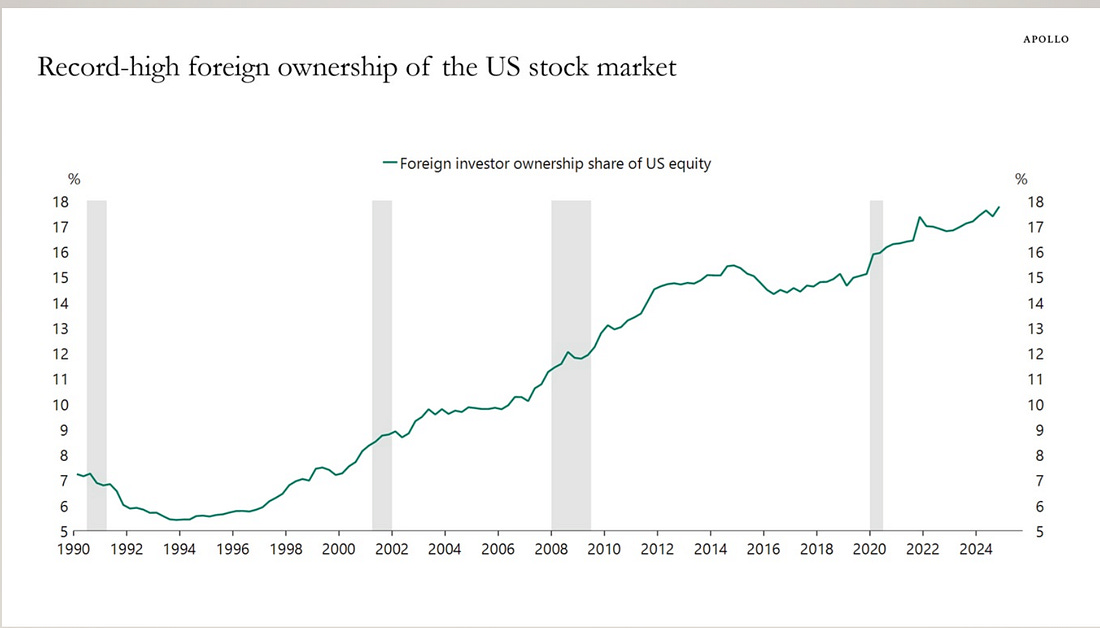

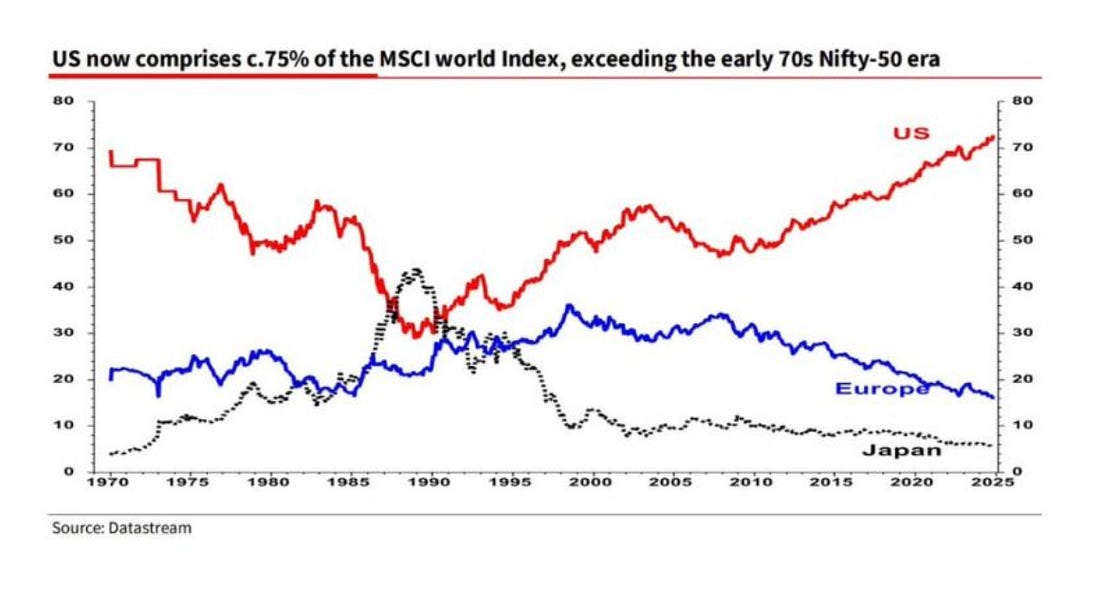

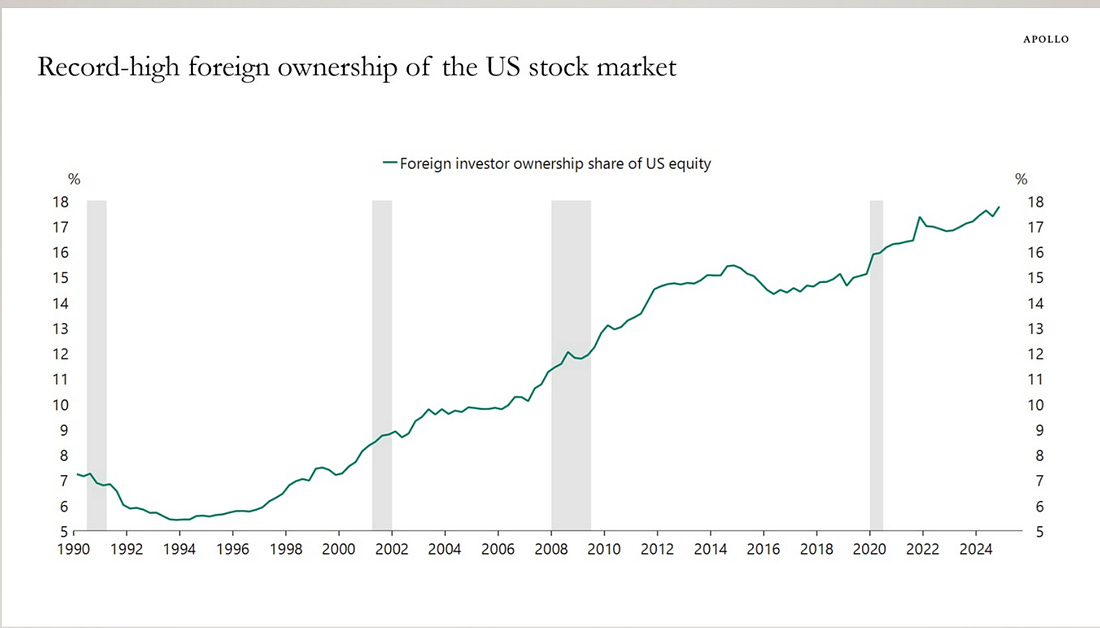

You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. All Eyes on This Chart, Please...At some point... this will be the story that everyone became an expert in...Dear Fellow Traveler: You’ll hear plenty of talking heads tell you that when the pin leaks and valuations start to drop… that it will be the AI Bubble deflating… But it won’t be AI. It’ll be something bigger… It’ll be America. Not everyone sees the writing on the wall… But two important voices on macro forces both raised the alarms this weekend… Michael Howell at Capital Wars… and Macro Reports… They both approached the same problem from different angles… And they both delivered the blisteringly clear message. When the levy breaks… the real threat will be the exodus of foreign capital from U.S. markets… We continue to see record-high foreign ownership in the U.S. equity markets as these investors seek alpha from the only game in town… Over the last 13 years, the U.S. has gone from about 33% of the Global MSCI Index to 75% in January 2025, according to Syz Group... Foreign capital helped push those figures… Especially in a world of zero interest rates after COVID. But we all know this is not sustainable… While skeptics will say that this isn’t enough to move equity valuations much lower, they’re discounting that 1) it’s already happened before and 2) the market structures have changed dramatically since Japan’s volatility explosion rocked equities in August 2024. Let’s start by recognizing that the world is running out of “Easy Money…” And do so by giving you a simple way of understanding what this means… Understanding Liquidity…I want you to think of the term “liquidity” or money moving around like water. It’s not complicated. You’ve heard the term “A rising tide lifts all boats…” Same concept… When a lot of water flows into the United States, everything goes up… stocks, housing, crypto, tech, everything. When the water slows down… prices stop rising. When the water starts flowing OUT… things break. That’s it. That’s the whole stupid system. And it’s been this way for decades and decades… With water on the verge of leaving, one expert says, “This is not great news for risk assets.” Which means… hey… maybe get a life preserver on. Meanwhile, our other expert tells us the thing that doesn’t get a lot of play… A massive amount of “water” that pushes up U.S. stocks isn’t American water… It comes from overseas. Japan, Europe, the Middle East… China… they pump money into the U.S. because our markets pay better. Think of it like tourist stimulus… When tourists show up, your town looks booming. When they leave, the town looks empty overnight. This matters because… right now… Foreign money owns a gigantic chunk of our stocks and bonds. And they are now looking for the exit. Why? One reason is that the U.S. is trying to push for a weaker dollar… And a weaker dollar hits foreign investors right in the teeth. So what could they do? They’d sell… take their money home and invest domestically or in other markets… And when they sell, U.S. markets can fall fast… Why I Care About JapanSo, I talk about Japan a little too much, and it makes people wonder if I’m okay… But for years, Japan had ultra-low interest rates. It was here that the world borrowed money from Japan for very little and shoved it into U.S. stocks. That trade worked beautifully until August 2024… But now, Japan might have to raise interest rates. That might lead to a stronger Yen (their currency), and that could put a dent in the “borrow-and-buy-America” game. When that carry trade unwinds, money doesn’t trickle out… it rushes out like someone pulled a drain plug. See August 2024. That’s why Japan matters. They’re the quiet money-lender to the world, and their problems become your problems even if you’ve never been to Tokyo. As I said, we’ve reached the point where it’s like your neighbor’s thermostat can impact the temperature of your house. The Bank for International Settlements made this observation back in April. But seriously… who other than this guy actually sat down and read that thing… Here’s the ProblemIt’s been a solid 15 years of cheap money, making everything look good… The problem is if all that capital starts to disappear. Howell and Macro Reports both effectively tell us that the world is hitting peak liquidity, that foreign investors are too exposed (and concentrated) to U.S. markets, that there are clear political forces in D.C. that want a weaker dollar, and that Japan’s cheap-money policies are ending after decades… And most important… the next shock could come from foreign flows reversing, not from a recession… after decades of this chart inflating… Which is a reminder… crisis doesn’t happen when a fund or industry blows up… It happens when liquidity dries up and money leaves. This happened in 2008. That’s the risk again now. Let’s Make This SimpleYou don’t need a PhD to understand how markets work... Money flows like water. When the tide comes in, everyone thinks they’re a genius. When the tide goes out, you see who was swimming naked. Right now, the tide is pulling back. Liquidity is peaking. And a large share of the capital supporting U.S. markets belongs to foreign investors who are preparing to head home. Some people are going to say that it’s way more complicated than this… I’ll predict that they’re trying to sell you something you don’t need… Or that I’m a doomsdayer… Not true either… This isn’t doom. It’s just plumbing. The water was high. Now it’s gently draining. Now it’s time to put on waterproof boots before everyone else notices their socks are wet… It’s going to be a very interesting 2026… and we’re preparing accordingly… My 2026 Outlook will arrive later this month after I’ve digested about 30 institutional reports. I’ll be increasingly bullish on corporate bonds and foreign defensive names… But I will need some time to get myself into a more reserved and less euphoric mode… For now, just enjoy the show… Stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "All Eyes on This Chart, Please..."

Post a Comment