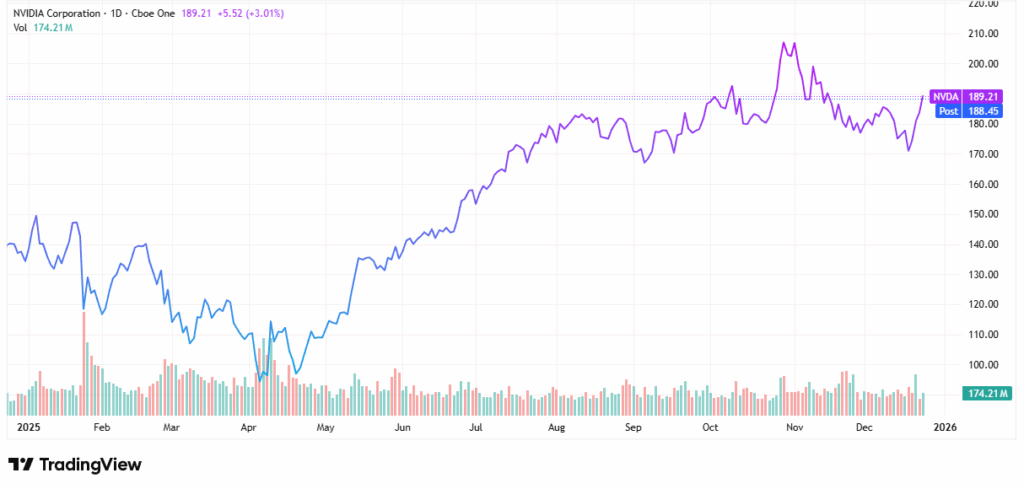

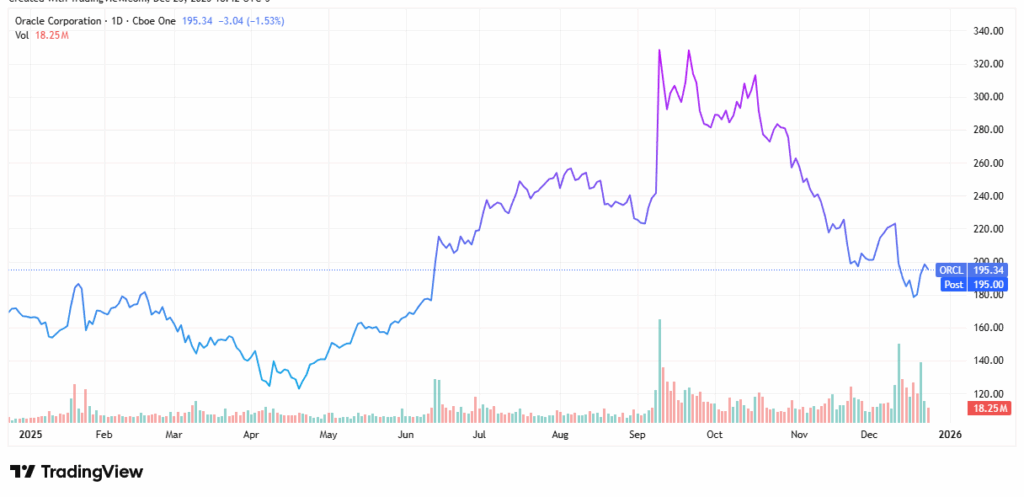

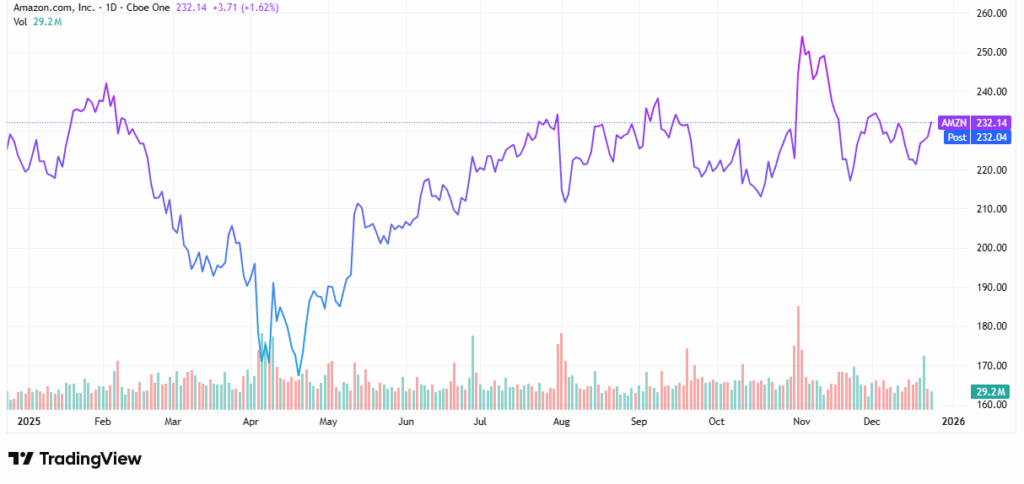

| Editor's Note: Former billion-dollar hedge fund manager Larry Benedict has an uncanny ability to spot market opportunities long before the crowd. Very few people ever get a peek inside how he consistently pulled off winning years — even in chaotic markets… But this move may be the most surprising of his career… Dear Reader, Larry Benedict here. I'm making one of the most unexpected moves of the year… I'm sharing a FREE over-the-shoulder demo of my One Ticker Retirement strategy. In it, I'll show you how I get repeatable results trading certain tickers over and over again. It's the same system that helped me lock in 20 straight winning years — through bull markets, bear markets, and everything in between. Best of all, anyone who watches today can claim a full year of my One Ticker Trader service for just $19. Considering my service retails for $499, this is likely the most valuable offer you'll see this year. Watch my demo to see how it works (and how to claim 96% off before this deal expires). If creating more wealth and freedom is on your list of 2026 to-dos, this deal is for you. Talk soon, Larry Benedict P.S. I know your time is valuable. That's why, in addition to showing you my strategy, I also reveal my #1 stock to trade — just for watching my demo. Check it out while you still can. Today's editorial pick for you Three Oversold Tech Giants That Are Rebounding Heading into 2026Posted On Dec 23, 2025 by Ian Cooper Heading into 2026, some of the most oversold tech giants are just starting to rebound. And let’s face it, the turnaround can’t come soon enough. After 18 months of an almost uninterrupted bull market, tech stocks could no longer fight gravity. Table of ContentsThere were concerns about valuations. There were concerns about an artificial intelligence (AI) bubble. But as 2025 comes to an end, money is going to where it’s treated best. And for now, that means in several oversold tech giants. If you’re looking to reposition for 2026, here are three names to consider. Oversold Tech Giants #1: NVIDIANVIDIA Corp. (NASDAQ: NVDA) has been a volatile, and I could say misunderstood, stock in the last 12 months. Oversold at triple bottom support dating back to September, it's just starting to pivot higher. Not only is NVIDIA still riding Micron's earnings and guidance, but it's also still riding a Barclay's upgrade to a Buy rating thanks to the likelihood of further AI spending. "We are OW (overweight) as the company has long-term sustainable growth led by a large lead in GPUs for AI in DC, with further Edge opportunities (autos, robots, etc.) and a competitive moat around a large portion of the market," said the firm, as quoted by CNBC. From its last traded price of $174.14, we'd like to see NVDA initially retest $200.  Oversold Tech Giants #2: OracleShares of Oracle (NYSE: ORCL) are also regaining momentum. After getting crushed earlier in December, Oracle is also benefiting from Micron's blowout earnings and guidance. Also helping the stock, Oracle and TikTok agreed to sell its U.S. operations to a new joint venture that include Oracle and private investors at Silver Lake. Plus, analysts are becoming bullish on ORCL stock. Wells Fargo, for example, has an overweight rating with a $280 price target. Bank of America has a Buy rating and a price target of $300. Barclays has an overweight rating with a price target of $310 a share. UBS has a Buy rating with a $325 price target. Severely oversold at $180.03, Oracle is oversold on key technical indicators including RSI, MACD, and Williams' %R. From here, we'd like to see Oracle initially refill its bearish gap at around $220. Longer term, we'd like to see it rally back to $280 a share.  Oversold Tech Giants #3: AmazonShares of Amazon (NASDAQ: AMZN) are showing signs of life. OpenAI is in talks with the e-commerce giant about an investment that could exceed $10 billion. It could also include an agreement to use Amazon AI chips, too. This comes not long after OpenAI restructured and outlined the details of its relationship with Microsoft, which, according to CNBC, will allow it to raise capital and partner with other AI companies. In addition, just weeks ago, Amazon ran on news of its plans to invest $35 billion across its businesses in India through 2030. By then, the plan is expected to quadruple exports to $80 billion, while delivering AI benefits for millions of small businesses. Technically, shares of Amazon just found support at $222.56, with over-extensions on RSI, MACD, and Williams' %R. From its last traded price of $222.56, we'd like to see the stock initially break through its 50-day moving average at around $229.25 a share. AMZN stock is also benefiting from bullish analyst sentiment. Oppenheimer raised its price target for AMZN from $290 to $305, noting that Amazon Web Services (AWS) could double its capacity through 2027, and serve as a key stock catalyst.  Oversold Tech Stocks Are Drawing Fresh Capital Heading Into 2026As 2025 comes to a close, investor sentiment toward technology stocks is beginning to shift. After months of valuation concerns and fears of an AI-driven bubble, money is rotating back into proven leaders that have already absorbed a significant amount of bad news. NVIDIA, Oracle, and Amazon all share a common trait: they remain deeply embedded in the infrastructure of AI, cloud computing, and global digital growth. From a technical standpoint, each stock has shown signs of stabilization after becoming severely oversold. Fundamentally, analyst confidence remains strong, with price targets implying meaningful upside if broader market conditions cooperate. While volatility is likely to remain a factor, these tech giants appear better positioned than most to benefit from renewed spending cycles and long-term AI adoption. For investors looking to reposition for 2026, oversold leaders with durable business models may offer an attractive risk-reward setup. This is a PAID ADVERTISEMENT provided to the subscribers of StockEarnings Free Newsletter. Although we have sent you this email, StockEarnings does not specifically endorse this product nor is it responsible for the content of this advertisement. Furthermore, we make no guarantee or warranty about what is advertised above. Your privacy is very important to us, if you wish to be excluded from future notices, do not reply to this message. Instead, please click Unsubscribe. StockEarnings, Inc

|

Subscribe to:

Post Comments (Atom)

0 Response to "Wall Street Legend’s Unexpected New Year Move"

Post a Comment