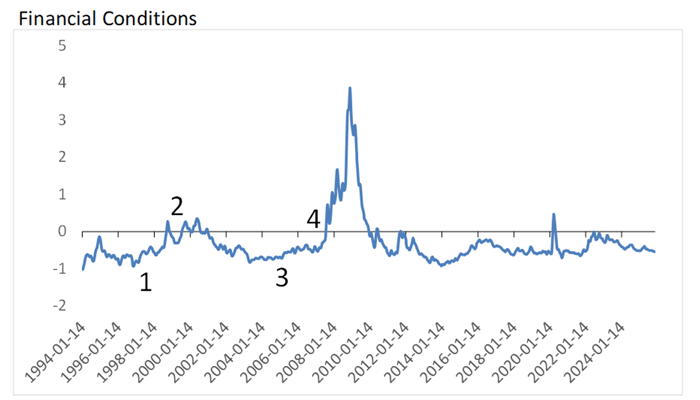

The Hidden Factor Driving the AI Trade By Larry Benedict, editor, Trading With Larry Benedict Michael Burry of The Big Short fame is at it again. Burry rose to stardom for his massive bet against the housing market heading into 2008’s Great Financial Crisis. Back then, the S&P 500 got cut in half as excessive leverage in the housing market took down the entire economy. Meanwhile, Burry delivered a $700 million windfall for clients in his hedge fund. Now Burry is back, calling for another bubble… in artificial intelligence (AI). Spending on AI infrastructure resembles the early 2000s telecom boom leading into the internet bubble. Burry’s argument stems from the massive sums being spent on AI. He claims that AI investments will never see an adequate return… and eventually, the stock market will realize that. Burry may well be right. But he’s missing one key catalyst that could tank AI stocks more than anything else. It happened before the last two bubbles burst, so you need to watch carefully… The Inflating and Popping of Bubbles The Federal Reserve’s monetary policy and the outlook for interest rates have a big impact on liquidity in the financial markets and the cost and availability of credit. When we’re in an “easy money” environment, these money flows find their way into more speculative segments of the stock market. Stock market valuations also tend to get a boost… just like you’re seeing today (I highlighted this here). But just as loose financial conditions can drive speculative excess, a reversal in these conditions can spark a massive unwind. The Fed’s Chicago district keeps track of financial conditions. It notes if they’re running at levels that are looser or tighter than the historic average. Here’s the chart of financial conditions going back 30 years:

Source: Bloomberg (Click here to expand image) The line at zero represents the average for financial conditions. When the blue line moves below zero, conditions are looser than average. As I mentioned above, loose conditions boost asset prices. When the line goes above zero, conditions are tighter than average. This is when liquidity and credit become limited and expensive, which is a headwind to asset prices. I’ve highlighted several key points on the chart. “1” is during the late 1990s when loose conditions helped fuel the internet bubble. “2” is when conditions started getting tighter in 1999… just ahead of the peak. “3” shows the loose conditions that helped fuel the housing bubble in the 2000s, and “4” is when conditions tightened in 2007 ahead of the financial crisis. In other words, the level of conditions can play a huge role when it comes to inflating and deflating bubbles. Loose conditions create booms… and tightening conditions lead to busts. Now, with another bubble in the making, investors need to be tuned into a key factor that could start driving conditions to tighten from here… Tune in to Trading With Larry Live

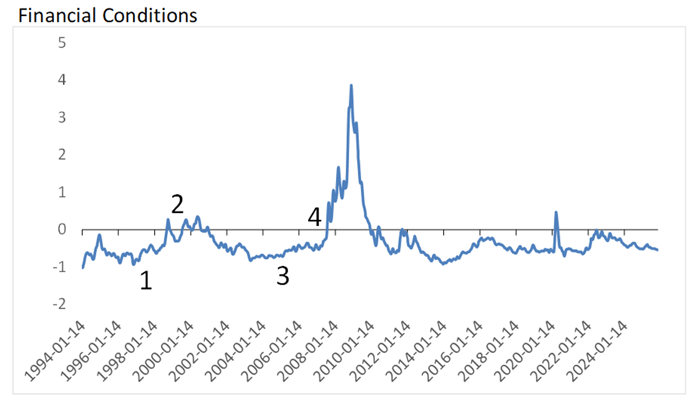

Each week, Market Wizard Larry Benedict goes live to share his thoughts on what’s impacting the markets. Whether you’re a novice or expert trader, you won’t want to miss Larry’s insights and analysis. Even better, it’s free to watch. Simply visit us on YouTube at 8:30 a.m. ET, Monday through Thursday, to catch the latest. | Stock Market Bubble Headwinds Conditions are running at their loosest levels in four years. That’s been the perfect backdrop for the AI trade to reach record valuations… like Nvidia’s $5 trillion market cap or OpenAI’s $500 billion valuation. Those are both new records for public and private sector valuations, respectively. Yet across the board, AI stocks are driving the stock market as a whole to some of its most extreme valuations in history. But financial conditions could soon become a headwind to the stock market. And to spot this happening, we need to keep a close eye on the Fed. Remember, the Fed’s interest rate policy plays a huge role in driving financial conditions. Take another look at the chart:

Source: Bloomberg (Click here to expand image) The Fed had started raising rates around “2” and “4.” And we’re already seeing how sensitive stock prices are to the Fed’s decisions. The S&P 500 recently dropped 5% from the October peak and closed below its 50-day moving average for the first time in 138 trading sessions. The drop occurred alongside plunging odds for a Fed rate cut in December. As hopes for a rate cut swing back in the other direction, stock prices are stabilizing. The stock market has become extremely dependent on loose financial conditions and easy money, which is what you’d expect in a bubble. But if those loose conditions fade away as the Fed stops cutting rates, then the AI bubble could quickly lose an important source of fuel. Burry can build his bearish case around the massive sums of money going into AI spending. But Burry’s payday will ultimately come when financial conditions are no longer inflating the bubble… just like we’ve seen before. Happy Trading, Larry Benedict

Editor, Trading With Larry Benedict P.S. Burry scored massive gains in the past for a select few with access to his hedge fund. But I believe everyone needs to be prepared to take advantage of volatility and protect their portfolios. That is why I’m sharing an exciting venture in just a few days. It’s my “hedge fund for everyday folks,” and I believe it’s the best way for you to take advantage of the coming bubble burst. If you’d like to join me for my sit-down on December 3 at 8 p.m. ET, then all you have to do is RSVP with one click right here. Then you’ll have the chance to get my big end-of-year prediction… where I go into even more detail on the circumstances setting us up for trouble. I hope I’ll see you there! Free Trading Resources Have you checked out Larry’s free trading resources on his website? It contains a full trading glossary to help kickstart your trading career – at zero cost to you. Just click here to check it out. | |

0 Response to "The Hidden Factor Driving the AI Trade"

Post a Comment