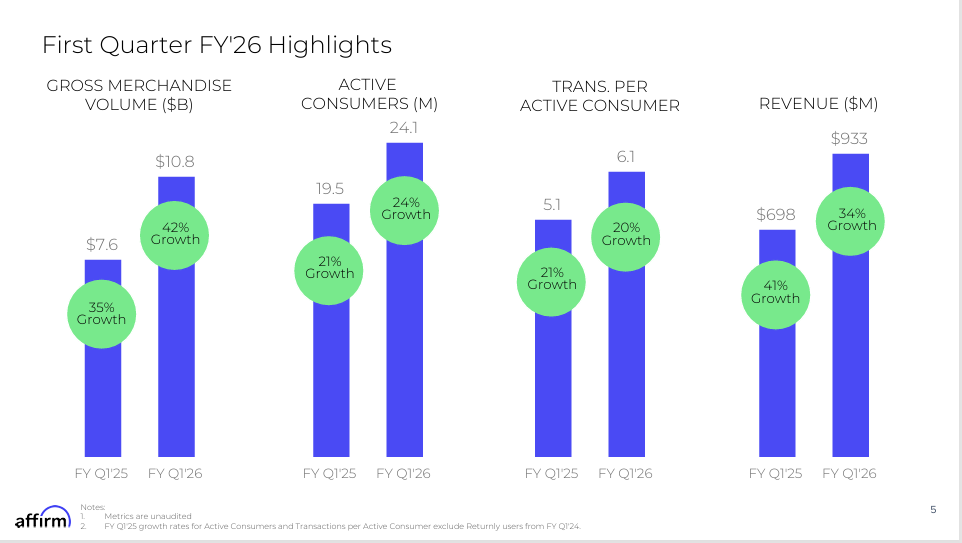

| Below is an important message from one of our highly valued sponsors. Please read it carefully as they have some special information to share with you. Dear Reader, This ad is sent on behalf of Paradigm Press, LLC, at 1001 Cathedral St., Baltimore, MD 21201. Today's editorial pick for you Two Hot BNPL Stocks to Buy and Hold Every Holiday SeasonPosted On Dec 19, 2025 by Ian Cooper Buy-now, pay-later (BNPL) stocks have been among the best-performing stocks in 2025. And there are reasons to believe that trend will continue. Table of ContentsFor one, the BNPL market is expected to rally from a market valuation of about $560 billion in 2025 to more than $1.4 trillion by 2028. Second, Americans are taking on substantial amounts of debt. In fact, Americans are seeing total household debt reaching a record high of $18.59 trillion in the third quarter of 2025. And third, as a way of managing that debt, more Americans are turning to buy-now, pay-later borrowing. According to CBS News, "A growing number of consumers are taking out 'buy now, pay later,' or BNPL, loans to cover everyday living expenses, data shows, a sign of the precarious financial state facing many U.S. households. A quarter of Americans now use BNPL loans to pay for groceries, up 14% from last year, according to a recent survey from LendingTree." In addition, "Americans spent $1.03 billion on Cyber Monday alone using buy-now-pay-later services like Klarna (KLAR), Affirm (AFRM) and PayPal (PYPL) – an all-time high, according to new data from Adobe – and that figure is expected to go even higher," according to Morningstar. So, it comes as no surprise that BNPL stocks are still exploding higher. If you’re looking for opportunities to add to your portfolio in 2026, here are two different options to consider. BNPL Stocks Option #1: Affirm HoldingsAffirm Holdings (NASDAQ: AFRM) is a financial technology (fintech) company that provides point-of-sale consumer lending and payments solutions for online and in-store purchases. Its core product is a buy-now-pay-later (BNPL) platform that enables consumers to split purchases into fixed, transparent installment loans with no hidden fees. Since bottoming out at around $35 in April, AFRM now trades at $71.81, with plenty of upside potential remaining thanks to the BNPL boom and strong earnings. In its most recent quarter, AFRM’s EPS of 23 cents beat estimates by 12 cents, completing the company’s first full year of profitability. Revenue of $933.34 million, up 33.6% year over year, beat by $49.98 million. Also, during the quarter, AFRM extended its US agreement with Amazon through January 2031. Even better, gross merchandise volume (GMV) jumped 42% to $10.8 billion. Direct-to-consumer (DTC) revenue jumped 53% to $3.2 billion. Active users jumped 24% to 24.1 million. And its active merchant count jumped 30% to 419,000 as of late September.  Adding to the bullish story, AFRM stock has a consensus price target of $94.73. That would be a 31.5% gain from the stock’s price as of this writing. BNPL Stocks Option #2: iShares FinTech Active ETFIf you'd rather have an option that offers diversify at a lower cost, there's the iShares FinTech Active ETF (NYSEARCA: BPAY). This is an actively managed fund of global companies involved in innovative technologies used and applied in financial services. BPAY was launched on Aug 16, 2022, and is managed by BlackRock. With an expense ratio of 0.66%, the ETF offers exposure to technology disruption around the world and across multiple areas in finance, such as payments, banking, investments, insurance and software. Some of its 37 holdings include PaylPal, Charles Schwab, Capital One, Synchrony Financial, Block, and Global Payments. The fund is up 1.76% year-to-date as of December 18. However, that includes a steep 19% drop-off in the prior three months. Prior to that, the stock had been trading at an all-time high of around $34 in the summer. With expectations for BNPL payments to continue, the BPAY ETF remains a solid choice for investors. BNPL Growth Still Has Room to RunBuy-now, pay-later is no longer a niche payment option—it's becoming a core part of how consumers manage spending. With household debt at record levels and BNPL adoption accelerating, the long-term growth outlook for the sector remains compelling. Affirm offers direct exposure to that trend with improving profitability and expanding partnerships, while the BPAY ETF provides a diversified way to participate in fintech innovation. For investors willing to accept volatility, BNPL stocks may continue to deliver significant opportunities as the market enters 2026. This is a PAID ADVERTISEMENT provided to the subscribers of StockEarnings Free Newsletter. Although we have sent you this email, StockEarnings does not specifically endorse this product nor is it responsible for the content of this advertisement. Furthermore, we make no guarantee or warranty about what is advertised above. Your privacy is very important to us, if you wish to be excluded from future notices, do not reply to this message. Instead, please click Unsubscribe. StockEarnings, Inc

|

Subscribe to:

Post Comments (Atom)

0 Response to "⚡Trump’s SHOCKING Plan to Create MASSIVE Wealth for Americans"

Post a Comment