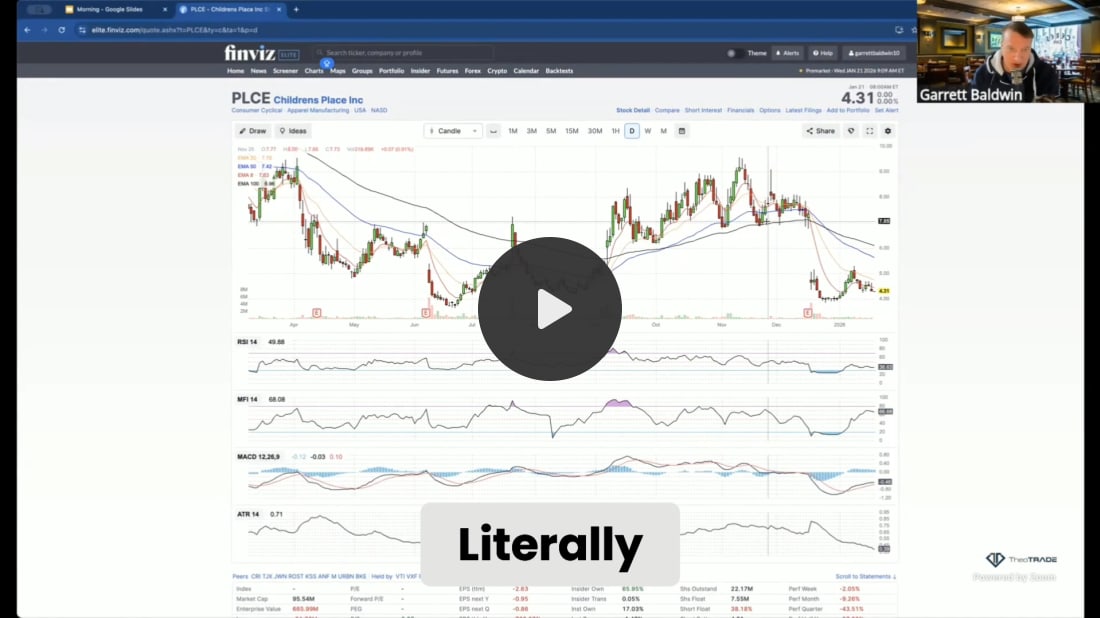

China Has No Windmills And Other Things I've Learned...Good morning... I guess we'll just blow into the electric socket and see how it goes...Good morning: Well… off the bat… I apologize for the stock market… Here we are doing advanced analysis of volatility, momentum, and liquidity… we had a signal switch negative two days ago… and we were starting to hammer the boards into the sides of the windows… But all it took was President Trump to remind us that one Tweet or one sentence can shift sentiment harder than the Federal Reserve or the “money printer” ever could. Man… that was a lot. One of those days where you think… “I could have been a failed novelist… written bad thrillers… or just lived in my parents’ basement. Way less stress.” Instead, I watched that speech in Davos… and I am pretty sure that Vince McMahon retired to become a Presidential speech writer, because life feels like the WWE. What did we learn yesterday? A lot of things. To start, from President Trump, I learned that China has no windmills… I found that to be really interesting. One that seems like a very large place to not have windmills. Two, with all those windmills they build for European “loser” nations, they wouldn’t just keep one for fun? Third, I once worked for a company that tracked major wind projects in… China. Sarcasm aside, as you know, I don’t do politics. I’m just pointing the camera and testing a financial thesis over and over again to determine if the repo plumbing and accommodative policy are really driving this. But somewhere, I know there was a college intern assigned to fact-check the President’s speech at the World Economic Forum for The Guardian or the Kansas City Star… and after a nine-hour shift, that kid is now dropping out of his journalism program to take six months to travel and find himself in the Darian Gap. I know there is this temptation to call all of this the TACO trade - this concept that Trump Always Chickens Out. Or there will be this argument that the speeches, the taunts, the threats, and the Peace Prize letter were all part of some elaborate “mouse trap”- like plan to ultimately get this deal for autonomous zones in Greenland. We learned again why TACO exists… I stress to you the commonality between the Trump decision to call off the Greenland tariffs (and military threat) and the April decision to cancel Liberation Day. The U.S. bond market and the threat of a leverage unwind. Recall back in April, Trump was adamant on doubling down on tariffs and trade battles. But the U.S. abruptly pivoted… insiders bought at levels we hadn’t seen yet in 2025, and they bought the 3X leveraged Nasdaq 100 ETF (TQQQ). It would take former Fed Chair Janet Yellen a few weeks - and a trip to the other side of the world - to casually explain that the problems in the financial system were linked to spiking U.S. bond yields because leveraged hedge funds had started selling Treasuries… an unwind of the basis trade that is so vital to suppressing yields and establishing demand for American debt. Leveraged positions were starting to give… that was extremely evident in the Bitcoin and crypto markets, where there were about $1.8 billion in liquidations in the days leading up. All while we saw more aggressive exiting in the carry trade. It was just a matter of time, with our signal red, that we would see an unwind in Treasury positions, all while major banks warned of the possibility of $130 billion in UST sales. Across the world, various pension funds and sovereign wealth funds began selling U.S. Treasuries. Many aren’t going to buy those positions back. For right now… I’ll just say this. You’re seeing a preview of the next major paradigm shift - a quick repricing of risk in the global markets. We’ve been witnessing this for the last year in the gold and silver markets. And we’ve seen multiple “surprising” downturns fueled by the repo markets, concerns about Japanese yields, and questions about all the leveraged positions that build as part of ways to protect yields from rising in aggressive ways (Genius ACT, Basis Trade, Carry Trade, fiscal repression) We’ve had at least six events in the last 18 months where the S&P 500 Volatility index has surged, only to pull back by at least 40% in the next 10 trading days. That type of event had never happened before the European Debt Crisis in 2011. Now, it’s a common occurrence. But it’s not sustainable. Japan has proven that it’s a dead canary at this point, and now they’re going to maintain interest rates at a time when they need to raise them. Closing our eyes and clicking our heels will not make this situation go away. There was no demand for Japanese bonds the other day… none. And the Bank of Japan seems exasperated by the situation they’ve created for themselves and the possibility that they might have to buy more assets and continue this pace of fiscal repression. This is madness… but it proves that despite all the concerns we might share, this whole dance can go on for longer. Right now, you have multiple policy efforts that are throwbacks to previous crises, all aligned at once… showcasing the fragility of the global financial system. You have the Fed buying up short-duration bills… pretending it's not money printing… to avoid another 2019-style Repo event… and to ensure ample reserves in the banking sector, a policy throwback to the 2023 Silicon Valley Banking Crisis. You have the Treasury Department turning more and more to short-term issuance of T-Bills to finance our spiraling debt… which is not Yield Curve Control, but sort of Yield Curve Control, and a throwback to all fiscal debt issues since 2008. We have Japan likely not set to raise rates… the same thing they did in … (checks notes)… August 2024 after their stock market crashed and warned us that something was deeply wrong. We’ve had multiple downturns linked to Japan in the last 18 months, all culminating in the nation injecting $117 billion in stimulus with no plan to shore up revenue. We have Japan now talking about tax cuts… and bond worries at play… a reminder of the 2022 GILT Crisis, which ended because of tax cuts and revenue issues… combined with local banks unable to sell bonds without taking a huge bath on the investments. And we have President Trump calling off Greenland-related tariffs, much like he did in April’s trade crisis… and I suspect that it’s because Scott Bessent is in his ear about the impact on U.S. debt. I will remind you of one last thing… when Scott Bessent started his role, he said he was the world’s biggest bond salesman, eager, and had a great story to tell. That to me is the most important admission of this Presidency. He has to keep demand steady or else… NONE of this matters. And whether it’s finding creative ways to establish demand through the Genius Act… or tolerating the Basis and Carry trade… or enabling the Fed to handle the reserves creation while banks shift over to buy the debt (despite the possible repo consequences)… It’s all about that. We have to find buyers for this debt… or else the yields run… the leverage unwinds… and everyone, everywhere becomes an expert on the basis trade… This clearly isn’t over… We’re somewhere in the fourth inning here. We were given some time… which is really good for investors. You can take your time answering the questions I asked yesterday. Please do me a favor… take the time to ask and answer these questions before the next round of chaos begins… You Long Children’s Place? Here’s a video of me basically explaining that fundamentals don’t matter anymore for stocks like Children’s Place or Airbnb... It’s very flippant… but I was in a mood on Wednesday. I’m going to write about Short Squeezes and stocks like Children’s Place that benefit from all the “money printing.” Let’s get to the day ahead… Continue reading this post for free in the Substack app |

Subscribe to:

Post Comments (Atom)

0 Response to "China Has No Windmills And Other Things I've Learned..."

Post a Comment