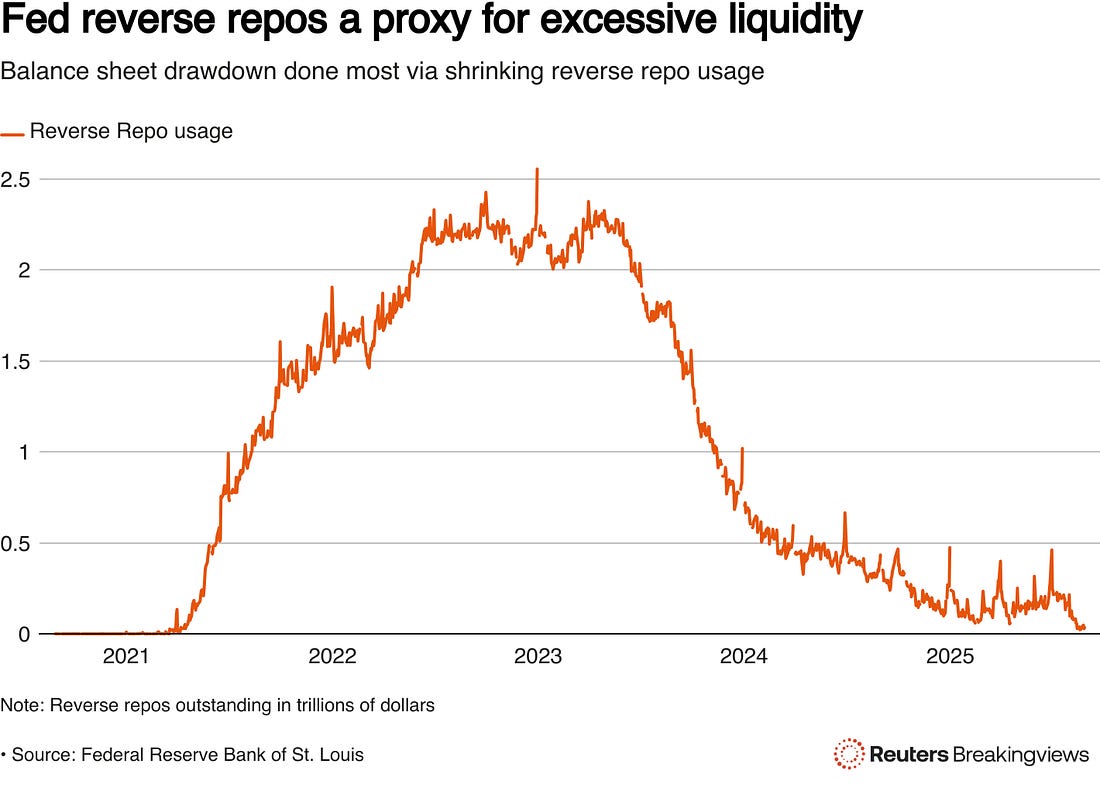

You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. Money Printer 104: What Do You Mean By "Policy Accommodation?"You want to understand what "money printing" really means? Let's go there...Dear Fellow Traveler, What I’m about to tell you can’t fit on a chyron. The things in his article aren’t suitable for dinner conversation… or for pillow talk. Some people will find this conversation boring… and others too dangerous. Or it’ll be dismissed by a financial advisor who doesn’t understand fiscal policy and wants to show you more pie charts instead... Former New York Fed Economist Zoltan Poszar gave us a map of the pipes… the places that money moves. We have to show you the Drano and Liquid Plumber… the things that get the financial pipes moving. Investors and the media often discuss “policy accommodation” in modern finance. But they think it’s limited to just two things: Either the Federal Reserve cuts interest rates… or it’s Quantitative Easing (cough… the real money printer). But that’s like saying the entire restaurant industry is built around “burgers and fries.” Sure, it’s technically accurate… but that statement is comically incomplete. Today’s financial system is bigger, faster, more leveraged, and more connected than it was in 2008, right before the Great Financial Crisis changed everything we know. The world and its tools are radically different than where we were two decades ago. There’s an immense amount of hidden plumbing in American-led finance. It’s gotten incredibly more complex… three-dimensional even… Policymakers now have countless ways to ease conditions… or “accommodate.” Most of these ways never show up in a press conference and rarely make the news. And even if they do make the news… they’re explained very poorly. I’ll do my best… The Real DefinitionRemember this KEY lesson from Money Printer 101-102-103 this week… Liquidity is the cause. Momentum is the effect. Returns are the result. Now… let’s complete the loop… How do you get the liquidity in the first place… It’s not magic… It’s gotta come from somewhere, right? The answer is policy accommodation… That’s what creates that liquidity in the first place. Accommodation means that financial funding stress falls, refinancing becomes easier, collateral quality improves, and the system faces less friction. It means (and creates)… permission. Everything else… momentum, stock performance, and multiple expansion, flows downstream from that one condition. I know it sounds overly simple. That’s because it is. Too many people screw this up and make it more complicated, either because they’re trying to keep it a secret or because they didn’t take the time to read the Fed research. Now, to achieve the goals of looser financial conditions and policy accommodation… You need tools (even if you make them up on the fly). Let’s look at a bunch of them. Some of them are obvious… Most of them need a second and third explanation... The Tools Nobody Talks AboutYes, you know Quantitative Easing… you see the term “stimulus”… And, of course, lower interest rates ease financing and refinancing in the global plumbing… But what really greases the pipes when no one notices. Well… let’s start with No. 1. 1. The Treasury Bill FloodThe Treasury Department has quietly become one of the world's biggest liquidity levers. And 99% of investors have never heard of it. I’ve actually been surprised that people hadn’t caught on to how this game was played since Secretary Steven Mnuchin - pictured below in a picture that gives me the creeps, jim-jams, and screaming meemies - funded the Tax Cuts and Jobs Act with a simple math trick… he turned to short-term debt to ensure the financing… When the Treasury shifts borrowing from long-term bonds to short-term bills, there’s less pressure on long-term rates, more cash in the money markets, and banks find it easier to obtain collateral, leading to lower borrowing costs across the board. T-bills are the Fed Funds rate wearing a bow tie and pretending to be something else. If you flood the system with short-duration bills (for now), you quietly relax everything. This shift from 11% T-Bills to 22% or more in the future is accommodation disguised as “normal funding operations.” This is ike a bartender refilling your glass while insisting he’s just tidying up… For a recap of how funds build leveraged positions off this… here’s a reminder. 2. The Reverse Repo DrainThe Fed’s reverse repo facility is where Fed critique goes to sleep. Banks and money funds park cash there overnight… (ZZZZZZZZZZZZ)… When that cash leaves, it goes into short-term funds, credit markets, Treasury auctions, stocks, and corporate debt. It flows into the entire system (hey… there’s a word for that… Li… Li… Liquidity?). A falling reverse repo balance is money leaving the Fed and entering the real economy. One of the strongest forms of accommodation. And it requires the Fed to do absolutely nothing. Remember… liquidity is the absence of obstruction. The Fed just stops blocking the door. 3. The Standing Repo FacilityHere’s the most important plumbing innovation since QE. Do you know it exists? A lot of people are still confused by this one… The SRF is basically a Romanian Money Box. It guarantees big banks can turn Treasury holdings into cash instantly. They can do it any day, automatically, and no one is allowed to ask questions. The SRF prevents panics, stops funding crunches before they start, and kills the fear that makes banks hoard cash rather than lend it. When QE happens, the Fed Chair is shouting. When the Standing Repo Facility BRRRING… the media isn’t paying attention. But I promise you… The markets hear both things. 4. Emergency Lending ProgramsThe Fed has built a network of emergency tunnels… It looks like the freaking tunnels under the Gopher tunnels in Caddyshack. Consider the terms Bank Term Funding Program, Primary Dealer Credit Facility, Money Market Lending Facility, and… The discount window. These are all pre-built escape routes for banks, brokers, and money funds. Banks know these exist… and just knowing they exist is a form of accommodation. Liquidity is not just cash. As I said, it’s a confidence to access cash. The difference between having a fire extinguisher and knowing where it is remains a critical part of fire safety and crisis confidence. The same goes for public policy. 5. Global Dollar Swap LinesA chain reaction almost brought down the global financial system in 2008. Foreign banks needed dollars (since trade and financing are settled in dollars), they sold Treasuries to get the dollars, which sent rates higher, and that created rate stress all around the globe. So, the Fed has extended dollar swap lines to central banks worldwide. Again, they’re not giving the central banks money… they’re effectively allowing them to borrow in a domestic currency - and then they’re getting paid back quickly. Foreign banks borrow dollars directly without selling Treasuries. This is quiet, technical, and a form of pure accommodation. The Fed built a dollar fire brigade that operates in 14 time zones. When the alarm sounds, that’s a sign that something significant is happening - and that the crisis is likely to lead to greater monetization and, with time, more accommodation. That’s the time that we have to pay attention to what the insiders are doing with their own money. The bottom is likely forming… because the world is on fire at that moment. 6. Shadow Banking SupportThis never makes it into your wealth manager's quarterly letter. The Shadow Banking system is still misunderstood… or it goes ignored. The first step in our rehabilitation as people (basically, if we have to start Money Printers’ Anonymous) is admitting that no one really controls the shadow system. Is it a higher power? Because this world of finance is unregulated and typically becomes the primary source of crisis when the world goes insane. Most leverage today isn’t in banks. It’s all happening in hedge funds, private equity, prime brokerage, asset managers, and non-bank dealers. The Fed can’t lend directly to these shadow banks (unregulated institutions). But when the Fed eases pressure on banks and credit, banks ease terms on everyone else. In addition, the repo markets are the critical spot where shadow banks access capital and build leverage. That’s why the Secured Overnight Funding Rate matters… Shadow lending continues because the banking side won’t seize. It’s like watering a plant by soaking the soil instead of pouring water on the leaves. 7. Regulatory ForbearanceOne of the most underrated tools that the Federal Reserve and government has? Doing nothing. What I mean is that they just don’t force banks to sell anything. Crazy… you’re telling me that Congress can benefit banks by… gulp… doing nothing? Yes… Here’s a situation where regulators relax capital requirements, delay rules, loosen accounting standards, and extend deadlines. That means potential forced selling becomes no selling across the market… which provides stability in equity, bond, and other asset markets by enhancing liquidity and financial conditions. Forced selling is liquidity leaving. Forbearance is liquidity staying. 8. Treasury BuybacksOh yeah… this happens a lot, too. Treasury buys back old, hard-to-trade bonds and swaps them for new, liquid ones. That sounds boring… doesn’t it? Well, this actually increases market depth, reduces volatility, improves collateral quality, and unclogs the system. Accommodation that doesn’t look like accommodation. It’s the most U.S. thing possible at a point that people are asleep on public policy… 9. Fiscal FlowsDon’t forget about Congress and where they’re putting your money (and their money). Yes… paging Nancy Pelosi… You know Nancy Pelosi would push for huge fiscal relief bills while she bought NVIDIA and Micron options. Well, there’s a reason for this… Fiscal spending is just an elephant wearing a T-shirt that says “I’m Not QE.” When the government spends heavily on infrastructure, subsidies, tax credits, emergency relief, and industrial policy, it injects cash directly into the economy. This bypasses banks entirely. (Recall why the Treasury General Account matters.) Fiscal accommodation is a new liquidity superpower. Sometimes it overwhelms monetary policy entirely. That was 2020, 2021, and increasingly, right now. Get to the Point, We Believe YouEvery tool I just described, T-bill flood, reverse repo drain, standing repo facility, swap lines, shadow support, forbearance, buybacks, fiscal flows, affects one thing… Whether money can move. Does it have permission to move… Do you have permission to own risk assets? None of them is technically QE or a rate cut. But all of them are accommodations. In Money Printer 101, we said liquidity is permission. In Money Printer 102, we noted that momentum reflects that liquidity. In Money Printer 103, we said insiders are a signal that permission will change. Policy accommodation is where that permission originates. It’s the source code. Some people look for storms but don’t spot them until we’re right in the eye of it. I’m the guy looking at the pressures creating them… well ahead of the headlines. Now you know where to look for those accommodations as the storm swirls (and what we call them) Just be aware… they’ll just call it something else next time… but what really matters isn’t the name. It’s the policymakers’ intentions to deliver QE-like outcomes. Judge a system ONLY by the outcomes. You’ll be a lot happier if you do… Stay positive, Garrett Baldwin PS: In Money Printer 105, we talk about the Cantillon Effect… and it’s a dagger... About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "Money Printer 104: What Do You Mean By "Policy Accommodation?""

Post a Comment