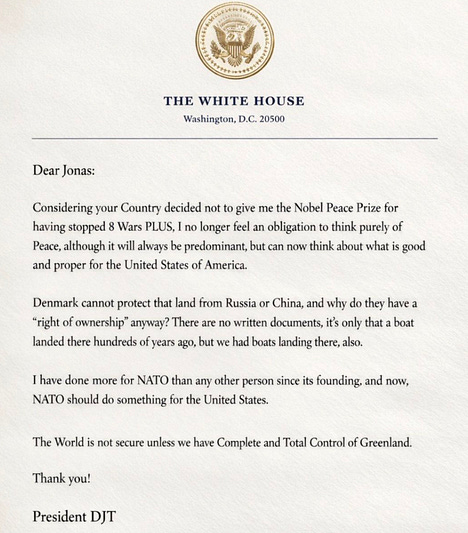

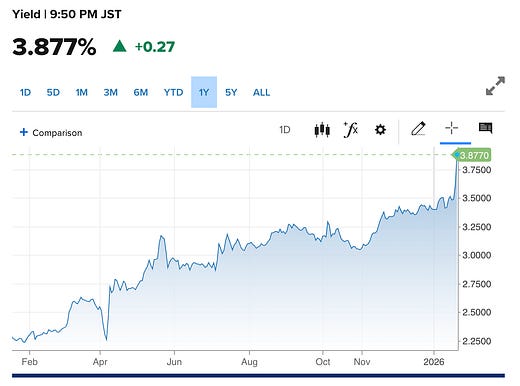

Good morning: Markets love stories. They love villains, maps, and headlines that can be explained with a finger stabbing a television screen. That is why the headlines focus so heavily on the Greenland tariff story… Yes, it’s a massive geopolitical story. But we’re now figuring out why the FNGD has remained over its 20- and 50-day EMA for an extended period. And questions around the banking sector. Here’s the headline driving the narrative… But let’s recall that the Japanese Nikkei is down 3% today… and that risk was moving in Asia before Europe. Why would Japan be down this much if this is a trade dispute between the U.S. and Europe? Because that’s not the real issue… It’s not really just about politics. It’s a plumbing issue… Markets tell you who pulled the fire alarm by the time the smoke shows up. Remember, Japan is repricing money… and has been for months. Japan’s 30-year bond has increased by nearly 40 basis points in two days. Its 40-year pushed over 4%. And everyone keeps wondering what’s wrong… When JGB yields rise, the effects ripple through the market. Borrowing costs climb globally. The yen weakens, and dollar funding tightens. Japan sits at the center of global carry trades, the quiet engine that has greased the wheels for risk assets everywhere for years. When that plumbing clogs, everything leveraged feels it. This mechanism matters. Higher bond yields do not just mean bonds look more attractive. They mean debt costs more. That means risk appetite contracts and leverage gets unwound. We’ve been wondering what the problem has been at the top of the pyramid for a while, asking why MAG-7 stocks have been lagging. I have no better explanation than Japan. Uncertainty has a yield, and we’re seeing it priced in real time… even while Japan engaged in stimulus… the Fed is pumping $40 billion a month into short-duration bills… and we’re watching more and more efforts to keep the money markets stable. Japan’s politics make the problem harder to solve. Policymakers are boxed in between a budget fight, rising yields, and a weak yen all at once… plus snap elections coming. If they defend the yen by selling U.S. assets, they hurt global markets. Let the yen fall, and the dollar strengthens, tightening liquidity anyway. Either path pressures risk assets. The important takeaway is not today’s price action. It is that Japan has re-entered the global liquidity conversation in a serious way. The rest of this stuff feels like noise for now. Watch Japanese bond yields. Watch the yen. Watch global rates. And if you want to understand crypto, stop staring at charts. Start watching balance sheets, bond auctions, and currency stress. Everything else is just the soundtrack playing too loudly in the background... Continue reading this post for free in the Substack app |

Subscribe to:

Post Comments (Atom)

0 Response to "Hoo... Hoo... Hoo... Who's Ready for Today's Greenland Debate"

Post a Comment