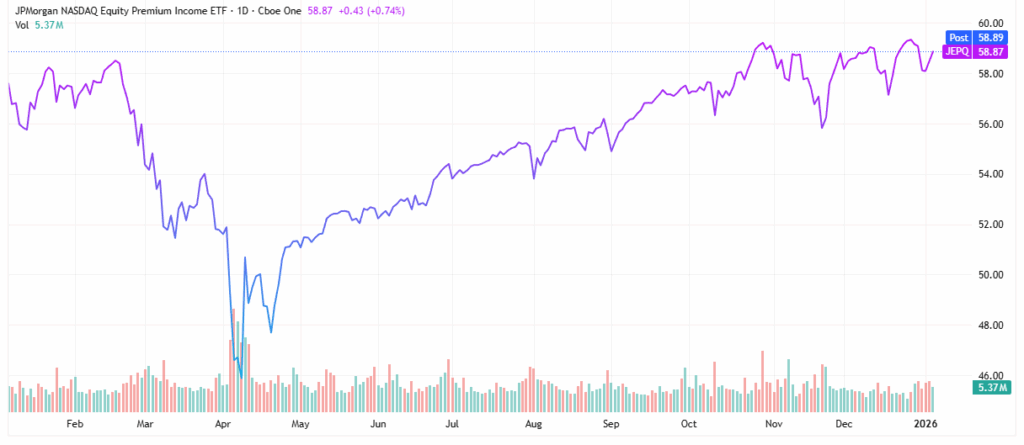

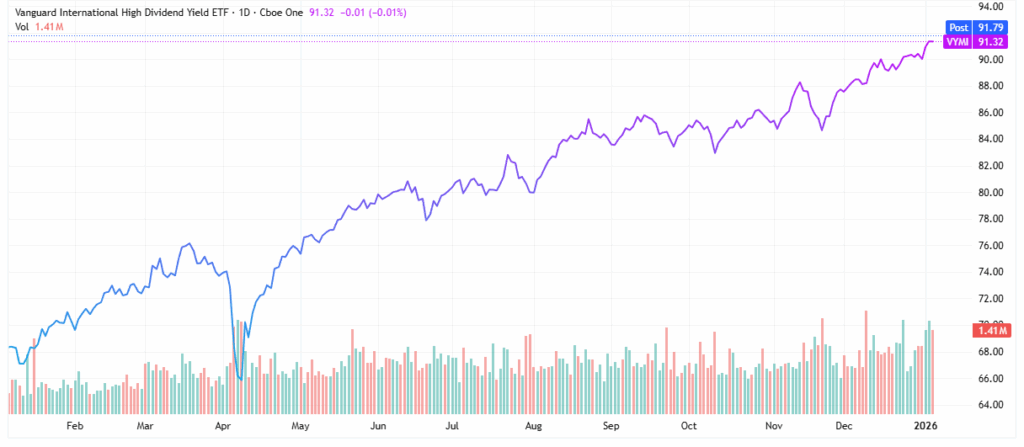

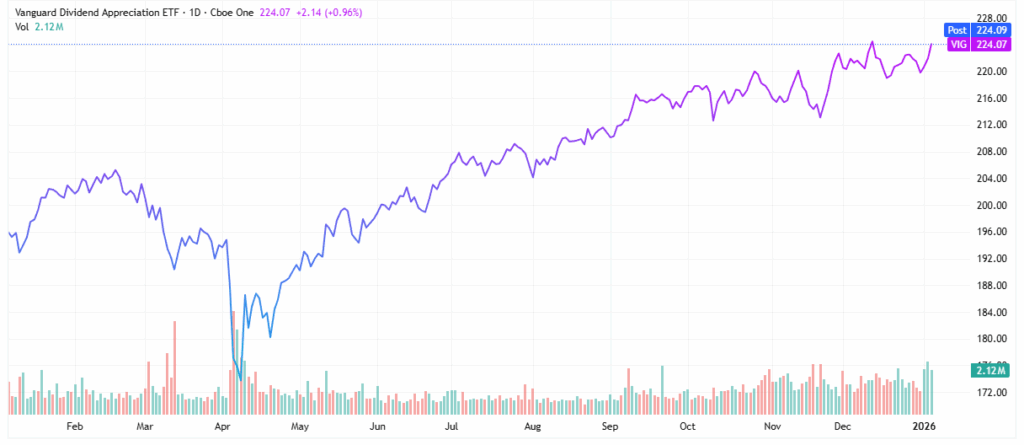

| BioStem Technologies (BSEM) is doing what most small-cap MedTech companies never achieve: delivering consistent profitability while scaling adoption in a massive, underpenetrated market. Q3 2025 marked BSEM's seventh consecutive quarter of positive adjusted EBITDA, alongside $10.5 million in revenue and $0.8 million in GAAP net income. Backed by $27.2 million in cash and industry-leading gross margins, the company has shown it can navigate reimbursement shifts without sacrificing financial discipline—an increasingly rare trait in regenerative medicine. What truly separates BSEM is its clinically validated BioREtain® technology, supported by Level 1 randomized trial data showing dramatically better outcomes than standard of care in diabetic foot ulcers. With expansion underway into the VA, Medicaid, hospitals, and ASCs—and a Nasdaq uplisting targeted for mid-2026—BioStem is positioning itself for greater institutional visibility and market re-rating. Add in a $25.50 Zacks price target, and this looks less like speculation and more like a company entering its next growth phase. Today's editorial pick for you High-Yield Funds: 3 Smart ETFs for Reliable Income as You Near RetirementPosted On Jan 07, 2026 by Ian Cooper If you're nearing retirement, one of the last things you want to worry about is cash flow. Instead, you need high-yield funds that let your money make you money. Table of ContentsWith high-yield funds, you aren’t constantly timing withdrawals or watching market swings. Instead, these funds are a passive investment idea that can deliver consistent income while still offering long-term growth potential. Some of the best options for finding stocks with high yields are exchange-traded funds (ETFs). ETFs offer diversification, professional management, and low costs. These are three traits that become increasingly important as you move from accumulation to preservation and income. Below are three ETFs that combine income generation with quality holdings. Each offers a different approach to building a dependable cash-flow stream without abandoning long-term capital appreciation. High-Yield Funds: JPMorgan Nasdaq Equity Premium Equity Income ETFLook at the JPMorgan Nasdaq Equity Premium Equity income ETF (NASDAQ: JEPQ), for example. With a yield of about 11.5%, the ETF generates income by selling covered call options on its portfolio while also investing in U.S. large-cap growth stocks. This approach allows the fund to monetize market volatility and distribute option premiums to investors, supplementing the dividends paid by its holdings. That strategy makes JEPQ particularly appealing for income-focused investors who still want exposure to the technology and growth stocks that dominate the Nasdaq. Instead of relying solely on traditional dividends—which tend to be lower among growth companies—JEPQ uses options to convert price movement into cash flow. In fact, the ETF recently paid a dividend of just over 57 cents per share on January 5. Before that, it paid just over 55 cents on December 3. While monthly payouts can fluctuate based on options income, the fund has consistently delivered meaningful distributions. Importantly, investors haven't had to sacrifice price performance. Since bottoming out near $42 per share in April 2025, JEPQ has rallied to a recent high of $58.09. That combination of high income and capital appreciation highlights why this ETF is often viewed as a core holding for retirees seeking cash flow without abandoning equity exposure. The trade-off? Covered call strategies can cap some upside during strong market rallies. But for investors prioritizing income and stability over maximum growth, JEPQ offers an attractive risk-reward profile.  High-Yield Funds: Vanguard International High Dividend Yield Fund ETFFor investors who want diversification beyond U.S. markets, the Vanguard International High Dividend Yield ETF (VYMI) provides access to high-quality global income stocks at a very low cost. With an expense ratio of just 0.17% and a quarterly dividend, the fund targets international companies with above-average yields. VYMI's holdings include well-known global leaders such as Nestlé (OTCMKTS: NSRGY), Novartis (NYSE: NVS), Toyota Motor (NYSE: TM), and Shell (NYSE: SHEL), among many others. These are established companies with strong balance sheets, global revenue streams, and a history of returning capital to shareholders. The fund's income record is also compelling. It paid a dividend of just over 93 cents on December 23, following a 70-cent payout on September 23 and just over $1.07 per share on June 24. While international dividends can be uneven due to currency movements and varying payout schedules, VYMI has delivered meaningful income over time. From a price perspective, the ETF has also rewarded patient investors. Since bottoming near $64 per share, VYMI has climbed to $90.91, reflecting improving global markets and investor demand for income-oriented assets. Beyond yield, VYMI provides an important portfolio benefit: geographic diversification. Retirees who rely heavily on U.S. stocks may be overexposed to domestic economic cycles. By incorporating international dividend payers, investors can reduce concentration risk while maintaining steady income.  High-Yield Funds: Vanguard Dividend Appreciation ETFWhile not a high-yield product in the traditional sense, the Vanguard Dividend Appreciation ETF (VIG) is designed for investors who want reliable income growth over time. With a razor-thin expense ratio of 0.05% and quarterly dividends, VIG tracks the S&P U.S. Dividend Growers Index, which includes companies with a long history of increasing payouts. The fund manages more than $120 billion in assets, holds 338 stocks, and offers broad diversification across industries. Its largest holding is Broadcom, at roughly 7.6% of assets, and other major positions include Microsoft, JPMorgan, Apple, Visa, Eli Lilly, and Exxon Mobil. VIG currently yields about 1.57%, lower than the other two ETFs, but its appeal lies in dividend reliability and growth. It recently paid just over 88 cents per share on December 24, following 86 cents on October 1 and 87 cents on July 1. Over time, those payouts have steadily increased as underlying companies raise their dividends. For retirees or near-retirees, VIG can play a complementary role. While it may not deliver the headline yield of an options-based or international dividend fund, it provides stability, high-quality holdings, and growing income that can help offset inflation.  Building an Income-Focused ETF PortfolioEach of these ETFs serves a different purpose. JEPQ offers high monthly income through options strategies. VYMI provides international exposure and above-average dividends. VIG emphasizes quality, consistency, and dividend growth. Used together, they create a balanced approach to retirement income:

This layered strategy allows investors to generate dependable income while still participating in market appreciation—a key objective for anyone looking to protect purchasing power during retirement. This message is a PAID ADVERTISEMENT for BioStem Technologies, Inc (OTC: BSEM) from Sideways Frequency. StockEarnings, Inc. has received a fixed fee of $7000 from Sideways Frequency for multiple Dedicated Email Sends, Newsletter Sponsorships and SMS Sends between Jan 08, 2026 and Jan 14, 2026. Other than the compensation received for this advertisement sent to subscribers, StockEarnings and its principals are not affiliated with either BioStem Technologies, Inc (OTC: BSEM) or Sideways Frequency. StockEarnings and its principals do not own any of the stocks mentioned in this email or in the article that this email links to. Neither StockEarnings nor its principals are FINRA-registered broker-dealers or investment advisers. The content of this email should not be taken as advice, an endorsement, or a recommendation from StockEarnings to buy or sell any security. StockEarnings has not evaluated the accuracy of any claims made in this advertisement. StockEarnings recommends that investors do their own independent research and consult with a qualified investment professional before buying or selling any security. Investing is inherently risky. Past-performance is not indicative of future results. Please see the disclaimer regarding BioStem Technologies, Inc (OTC: BSEM) on Huge Alerts website for additional information about the relationship between Sideways Frequency and BioStem Technologies, Inc (OTC: BSEM). StockEarnings, Inc |

Subscribe to:

Post Comments (Atom)

0 Response to "🧬 Zacks Sets $25.50 Target on This BioTech Stock"

Post a Comment