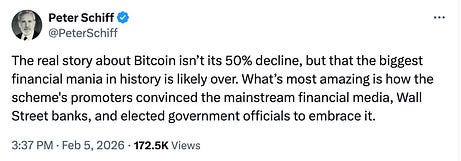

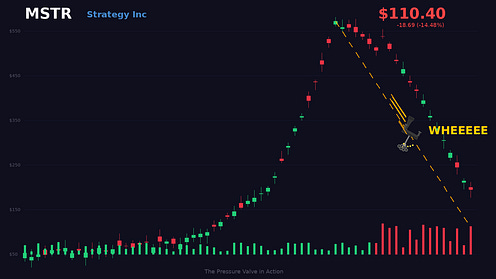

You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. What If Bitcoin's "Utility" Is to Blow Up?Liquidity hit at all-time highs, but it's rate of expansion stalled. Then, all the leveraged funds hit the wall at the same time. That doesn't seem like a bug.Dear Fellow Traveler: Economist Peter Schiff is celebrating... In the never-ending tussle that is his X account, he took a victory lap as gold reclaimed $5,000… At the same time, Bitcoin cratered under $65,000. It’s down about 50% from its October all-time high (back when the liquidity cycle peaked). Schiff has taken aim at BTC again… saying that the financial mania to it is “likely over.” The anti-Bitcoin voices continue to argue that it has no utility and that it’s worthless. The Bitcoin fans are calling this a massive buying opportunity, and their back-and-forth is a not-stop argument about money, policy, and post-2008 economics... It’s the same debate… over and over again. It’s just a different quarter… where Schiff is winning this part of the monetary cycle. I don’t want to relitigate that debate because I have a completely different perspective now on the role of BTC. In that framing… let me ask both sides of that debate a question that may render the whole social media shouting match pointless. What if Bitcoin isn’t digital gold… and it isn’t an inflation hedge OR freedom money or even a story of value? What if the thing Bitcoin actually does inside the financial system is something nobody may have designed it to do (or maybe they did?). And why don’t you test this hypothesis instead of yelling at each other? Liquidity Is Still at All-Time HighsLiquidity in the financial system hasn’t really seen that significant a dent, according to Michael Howell and CrossBorder Capital. That figure is still at an all-time high. And central banks are providing quantitative support through various programs. That said, bond markets are showing some cracks, which impact the financial plumbing and the collateral used in modern credit markets. Here’s the thing that really matters. The rate of liquidity expansion has been slowing. And with a market that runs on momentum… that’s what really matters. If we recognize that liquidity lives upstream of momentum… and that a sizeable portion of returns is linked to momentum, valuation expansion, flow mechanisms, and incentives… then there’s a problem with a slowdown in the pace of that supply. As we’ve gone from crisis to crisis, we’ve witnessed a RRP rundown, bill-heavy issuance, fading QT, and a global bid for U.S. collateral. All of this lowered funding stress and pushed asset prices higher for three straight years. Earnings tell us where we’ve been. Liquidity tells us where we’re going. Right now, liquidity is telling you something very specific… It’s still here, but it’s not running up at a breakneck pace anymore. When Momentum Meets LeverageThat deceleration is subtle, but it stalls out momentum. Every leveraged crypto fund was running the same trade. Buy for a dollar, sell for two, on the assumption that the next wave of liquidity brings the next momentum buyer. The whole structure holds as long as the expansion keeps accelerating… so long as there’s always a bigger bid behind you. The moment expansion stalls, the next buyer disappears. The fund that bought for a dollar and needs to sell for two can’t find the bid. And because every leveraged player built the same position in the same direction, they all hit the wall at the same time. That’s what happened yesterday. It wasn’t a liquidity crisis. It was a momentum crash, one that represented a four-sigma move and bigger questions about the pace of this market into 2026. Every crowded long position tried to exit through the same door. Over $654 million in leveraged positions were liquidated in 24 hours. In October, it was $19 billion in a single day, the largest deleveraging event in crypto history. Order book depth collapsed by 98%. Open interest cratered. And here’s the question nobody’s asking: where did all that capital go? The Frictionless KingWhen a leveraged long is liquidated on Binance at 3 a.m., that’s not capital destruction. That’s capital being forcibly extracted from the speculative layer and returned to the broader liquidity pool. Margin calls force selling… Selling generates cash… and cash flows back into the system. Bitcoin is where this happens fastest, most violently, and most efficiently. It is frictionless in a way that no other asset class is. That was supposed to be a benefit of the cryptocurrency system. People didn’t want circuit breakers or trading limits. They didn’t want market hours or settlement delays. They wanted to trade models 24 hours a day, 7 days a week, across every time zone, with leverage available at levels that would make a traditional prime broker break out in hives. They want to go all in on one specific asset… In the words of Michael Saylor… You only need one chair… If that’s the case… you’d better be willing to ride that chair through highs and lows. When the momentum trade breaks, there is nothing between you and the liquidation engine. And Bitcoin is an incredible representation of that fact. There is no cooling-off period. There is no closing bell to pause the bleeding. It’s just math and technicals… in the purest form. That’s not a flaw. That’s the feature. The Fed has its own pressure valve… It’s called the Standing Repo Facility, where banks swapped a record billions for overnight cash on December 31. But the Fed’s facility handles institutional plumbing. It doesn’t touch the speculative froth that builds up in retail and semi-institutional markets during a liquidity boom. Bitcoin appears to be that pressure value for speculative excess. And while it might not be designed that way… It’s definitely exhibiting that behavior. It absorbs it on the way up… soaking up the leveraged risk-seeking capital that the money printer creates… and violently purges it on the way down, converting billions in speculative positioning back into base-layer liquidity in hours. Every liquidation cascade on a crypto exchange is one that doesn’t occur in the Treasury market, the corporate credit market, or the banking system… Or places that might really matter, like the oil and food markets. I’m Not Going to Make Any Friends Here…If this is what Bitcoin does… if its accidental or intended function is to absorb excess liquidity when conditions are loose and violently release it the moment expansion stalls… Then both sides of the debate have a problem. The maxis would have to reckon with the fact that Bitcoin isn’t a pristine store of value protecting you from debasement. It’s the most volatile component of the very system it was supposed to replace. The drawdowns aren’t aberrations. In essence, they’re the point. That’s what a pressure valve does. And the gold bugs have to reckon with the fact that Bitcoin is performing a stabilizing role that gold structurally cannot. Gold doesn’t attract leveraged speculation at scale… Bitcoin surely does… Gold doesn’t generate $19 billion in forced liquidations that drain risk appetite from the system in a single day. Gold sits in vaults and stores value. That’s its job. Gold doesn’t purge excess. Bitcoin has and certainly did this week... Perhaps that is the utility of it… Something to consider. Test It Out… Give It a GoIf this hypothesis is correct, it would explain the timing that everyone keeps arguing about. Gold moves first in a liquidity cycle… We see easing expectations, central bank accumulation, and de-dollarization flows. Bitcoin moves later, when excess liquidity reaches the speculative layer, and leverage starts building again. In 2016, after China engaged in stimulus, and the cycle bottomed out, gold trended higher first. Bitcoin caught fire later… in 2017. In 2020–2021, the same pattern played out… Gold broke to new highs at the onset of the QE wave in March 2020 (running from $1,600 to $2,000 in a few months) before pulling back. Bitcoin moved well after the COVID crash, but it didn’t enter hyperdrive until the end of 2020, when it ran from $10,000 to $65,000. Comparing them in the early stage of a liquidity cycle is like comparing a river to a reservoir after three days of rain. The reservoir fills first… the river floods later. Right now, the pressure valve is acting as I assume it would on the backside of a cycle top and a slowdown in momentum. Tack on all the leverage that’s built and the surge from passive flows in the last few years, and we start to see the mechanics of a leveraged unwind. Speculative excess from the 2024–2025 liquidity boom is being drained. Leverage is compressing, and momentum buyers aren’t chasing what they had. There’s a giant flush for every crowded long that assumed the expansion would continue indefinitely. Whoops… This doesn’t feel good if you’re holding Bitcoin (and yes, I still have a small position). But it’s not supposed to. That’s how a pressure valve works. It releases energy that would otherwise cause the system to blow up elsewhere… again… imagine if all that speculation was in the marginal purchasing of food or housing. It would raise many questions about the underlying role of speculation in the assets people need. No one really needs Bitcoin. So, the question isn’t whether Bitcoin is in a bull or bear market. It’s whether it’s in a liquid or illiquid one… or a leveraged or unleveraged one. Which reminds us that maybe there’s a different hypothesis in all of this… It may not be digital gold, an inflation hedge, or freedom money. Maybe it’s something different that we didn’t really see. That it’s the financial system’s most frictionless, most volatile, most efficient mechanism for absorbing and purging the consequences of its own excess at the exact moment that liquidity expansion stalls and momentum dies. Gold and Bitcoin aren’t really competing. They’re doing different jobs inside the same broken machine. Gold stores value for sovereigns. Bitcoin absorbs and releases the speculative energy generated by the money printer. Feel free to debate it… or don’t. I’m going to the Cheesecake Factory. Stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "What If Bitcoin's "Utility" Is to Blow Up?"

Post a Comment