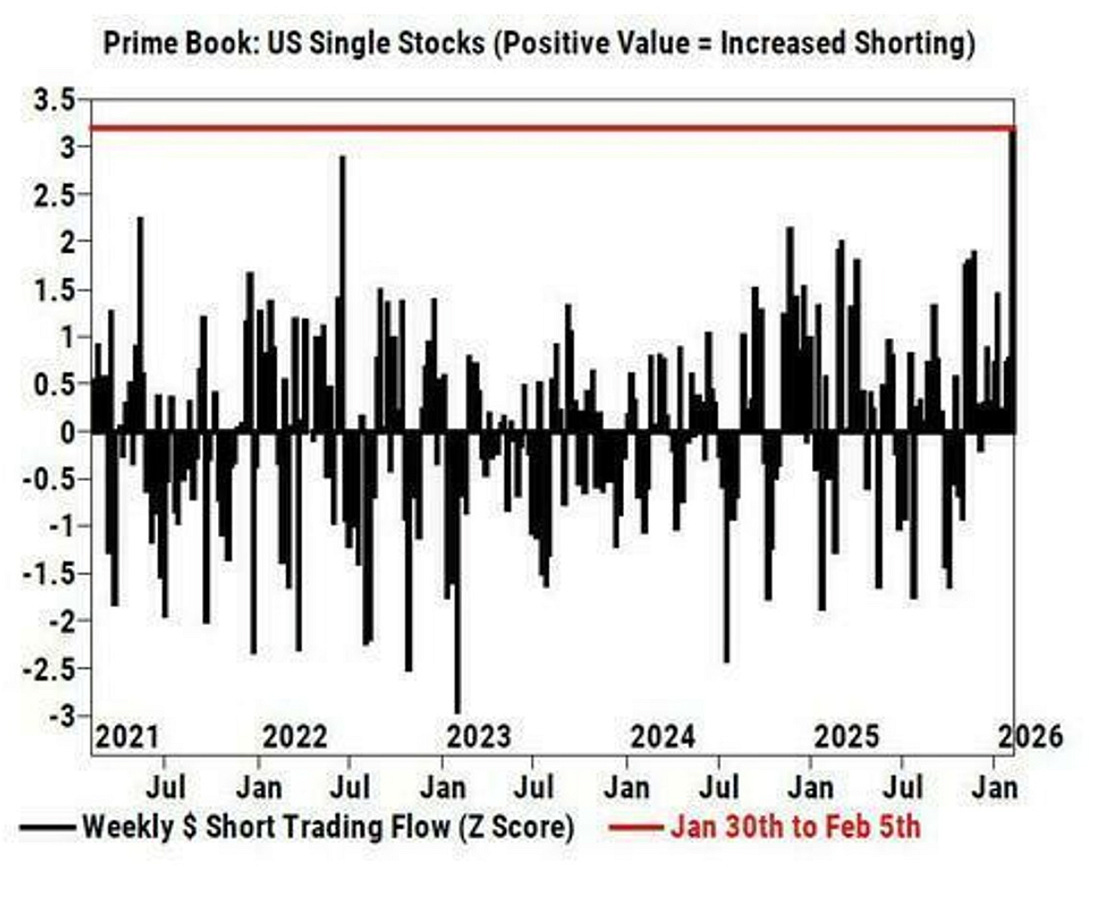

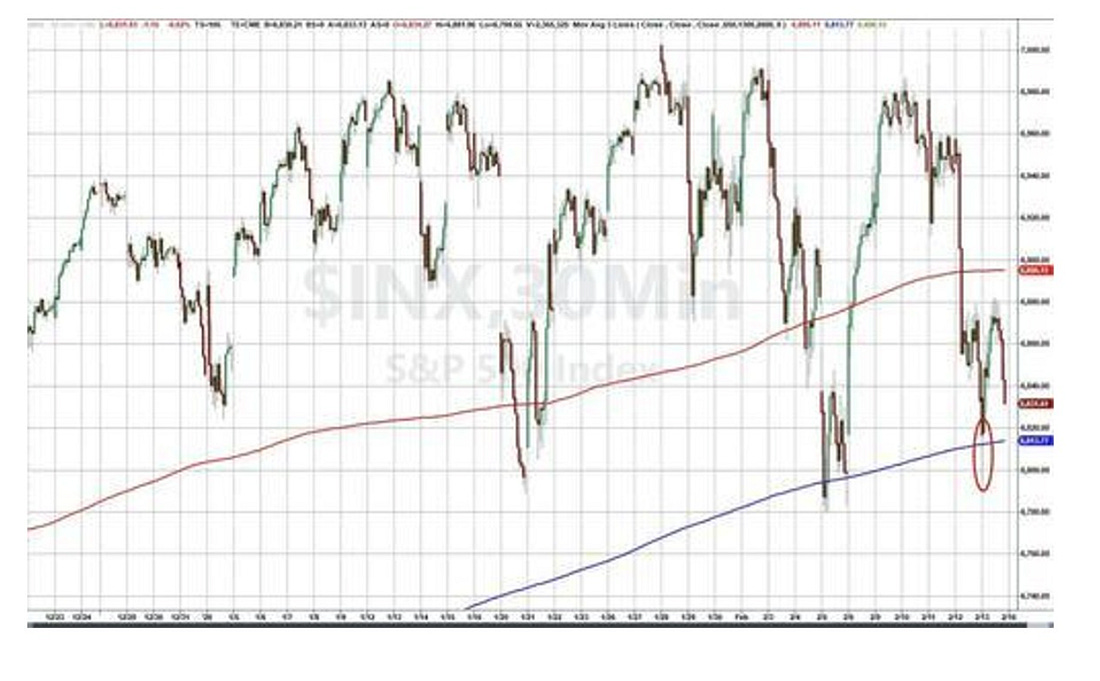

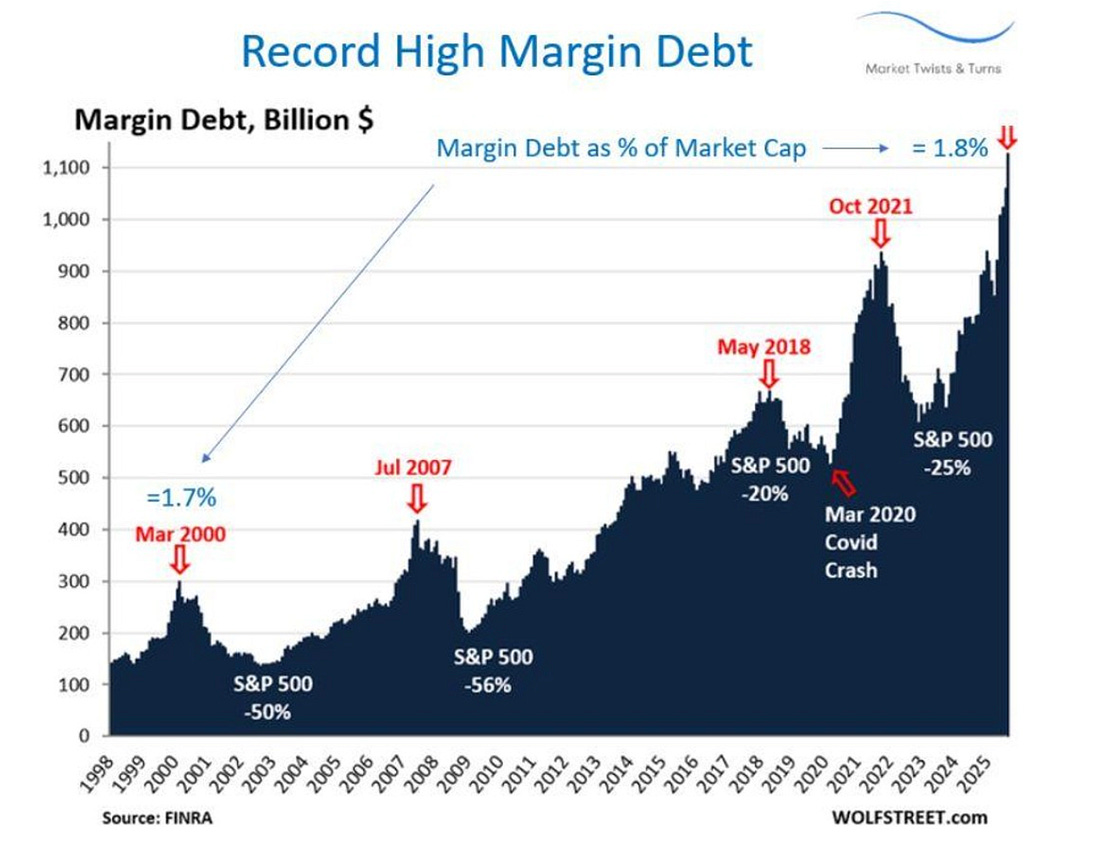

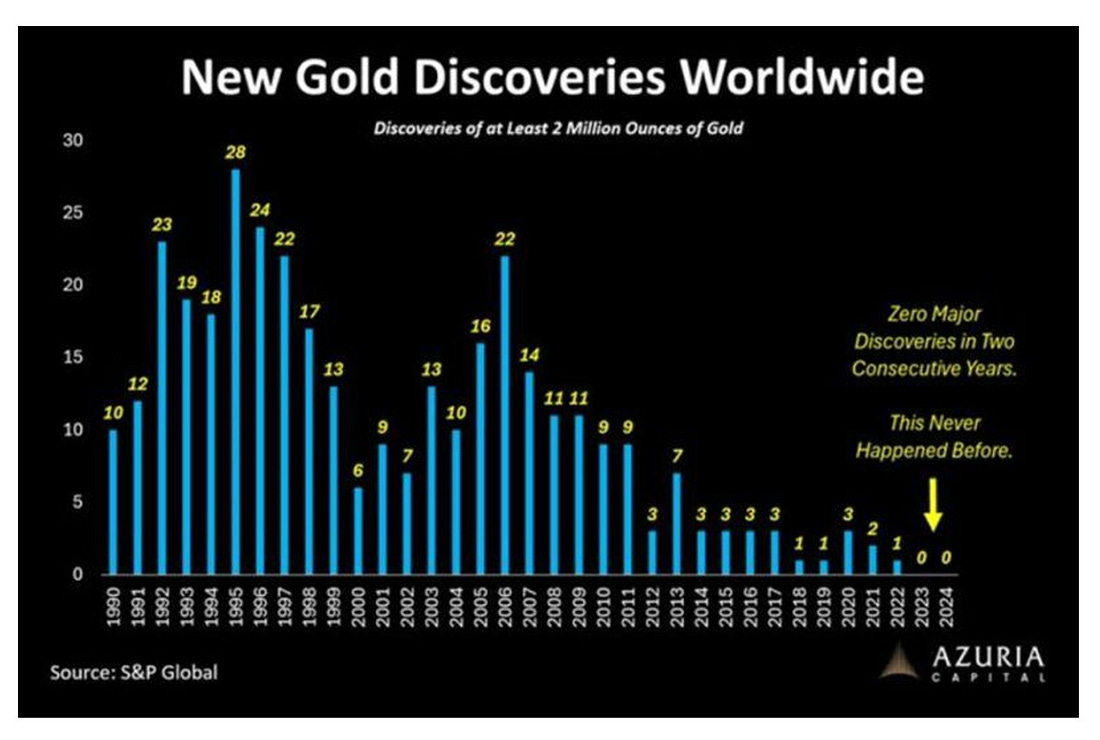

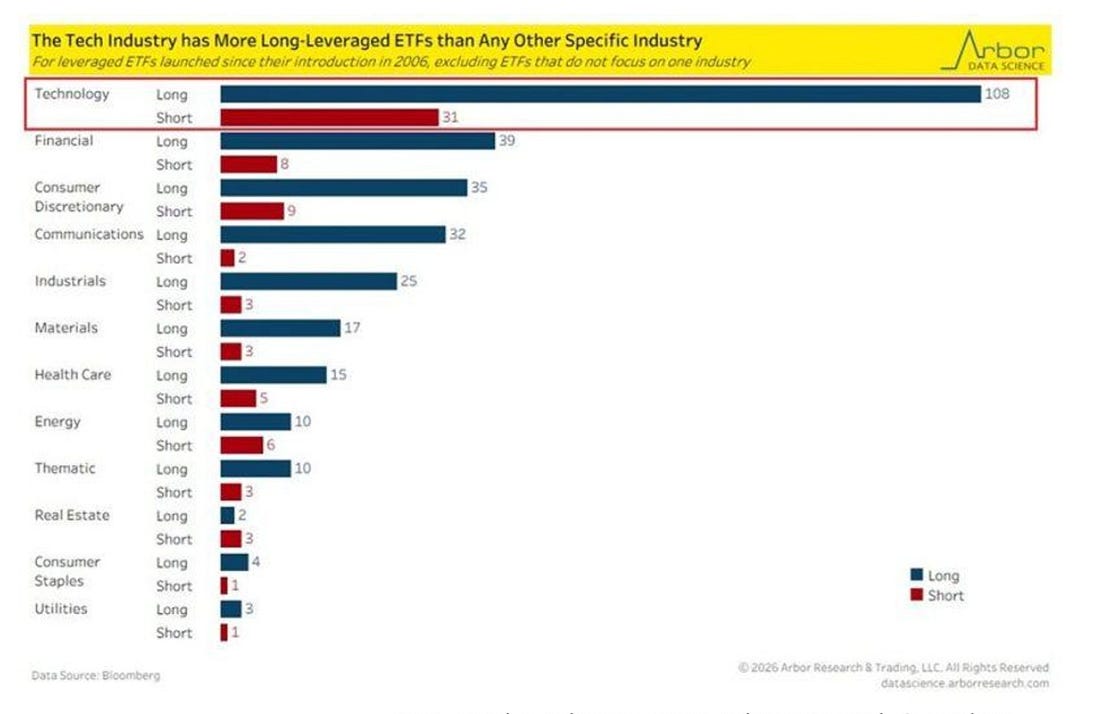

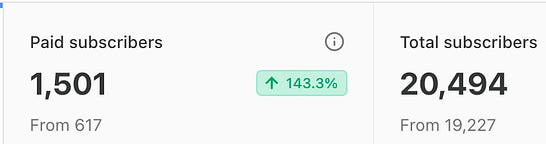

You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. This Chart Says A Lot...Record margin debt, heavy short selling, key moving averages, and fun with ETFs...Dear Fellow Traveler: My cell phone is taunting me. It keeps sending me Delta flight notifications… I was originally scheduled to fly to Milan, Italy, today to watch Olympic Hockey all week. But I changed my plans (because it’s Valentine’s Day and my daughter is eight) and elected to go to the World Baseball Classic finals in March instead. I’m having a little bit of remorse… I’m a huge fan of the Winter Olympics. Half-pipe, hockey, skating, and cross-country… Last night was brutal for U.S. men’s skater Ilia Malinin… But I enjoyed the lead-up and moment when Kazakhstan’s Mikhail Shaidorov won the men’s gold medal for skating instead. At the onset of his program, NBC commentator Tara Lipinski said Shaidorov was just planting the seeds for future success… all but writing him off while suggesting he might be in the mix to win a medal in 2030. The expectation went that Malinin would win easily, followed by his rival in Japan… But then, seconds later, Shaidorov’s music changed… and it was the song from the Diva Dance in the Fifth Element. He went off from there… I had to root for him solely on the basis of his song selection… but his performance was flawless.  Then we saw many people fall after him… including Malinin… And in Olympic spirt, anything did happen… Congrats to Shaidorov on that title… and be sure to watch it… Now we really get to hockey… That plane was supposed to leave in three hours… I’ll spend Valentine’s Day with my wife and daughter instead… Fair trade off… Let’s talk about the markets… With Momentum NegativeFor the last two weeks, we’ve been juggling some very choppy momentum conditions. Momentum conditions peaked on January 12 and experienced a significant rise in selling pressure, which carried us into the end of the month. You’ll recall, I threw my hands up and dumped silver and gold ETFs on January 26… Our S&P 500 Capital Wave reading went negative on the 28th… since then, we’ve had a collapse in gold and silver prices, a blowout in the cryptocurrency world, and one of the worst momentum selloffs in over a decade (two Thursdays ago). Selling pressure has increased… aided by this chart… That first week of the month was ferocious on the short-selling side. For those who don’t know, short selling is not about buying put options on stocks and hoping they rise as stock prices drop. Short selling is the process of borrowing shares from someone, selling them into the market, hoping they will go down, and then buying them back at a lower price. Then, they make money by pocketing the difference between the selling price (first step) and the repurchasing price (second step). There are a few key factors fueling this frenzy. First, we are on the backside of a cycle where we tend to see higher Beta tech names give way to consumer defensives and materials/energy. More importantly, this “AI Apocolypse” trade is catching more fire… You’ll recall the “Retail-opocolypse” trade last decade. The basic argument was that companies like Kohl’s, Toys R Us, Sears, Caldor, etc… they would all go the way of the dinosaur because of Amazon, e-commerce, and huge slumps in retail traffic. A lot of names disappeared… This AI theme is on steroids. AI threatens software stocks, law firms, brokerages, white-collar work, and the underlying real estate on which so many companies pin their operations. This narrative will be a dominant one for the next 18 to 24 months… What will also matter is how these concerns around disruption bleed into election issues this fall. That said… when we see these signals go red - and shorting will help fuel momentum red because of the selling pressure, always pay attention to key moving averages on the S&P 500 and the Nasdaq. Last Thursday (the 5th), the S&P 500 bounced right off its 100-day moving average… then gave us a nice two-day Dead Cat bounce… That black line… that’s the 100-day moving average for the S&P 500. We’ve double-tapped it in the last few weeks… Extreme MarginAs we stand at the top of this financial cycle, markets have benefited from support from the Federal Reserve, ongoing Treasury action at the front end of the yield curve, Japan’s stimulus and fiscal plans, and now China’s 3.2 trillion Yuan targeting… But this chart still looms… Because when we see margin debt cycles peak, that’s where the threat of valuation compression emerges if there is a broader unwind. The last top (2021) was a month before the markets pushed higher into November, and then began the long, sluggish march down 25% over the next 12 months… If this market does experience a broader pullback, I will remind you that the S&P 500 and the Nasdaq do not go straight down like an elevator. It tends to be a process of lower highs and lower lows… occasional sqeezes, shifts from oversold to overbought and then the next leg down. All the while, money will likely flow into defensives first… and then ultimately mid-tier bond duration. I think it’s a good opportunity right now to start talking about corporate bonds on the backside of the year, and the debt of countries with strong natural resource profiles and high economic freedom indices… if you’re looking for peace of mind. You have time to do your research. But there are opportunities… Then, if it all goes down… we start our game plan for the next cycle by looking at distressed debt, high-beta names, and whatever else people are crying about while predicting the next Great Depression and Hyperinflation. We trade the cycles until they break… Am I Still Long Gold?Yes… And I’m providing zero additional insight because this chart speaks for itself. Now You Know…You know what this economy needs? More leveraged technology ETFs. More ways to gamble on daily moves on Apple stock… This is just manic to me… There are 4,219 U.S. stocks that you can buy and trade… There are now… 5,003 ETFs. And the new ones that keep popping up are exotic, derivative-linked, leveraged single-stock ETFs… There will be implosions in this space in the next 24 months… But no one’s going to do anything about it… there’s too much money to be had in financial engineering… 1,500We reached our 1,500th subscriber today at The Capital Wave Report… I said I’d be giving No. 1,500 a gift… Benjamin Toh… in Singapore… You’ve been upgraded to Money Printer Elite… and you’ll receive an email today about our quarterly conference call… In Case You Missed ItFinally… I did a lot of writing this week… Monday: Things I Think I Think... (There Are Good People In the World) Tuesday: Out There on the Edge... Wednesday: Money Printer 301: Productive, Scarce, or Nothing Else? Thursday: Change is Good (Get on Board) Friday: Money Printer 302: The Number That Told Me Hell Was Coming I hope everyone had a great weekend. Postcards from the Edge of the World arrives tomorrow… and remember that the markets are closed on Monday… Stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "This Chart Says A Lot..."

Post a Comment