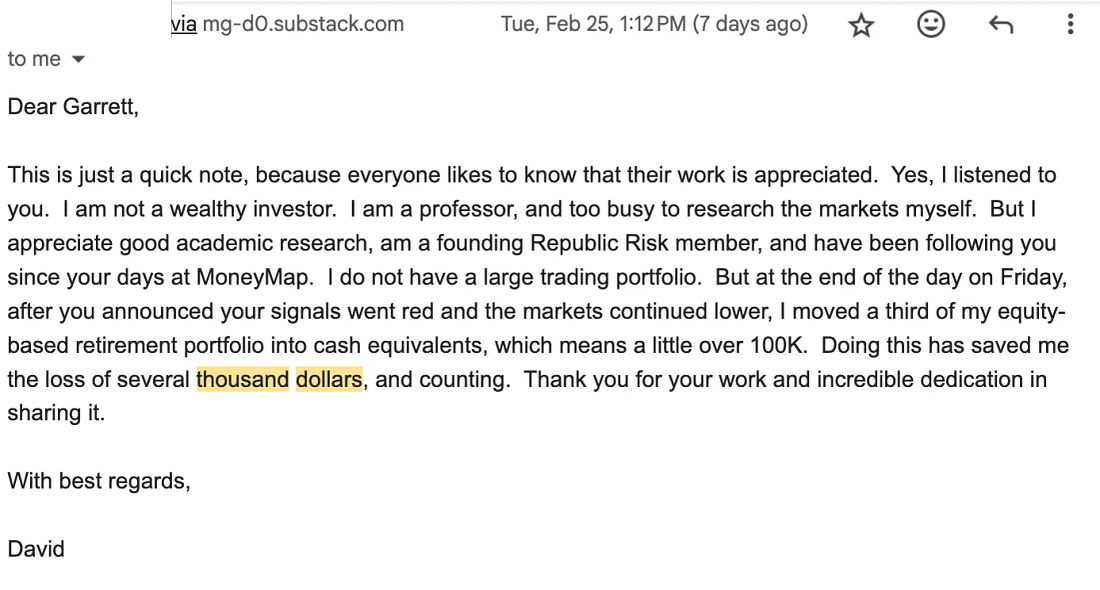

Dear Fellow Traveler: Once again, we’ve helped our Capital Wave Readers navigate another reversal in the markets… telling them to cut their shorts and instead looking for this rebound. In recent days, I’ve given you access to our daily updates, our signals, and our notes on Negative and Positive Momentum. This week exposed again that Japan is the real threat to the global financial system. Cracks in their bond markets started to emerge months ago, and we’ve had several sharp downturns in recent months linked to the global repo markets and Japan. What we do here is help play defense against crisis. And I’m VERY convinced that we’ll see yet another sharp downturn linked to liquidity concerns this year. Think about everything that is happening to help prop up our system today… The Fed is buying $40 billion a month in Treasury Bills to support bank reserves. The Government will buy $200 billion in Mortgage Backed Securities to goose housing. The Bank of Japan is NOT cutting rates and its government is planning to accelerate more stimulus spending. Quiet support in Europe aims to shore up our financial system… And China is providing trillions in support for its economy. I expect we’ll now see rampant speculation, higher metals prices, more volatility around Third Friday options dates, and concerns about our banking sector. That’s why I’m here to keep playing defense and helping you navigate momentum and liquidity in the years ahead. So, for the first time ever… I’m going to make an offer that hasn’t been done before. I’ll help you play defense and look for reversals for $1.01 a week. We have a busy year ahead with Japan, the U.S. banking sector, concerns about Europe, and plenty of geopolitical questions. This is my form of insurance… each morning, all the insight, all the updates, and more. Here’s a letter from a reader in March who told me I helped protect a large portion of his portfolio as the trade crash commenced in February 2025. This is what I try to do. Ensure that you protect your capital, avoid frustration, and have the confidence to trade and invest when liquidity and momentum are strong. Just click the link… And I’ll see you starting tomorrow morning with the latest issue of The Capital Wave report. Stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "Another Well-Timed Reversal... So Now What"

Post a Comment