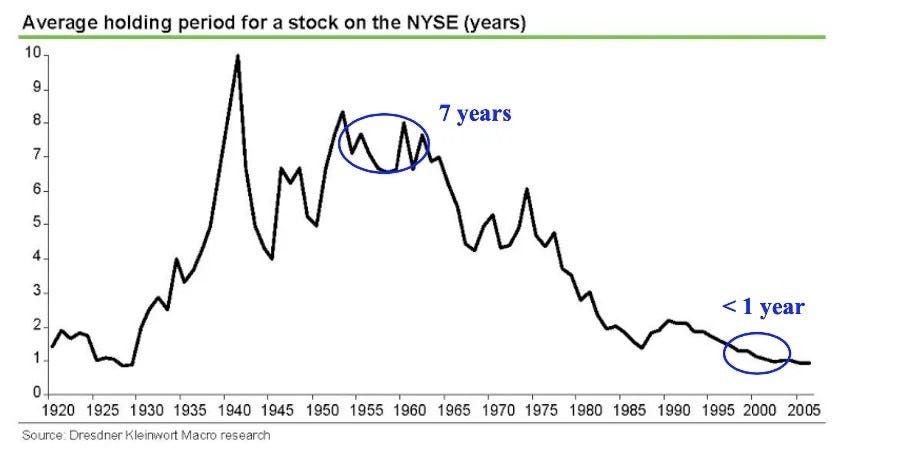

You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. Money Printer 203: What Do You Mean "Financialization" and "0DTE"?How Wall Street Turned the Stock Market Into a Casino and Then Added More Slot MachinesDear Fellow Traveler: Bryce doesn’t wake up anymore. “I just stop being asleep,” he once said on a first date. He sets his phone alarm for 4:47 am. Not 4:45. Not 5:00. 4:47. Bryce read somewhere that irregular alarm times trick the brain into thinking it chose to wake up. He believes this. Bryce also believes in cold showers and in something called “box breathing,” which he learned about on a podcast that shares his love for supplements and deer jerky. Each day, he puts on a Patagonia vest over a button-down that costs more than a new Honda HR-V starter. The vest reads: “Cantor Fitzgerald Institutional Equity Derivatives Conference 2024.” Bryce didn’t go to it. He works for a different bank, but he bought it on eBay so he could dress as his friend Josh (who does work for Cantor Fitzgerald) on Halloween. Oh, the laughs they shared. Bryce still wears it around. No one says anything about it. Today, Bryce is a market maker for a mid-tier options desk. He’s 31, and he’s never owned a plant that lasted longer than six weeks. Ask him what he does for a living, and it’s unclear if he really knows. Sure, he knows the lingo of the office. He’ll throw a ping pong ball during a drinking game at Down the Hatch and say things like “gamma exposure.” He’ll say the search term “dealer positioning” to Siri, in which Siri replies, “Got it. Deer pitching.” But if you asked Bryce to explain, in English, what happens if someone buys a 0DTE (Zero Date) option, he’d tilt his drink in his hand, squint, and say, “It’s complicated.” It is not complicated. The truth is… Bryce is the House in a massive casino. And, over time… the house always wins. Start Spreading the NewsAnd… here… we… go… On Monday, U.S. options exchanges will begin listing additional same-week expirations on what they’re calling ‘Qualifying Securities.’ Sounds fancy… In industry terms, these are 0DTE options (zero days to expiration) though exchanges prefer the softer phrase ‘additional same-week expirations.’” Functionally, this extends the index-style 0DTE model into single-stock options. It compresses traditional trading windows down to hours. The end result is the same: more ‘options lottery’ tickets. More leverage! More chances to WIN!!! Now… for my friends just getting to the show… An “option” is a contract that gives you the right to buy or sell a stock at a specific price by a specific date. If it were a coupon in the mail, the coupon would say: “This coupon entitles you to buy one share of Tesla for $400 anytime before February 4.” If Tesla goes to $450, your coupon is worth $50. If Tesla stays at $380, your coupon is worth nothing and expires worth… zilch. You lose whatever you paid for it. (Yes, it’s a little more complicated than that…) Now… “0DTE” stands for “zero days to expiration.” The option expires on the same day you buy it. You’re not betting on what a stock will do over the next month. You’re betting on what it will do before 4 p.m. or Happy Hour. The new expiration dates will be February 2, 4, 9, and 11. The initial securities are expected to include highly liquid names such as… Tesla (TSLA). NVIDIA (NVDA). Apple (AAPL). Amazon (AMZN). Meta (META). Broadcom (AVGO). Alphabet (GOOGL). Microsoft (MSFT). And the iShares Bitcoin Trust ETF (IBIT), because what’s a casino without a crypto table? GOOGL will be excluded from February 4 because it reports earnings that day. But that’s a key concession to sanity in this announcement (thanks to risk controls). It’s not that I’m against 0DTE. It’s just that we might want to put “The Bellagio” over the Nasdaq sign. What Financialization Actually MeansBefore we get to Bryce, let’s define a word that’s critical to our Money Printer ways. Financialization. This is something I discussed with Max Borders this week. Financialization happens when a financial system stops being a tool to support the real economy and becomes the “economy” itself. The stock market is supposed to connect people who have money with companies that need it. You invest your money in their business. They build their business. You get a share of the profits and cash flow, and hopefully the stock price appreciates. At least, that’s what the Investopedia articles and MBA books suggest… Reality is a much different animal. Today, the vast majority of trading volume is not humans investing in companies. It’s algorithms rebalancing, ETFs reconstituting, and options dealers hedging. This whole giant pool of money sloshes from one container to another at high speed. Fewer and fewer institutions start asking, “Will this company be more valuable in 1 year?” Instead, these firms start thinking, “What’s the positioning right now, and how do I extract a sliver of the flow?” You know… how do we extract from people… Financialization happened in stages in U.S. markets. First, we separated ownership from production. You don’t buy a piece of a factory. Instead, you buy a stock certificate that represents a claim on future profits. And that makes sense, as it’s the bedrock of the market. But then we created derivatives. The truth is that options and futures don’t fully represent ownership at all. They’re bets or hedges against price movement. Then we shortened the time horizon. We started with a monthly options contract that later became a weekly one. Then, we went from weekly to daily. So, now we have 0DTE… which are contracts that expire in hours. This is, by definition, pure volatility extraction. There really isn’t much of an investment thesis here. There’s no real long-term view. It’s just speculating on a single question: “What is the positioning right now, and how do I monetize it before lunch?” And that’s screwy… because people really… badly… need to learn how to invest. So… Bryce Explains His Job to a Woman at a Bar Who Didn’t AskIt’s5:17 pmM. Bryce is at Ulysses’ on Stone Street, sitting at one of the long communal tables on the cobblestones. This is where many people working south of Wall Street go after the bell. The Guinness is decent, and the food is overpriced. Beckett’s is better. The crowd is 82% Patagonia vests talking about “flows,” and Goldman’s intern class got their new workout bag today. They won’t shut up about it. Bryce is talking to a woman named Kathryn, who works in university nonprofit fundraising, and she made the mistake of asking what he does. She knew better, as this was the fourth time this week that it had happened to her. “Basically,” Bryce says, swirling his Old Fashioned, a drink that doesn’t belong here, “I’m a market maker. When someone wants to buy an option, I sell it to them. But here’s the thing.” He leans in like he’s about to reveal the location of buried treasure. “I don’t actually care if the stock goes up or down. I immediately hedge.” “What does that mean?” she says, trying to text her friend for help. “Let’s say you buy a call option on NVIDIA from me. You’re betting NVIDIA goes up. If I just sat there holding that risk, I’d lose money if you were right. So instead, the second I sell you that option, I buy some actual NVIDIA stock. That way, if NVIDIA goes up and you win, I win on the stock I bought. It cancels out. I’m neutral.” “So you can’t lose?” she says, having heard this same pitch on Tuesday (but at that table… over there...) “Not on any single trade,” Bryce says, now angry that his drink doesn’t have one giant ice cube (like the other guy in the Patagonia vest sitting at the table… over there...) He gets over it… or does he? He continues: “But over enough volume, with enough flow, the math works in my favor. I just collect a little fee on every transaction. The spread. It’s like...” He searches for an analogy. “You know when you exchange money at the airport and the rate is slightly worse than the real rate?” “Yeah… I’m going to Italy next month,” she says, hoping to change the subject to travel. “That’s me,” he says, not taking her social cues. “I’m the airport currency exchange. But for options on NVIDIA.” Kathryn flags down a server, who drops off her tab. She reaches into her purse. “So you’re skimming a little off every transaction, and you’ve set it up so you can’t lose.” Bryce doesn’t love the word “skimming.” “I prefer the term ‘providing liquidity,’” he says, trying to pay Kathryn’s bill with his company’s AMEX. She pulls the receipt book away and slides a $20 bill into the crease. Then, her phone buzzes. She looks at it with visible relief. “My Uber’s here.” She slams the rest of her drink and doesn’t say goodbye. What Bryce Didn’t ExplainHere’s what Bryce left out. When Bryce hedges, he doesn’t do it once. He does it all day. Because the amount of stock he needs to stay “neutral” changes with every price move. Let’s say you buy a call option on Tesla at $400. There’s roughly a 0.50 delta. So Bryce buys roughly 50 shares to hedge (which is a simplification…) Then, Tesla moves to $410. Your option looks better. The delta rises, and Bryce needs more stock to stay neutral. So, he buys more. And Tesla moves to $420. Then Bryce buys more… So, then, Tesla drops to $405. Delta falls, and Bryce sells some stock. This happens all day. When dealers are net short gamma, upward moves force buying. Downward moves force selling… And the closer we get to expiration, the more violent these adjustments become. If your option expires in 30 days, a $5 move in the stock doesn’t change the math much. Bryce adjusts a little. But if your option expires in 30 minutes? A $5 move changes everything. Bryce has to adjust a LOT and fast. This is called “gamma.” It measures how much Bryce’s hedging has to change when the stock moves. High gamma means small moves cause big hedging. On a 0DTE option, gamma is steroids, behind the wheel of a forklift. The thing that he also left out? Bryce’s buying and selling moves the stock. If there are price moves, Bryce hedges. The hedge moves the price, and therefore the price move forces more hedging. Think of a snake eating its tail… The market moves because the market moved. Isn’t that fun? Like something you’d like to talk about with a stranger for an hour? There was no fundamental change… It’s the result of a constant feedback loop spinning until the options expire… The Football Metaphor“Can you please simplify this?” you ask. Sure… I’m not Bryce… so imagine a football game instead. In a normal world, you place your bet before the game. So… so you think the Baltimore Ravens cover the 3.5 point spread against the Buffalo Bills, you put down your money, and you wait. Maybe you win, maybe you lose. But those are the only two options (you can’t push on that spread). But the bet doesn’t affect the game. Now imagine the betting market gets so big that the bets start affecting the game itself. The refs are watching the gambling lines… not the sidelines. The coaches are making decisions based on the spread. The game is still happening, but it’s not really about football anymore. It’s about the bets and the outcomes of how much money ends up in the hands of the people who bet on the Ravens and who bet on the Bills… and who TOOK the bets. That’s what’s happening in the stock market. 0DTE options are like betting on the next five seconds of play. And the bookies taking your bet have to hedge in real time by sending signals onto the field. The stock price is no longer telling you what a company is worth. It’s telling you what the hedging flow looks like. 0DTE: The Final Chapter0DTE isn’t just another product. It’s the logical conclusion of 40 years of financialization. In the 1970s, you bought stocks in companies. You held them for years, and your dividends mattered. In the 1980s, options went mainstream. It was a way to speculate on price movement without owning anything. In the 1990s, day trading arrived. Hold times dropped from years to hours. You can see that collapse in real-time in the 1990s and early 2000s. In the 2000s, algorithms took over and hold times were measured in seconds. In the 2010s, weekly options exploded, and then expirations on major indices like the SPDR S&P 500 ETF (SPY) and the Invesco QQQ Trust, Series 1 (QQQ) Now, in 2026, we have same-week expiries on individual stocks. We’ll get Tesla. NVIDIA. Apple and contracts that exist for hours and, on some days, generate more volume than the underlying shares. Each step made the same promise… It’ll offer more liquidity, tighter spreads, and better price discovery. In reality, each step did the same thing. It shortened the time horizon, increased the leverage, and shifted power toward whoever could move fastest. And it created a lot more Bryce’s a long the way, and sold a lot more vests and Old Fashioneds. 0DTE is the end of that road. You can repackage it, relabel it, or slice it thinner, but you can’t compress time beyond zero. This is as far as the system can go… or is it? Please? The Cantillon Punchline Now, here’s where this ties back to Money Printer 105: The Cantillon Effect. When new money enters an economy, it doesn’t enter evenly. It enters somewhere specific. The people standing at that entry point benefit first. And by the time the money reaches everyone else, prices have already risen. Apply this to 0DTE options, because the option premium now functions like freshly injected money entering the market at a specific point in time. Retail traders buy NVIDIA That premium reaches the dealer first… and Bryce immediately hedges. His hedging creates immediate price pressure in the underlying stock. By the time longer-term investors react to the price move, the premium has been collected, and the positioning has shifted. The retail trader sees the volatility and calls it “manipulation.” The advantage doesn’t come from secret information. It really comes from standing closest to where the money enters the system. Bryce doesn’t think of himself as an extractor. He thinks of himself as a facilitator. He’s not wrong… because he is facilitating. But he’s also skimming… every day, from short-term traders downstream. That’s the Cantillon Effect in a Patagonia vest, sitting on the cobblestones of Stone Street, wondering why that brunette nonprofit woman didn’t text him back. More on that later… And why that brunette ended up marrying a playwright and not Bryce. Stay positive, Garrett About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "Money Printer 203: What Do You Mean "Financialization" and "0DTE"?"

Post a Comment