You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. Quick announcement: I’ll be on Max Borders’ podcast later this week. If you don’t know Max… he’s the author of The Social Singularity, After Collapse, and Underthrow. He runs the Underthrow Substack. Great thinker. Better conversation. During our chat… we discussed his influence from Austrian economics. This reminded me of something I learned a long time ago. In Austrian economics, interest rates are not treated primarily as the ‘cost of money,’ but as a reflection of time preference. “Time preference?” That measures how much you value having something now versus later. Interest rates reflect what people are willing to pay now to control resources, rather than waiting. So if interest rates aren’t the actual cost of money… What is? “Just got done walkin’ in the snow. G—amn, that mo@$@#$@$ cold.” - Run the Jewels, walking in the snow. Dear Fellow Traveler: Most people believe that money becomes more expensive when interest rates rise. They believe this with the confidence of someone who has already repeated it out loud and now feels socially committed to it. It’s not surprising when we get quotes like this from media sites like Bankrate.

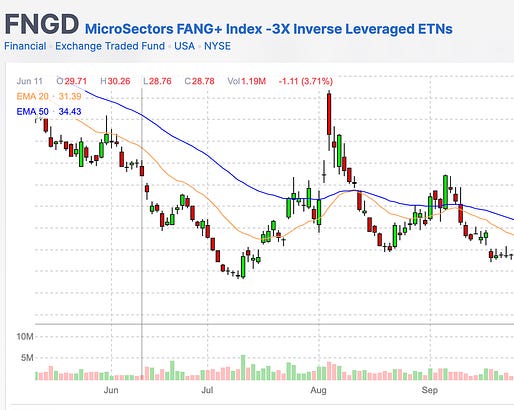

That quote sounds reasonable. But it’s also how you end up explaining a plumbing problem by staring at the thermostat. That’s not how it actually works. Money really gets expensive when access disappears. And that’s when everyone remembers a guy “who might be able to help,” and that guy stops returning texts. Consider this... A credit card with a 20% APR is useless if it’s maxed out, which is when the website stops showing numbers and just says “Call us” like you did something wrong. A mortgage rate doesn’t matter if the bank won’t approve the loan. A “low-rate environment” doesn’t help you if nobody will allow you to refinance or rollover your funding. Price matters when supply is available. And when supply disappears… the real cost shows up somewhere else. That “somewhere else” is a place that I haven’t spent a lot of time explaining… It’s called foreign exchange (or Forex) funding. Let’s explore. What Is Liquidity? (One More Time)You’ve heard me use this word before. One more time for the people in the back… Liquidity is not just the stock of available cash and credit in the global financial system that can refinance debt, influence asset prices, and drive economic activity. Liquidity is also permission, subject to balance-sheet capacity and risk tolerance. It is the permission to borrow, to roll over debt, and take risks without immediately breaking something. It is, like our momentum signal, a green light at an intersection. Here, the road exists, and cars are moving. But if the light turns red, nothing moves. The global financial system - with its banks, hedge funds, and governments - operates on a similar principle. The only difference is how many zeroes they require, and how significant the downturn can be if the light turns red and the financial plumbing freezes. What’s The Real Pressure?Now, we were talking about the price of money… and how it links to permission and financial plumbing. The key term we need to discuss is FX Funding. [It’s okay. This is usually where my sister pretends she understands what I’m about to say and then quietly scrolls.] FX stands for “foreign exchange.” You know those little stands at the airport that allow you to swap U.S. dollars for Euros or other currencies when you leave the country… Good… we’re talking about global currencies, but the exchange rate between those currencies at any given moment. Think about the price of the dollar against the price of the euro. (Today, €1 might buy $1.05. In a month, it might buy $1.10. The value shifts constantly, sometimes subtly, sometimes violently.) So, let’s think about a Japanese bank in Tokyo. The bank’s balance sheet in Japan will be measured in the local currency, the yen. The customers’ deposits are also in yen. But many of the assets you want to own, like U.S. Treasuries, Apple corporate bonds, and international loans… are priced in U.S. dollars. Well, those assets need to be “funded,” and it can’t be done in physical assets or on a vibe. The banking team can’t go into a local grocery store and swap ¥1 trillion in yen for U.S. dollars… They have to get that money somewhere. And that place is known as an FX swap market. A swap market isn’t that confusing. It’s like a trade and promise to trade back - regardless of what the assets are worth at a future time. Let’s say you are the Japanese bank, and I’m your trade partner here. You give me yen today, and I give you dollars at today’s exchange rate. We agree to reverse that trade at a later time… at a pre-agreed fixed exchange rate. You’re not buying dollars from me. You’re effectively renting them. That premium is the real marginal cost of dollar funding for globally leveraged balance sheets. The premium is known as “FX funding pressure,” particularly for non-U.S. institutions dependent on dollar funding. When that premium is cheap, the system isn’t facing any stress. It’s liquid. But when that premium for dollars spikes, that’s when the system abruptly begins to de-risk. That’s where real problems exist in cross-border capital flows. The Fed Funds Rate Is Not the BillPeople will say that the interest rate managed by the Fed is the “price of money.” But in periods of stress, it functions more as a policy signal than a binding price. Even the Bank for International Settlements has been explicit about this. Dollar shortages don’t show up first in policy rates. They show up in FX swap markets and cross-currency bases, where the real marginal cost of offshore dollars is revealed. The FX funding process is the system’s actual invoice. The Fed can say that money is “tight” or “loose,” and we can get into conversations about what is “restrictive” or “accommodative,” or “hawkish” or “dovish.” All that matters in stressed global markets is whether dollar funding is plentiful. If so, markets will hum along just fine. When dollar funding gets scarce, that’s where the problems start. That’s where we see pressure in Europe, or stress in Japan. And things can still crack even if the Federal Reserve’s policy rates haven’t moved. It’s not interest rates that cause real stress or ultimate crises. A shortage of funding… that’s what creates the problem. And when stress builds, and premiums build… the price of money goes up. The Cross-Currency Basis (Don’t Memorize This)Okay… I have one more term for you. I apologize… Economists have a fancy term to measure how desperate people are to access dollars. It’s called “Cross Currency Basis.” You can forget it forever… as I try to do. Let’s just say you have 100 Euros, and you need U.S. dollars for your trip. You trade with a friend. But since everyone wants dollars at the same time, your friend tells you, “I’ll give you dollars, but you have to pay a little extra.” That extra premium fee is the cross-currency basis. It’s the financial gap between what trading currencies should cost and what they really cost. In global markets, that “extra” shows up as a regular premium, the fee foreigners pay to access U.S. dollars. Here’s the thing… There is nearly always a small premium that foreign banks will pay for access to dollars. Okay… so when that premium surges, banks and other institutions are overpaying to access the U.S. dollar. Let’s try another example. You’re at the State Fair, with lots of food and rides. Everyone needs the same color ticket to ride. But all of a sudden, your tickets aren’t accepted anymore. You start offering extra money to people to trade for the right tickets. That extra payment is the basis. When that “extra money” cost starts to widen, it’s telling you something important. When the cross-currency basis widens further below zero, it’s telling you that leverage is stressed and dollars are scarce. This is where the financial plumbing is clogged, and we may need intervention through foreign swaps via the Federal Reserve to provide additional dollars to the system. Now, I want to stress one last thing about this… That stress rarely shows up after the fact. It tends to arrive when everything looks fine, spreads are narrow, and the basis looks just fine. This Usually Shows Up FirstForex (FX) funding stress is a leading indicator. It’s neither after the fact nor coincidental. Historically, in global funding crises, it’s the canary in the coal mine. When people say that their indicator has predicted 47 of the last 5 recessions and 8 of the previous 91 crashes (and that it’s just turned on), look instead at the FX markets… delivered very confidently, and always while making eye contact. The yen has become volatile alongside unwinds in global leverage (see August 2024). The euro has weakened sharply during periods of dollar funding stress (see late 2011). Emerging markets implode through the FX markets before equities start to crater. This is why every major bank’s Treasury desk is watching the FX market. It’s why every serious macro fund is eyeing those markets. It’s why the guy who covers this at every major Sovereign wealth fund rarely gets to go to the best financial conference for five days, because the problem can emerge at any moment. The FX markets are where leverage reveals itself. And when that leverage is exposed, the markets quickly face problems. The Fed and the BIS Know This TooWhen we look back at two of the biggest downturns in the last 18 years, we see that the most effective tool the Fed could use to stabilize markets was not rate cuts. Typically, the rate cuts come too late. In 2008 and 2020, the Fed’s most important weapon to alleviate stress was access to dollar swap lines. In fact, that access was offered to foreign central banks before Congress could even begin to consider ways to provide stimulus to Americans. As we’ve previously explored, swap lines allow foreign central banks to access U.S. dollars not from currency trading partners… but directly from the Federal Reserve. Those banks take those dollars and quickly distribute them to their banking networks. This is critical because when private FX markets freeze, foreign banks can’t access the dollars they need to survive. In Europe, local lending might be done in euros, but trade settlement is still done in dollars… Dollars are the oxygen of the system. And the whole global financial system operates on access to the dollar. It has been this way since the end of World War II. When the Fed opens up these swap lines, the associated funding stress in FX eases rapidly. You can actually see it in real time. Funding crises aren’t solved by rate cuts alone. The preferred policy tool is to directly inject U.S. dollars into foreign markets through FX plumbing activity. That tells you everything about how the system really works… and what matters. What This Means For YouI know you’re not trading FX swaps, and I’m not encouraging you to spend any time digging too deep into the international currency markets. It’s a deep rabbit hole that may require more breadcrumbs than you have to get home… That said, you live downstream from people who are trading swaps. If FX funding costs spike, it will cost foreign banks more money to access dollars. If it costs more to get dollars, they will charge more to lend them, or just stop lending them entirely. That’s a tell on tighter credit conditions. And it will come before the Fed announces rate changes, before the Fed Chair offers a speech, and before we get the headline from the mainstream press. You might notice shifts in mortgage rates, small changes in credit lines, and other signs of tightening conditions. By the time this shows up in economic conditions indices or when someone says we have “tighter financial conditions,” the contraction has already started weeks earlier in a place few people understand. Markets will wobble around almost out of nowhere because of FX. The stress will build, the selling will start, but it will be dismissed as “profit taking” at first. In mid-July 2024, when selling on the S&P 500 began, some outlets blamed China's export curbs. That was interesting, considering that in June 2024, Japan’s top currency diplomat had warned of possible “rapid” FX moves in the yen. On August 1, when our signal went Red and the FNGD cracked above its 50-day moving average again… the market really sold off. On August 5, 2024, Japan’s equity market had its worst one-day selloff since 1987, and the Bank for International Settlements (not the media) offered an autopsy of the event and its relationship to FX markets. The stress shows up first in the plumbing. The experts are speaking about this stuff every single day. Headlines come later because we’re too busy counting Tesla (TSLA) inventory levels and offering hot takes on Beyond Meat (BYND). Now What?The Fed Funds rate is the sticker price. FX funding spreads are what clear the checkout when the crowd gets nervous. Currency stress always looks like it’s “contained,” right up until the point that things crack. In September 2019, repo rates spiked from 2% to 10% in a single day. The Fed injected $75 billion overnight… while officially “tightening” through balance sheet runoff. This wasn’t an interest rate problem. It was a market funding problem. The system didn’t need cheaper money. It needed access. We can keep talking about dot plots and about whether the next Fed Chair will be a hawk or a dove. But that’s the 14 hours of non-stop coverage before the Super Bowl happens. The real game is what happens when the plumbing starts to clog. It’s not going to change. All right… Go Hoosiers! Stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "Money Printer 202: The Price of What Matters"

Post a Comment