You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. Dear Fellow Traveler: Apologies for the late delivery… It was tax payment day at the Federal and State of Maryland level… and given that I’m independent and now firmly own my own business… it was scheduled payments. Hoo boy… I hope that Maryland has plans for my tax dollars… but I’m sure it will just be put into a cannon and fired into the Chesapeake Bay. Florida - of course - did not have any state taxes… but here we get the triple whammy of high property, high sales, and high state and county taxes. I don’t really complain too much because my wife and daughter’s quality of life is much better here than in Florida. But it’s a blistering reminder of how the Northeast operates compared to the lower-tax regions of the country. Of course, Maryland’s solution to everything is… higher taxes. And that is kind of an expected right that the state enjoys. Why? Because I continue to remind people that many higher tax states are connected to… the Cantillon Effect. New York City, New Jersey, Connecticut, Illinois, and other places where a lot of capital originates once it’s deployed by our central bank… Where does so much money originate for Marylanders? It’s not in Baltimore… It’s down in those counties that surround the nation’s capital. Maryland has three of the top 20 wealthiest counties in the nation. Why? Proximity to the capital… A lot of defense contractors… and people close to the infrastructure and stimulus train… Getting close to the origin of capital pays off… Thing No. 2: This Wouldn’t End WellSpeaking of taxes… this situation in California is a mess. For those who don’t know, the state is trying to implement a billionaire’s tax, with some calling for retroactive taxes on people leaving the state. Well… they talked about a 5% wealth tax too, and it appears they then turned around and thought… what if we just created a thermonuclear device that drives everyone with a net worth over $500 million out of the state. Garry Tan, the CEO of Y Combinator, went on a pretty interesting rant the other day on X, stating that a very poorly written bill could legally be interpreted as a mechanism to confiscate an incredible amount of billionaires’ assets. Tan states that the new language in this wealth tax bill won’t tax what people at public companies own. The tax would be on the voting power of your shares.

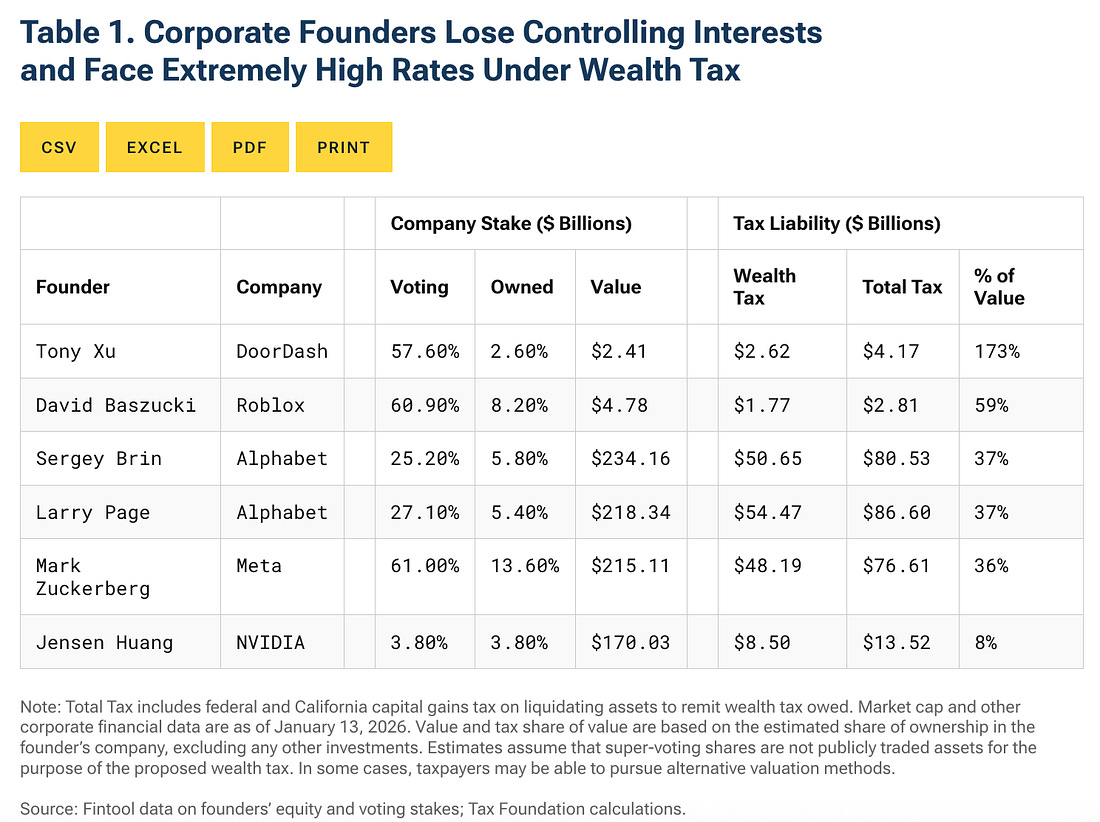

Recall that in markets, dual voting structures have been created to allow founders to maintain control of their companies over time as they sell or dilute their stakes. So, some people have Class A or preferred shares that carry 10 votes or more, while common stock might carry only 1 vote. Founders with 10X voting rights… people like Larry Page, Sergei Brin, or Mark Zuckerberg would face something incredible. If Tan’s interpretation is correct, their 3% stake in the company could actually be taxed at a 30% level due to the voting rights… All of a sudden, a $120 billion stake becomes $1.2 trillion for tax purposes. Five percent of that is sixty billion dollars. Each. Every year. Now, this is still subject to legal interpretation; it would force a vote and be subject to challenges. But if that were even close to true, this isn’t taxation. That’s asset liquidation at gunpoint and would effectively end their management of the company.... That would practically destroy founder-controlled companies, force fire-sales of equity, and detonate the entire startup ecosystem. The Tax Foundation did a hypothetical analysis of wealth taxes under this concept. I honestly didn’t believe this was real until I saw the Tax Foundation analysis… I figured it was just blogosphere red meat… But this seems like it’s a real proposal with significant implications, should it reach a very loose judicial interpretation. California… the weather’s great, but the math’s insane. We’ll see how quickly this gets walked back… Thing No. 3: Down the Rabbit Hole…YouTube got me yesterday... I got sucked into a 27-minute video of the best One Hit Wonders of the last 25 years… And I have to say that I couldn’t believe that I know the words to so many of these songs. Now… this will be a rare one for me… But my favorite one-hit wonder is not the one I might consider the best one… I really like Norman Greenbaum’s “Spirit in the Sky,” Gotye (feat. Kimbra) with “Somebody That I Used to Know,” My favorite one-hit wonder is Steal My Sunshine by Len, a song that doesn’t appear on any VH1 or MTV top lists… One of my favorite nights of college is embodied in this song. The first time I ever heard this was in my final two weeks of college, and we were driving down Lake Shore Drive. My friend Kristine put this song on, and the whole car went wild - except I’d never heard it before... We were driving down Lake Shore Drive in perfect weather with this song blasting, looking at the Chicago skyline… a very good memory. This song is special to me… that band peaked on that song… Out of that YouTube ranking video, the top one-hit wonder on that list was Flagpole Sitta by Harvey Danger. And I thought… wait… that song? And then I listened to it once, twice… three times, remembering it well from earlier years. And I have to stress that lead singer Sean Nelson absolutely puts on a performance that’s worth praising… and then I thought… yeah, this song holds up… What’s your favorite one-hit wonder? Let me know in the comments below… Thing No. 4: And FinallyToday, someone over at TheoTrade had a pointed question for me to close my trading session… He asked…

Here is my reply… And I say it with an ounce of skepticism in a world where people feel outmatched. I am a very defensive trader… and I remind you that, whether it’s a marketplace, a supermarket, or a mall, put yourself in the stores' perspective. Their job is “To Sell.” It’s not for you to go get things… Don’t you think they want to sell you things? Well… apply that to the market… It’s for you to take on the risk that they once had… It’s a different way of looking at the world… A market is designed to make you trade when you shouldn’t. It is the greatest behavioral construct in the world - feeding on human emotion, unlike anything that I’ve witnessed… It flashes green when you fear missing out. It plunges when you fear losing everything. And it’s built to provoke action, not patience. Have you noticed that every rally looks irresistible? That’s by design… especially the ones right before a downturn. Rallies attract buyers, allowing sellers to exit at good prices. It’s not manipulation. It’s how order flow works. It’s also a point that markets are designed to transfer risk from one person to another. And who are we kidding? Every crash is designed to make you panic. Crashes force weak hands to sell so strong hands can buy. “The purpose of the market is to sell” means the market’s job is to test you, not reward you. It constantly invites you to chase tops, dump bottoms, and confuse noise for signal. The phrase is a reminder that your instincts are the counter-signal, your emotion is the product, and the market is a machine that survives by shaking people out. How do you use this information? When the market tries to seduce you into buying everything, slow down. Momentum is real, but blow-off tops always feel “safe” right before they break. When the market tries to terrify you into selling everything, slow down. Bottoms always feel like the world is ending. But they’re just the beginning of something special in a world where insiders and public policy act as guidance. Finally, build rules that override your instincts. Focus on position sizing, stop-losses, momentum screens, and insider flow. Do things that reduce emotion. Treat rallies and crashes as tests of discipline, not calls to action. I hate to say this, but the market is not your friend… and neither is the guy selling you options… It’s not your enemy either… But it does act as an extraction machine… and it does shake money loose. Your job is not to be the person it shakes. I’ll be back tomorrow with more thoughts… Stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "Things I Think I Think... At Tax Time..."

Post a Comment