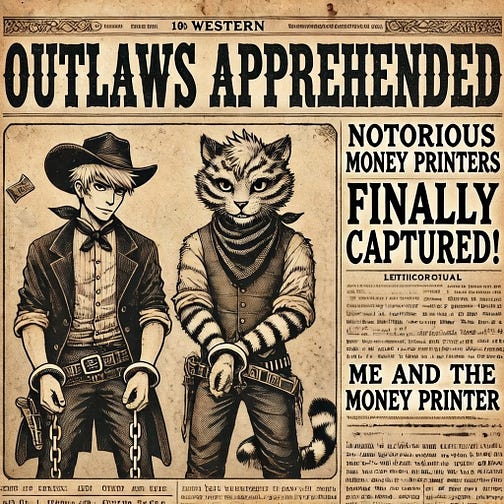

You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. The de-organizing principle, for any society, is to print money...For 113 years, we've been expecting politicians and regulators to get their act together and create sound money. Their decisions show the opposite effect.Dear Fellow Traveler: The other day, I started my Postcards issue with a quote from the film JFK.

Well… let’s look at the de-organizing principle… The deconstructing… the elimination of rules… The way to pay for war… and benefits… and more debt… It’s to print… more and more of the fiat currency. The U.S. dollar has benefited from its status as a reserve currency since the Bretton Woods system in the mid-1940s… But a unipolar world is moving very fast. CBO’s baseline points to gross federal debt of around $64 trillion by 2036. I think it could run higher, potentially into the $70 trillion to $80 trillion range if the next crisis hits before the last one’s paid for. Now, people know there’s something wrong with our money… But people want to pick just one moment when the currency broke. Was it Nixon? Was it 2008? Was it the day Jerome Powell fired up the printer during COVID and the balance sheet went vertical? It wasn’t any of them. And it was all of them. For 113 years, U.S. monetary policy has centered on doing one thing, over and over again… removing any restraint on the money printer. De-organizing… deconstructing… removing barriers. It’s not all at once. It’s not in some dramatic collapse. It’s just been one guardrail at a time, one crisis at a time, until there’s nothing left standing between the people who run the system and the button that says “print.” Let’s RecountOur madness started in 1913, when the Federal Reserve was created. Before that, the money supply was constrained by gold reserves and the limits of fractional reserve banking. The Fed was supposed to be a stabilizer… a lender of last resort that would smooth out panics. Instead, it became the engine and did little to prevent or resolve the Great Depression, in part because then-Governor (President) of the Federal Reserve Bank of New York, Benjamin Strong, died in 1928, a year before Black Tuesday, leaving a leadership vacuum. In 1933, Roosevelt confiscated private gold holdings and revalued the metal from $20.67 to $35 an ounce… reducing the dollar’s “gold content” by 41%. The constraint of private gold ownership was gone and wouldn’t return until 1974... After the war, Bretton Woods tied the global financial system to the dollar, and the dollar to gold at $35 an ounce. It worked until it didn’t. By the late 1960s, the U.S. was spending faster than its gold reserves could support… The Guns and Butter economy forced spending on Vietnam, the Great Society, and a government that had discovered it could write checks the Treasury couldn’t cover. In August 1971, Nixon severed the last link between the dollar and gold. The final physical constraint on the money supply had been removed. Everything after that is just a story of removing the smaller guardrails that were supposed to substitute. The Guardrails Keep Coming OffIn 1985, Congress passed the Gramm-Rudman Act, which set mandatory deficit-reduction targets and triggered automatic spending cuts if those targets were missed. It was supposed to force fiscal discipline. The targets were routinely missed. The law was ruled unconstitutional… and largely went away. In 1990, they tried again. Congress wanted pay-as-you-go rules and discretionary spending caps. Feel free to pour a drink and look up the term “sequestration triggers.” Those things worked for about a decade, helping to fuel a surplus. But then they quietly expired in 2002, and nobody renewed them. In 1999, they repealed Glass-Steagall… the 1933 law that had separated commercial banking from investment banking for 66 years. The firewall between your savings account and Wall Street’s trading desk was removed because it was “outdated.” Nine years later, we found out why it existed. The Commodity Futures Modernization Act (CFMA) slid through at the end of 2000 inside a must-pass bill, blessing a lot of OTC derivatives with “legal certainty.” In 2008, the Federal Reserve invoked Section 13(3) of the Federal Reserve Act… an emergency lending provision that had been dormant for over 70 years. Suddenly, the Fed wasn’t just lending to banks. It was lending to insurance companies, investment banks, and money market funds. The Fed’s emergency lending programs swelled over $1 trillion by late 2008. The constraint that the Fed only supports depository institutions was gone. Then came Quantitative Easing. The Fed had never purchased mortgage-backed securities before. Now it was buying over $1 trillion of them. A constraint that had existed since the Fed’s founding… that it would only hold Treasury securities… was gone. The balance sheet went from $900 billion to over $2.3 trillion, then to $8.9 trillion after COVID. One round of QE at a time… The debt ceiling, which is supposed to be the ultimate fiscal constraint, has been raised or suspended 78 times since 1960. Since 2013, Congress stopped even raising it… they now just suspend it, let spending run, and reset the number when the suspension expires. It’s not a ceiling. It’s a political football masquerading as a fiscal suggestion. In 2020, the remaining guardrails came off in a single month. The Fed cut reserve requirements to zero… meaning banks no longer had to hold any reserves against deposits. We’ve still not raised that back up… Some believe that triggering it could lead to another liquidity challenge fairly quickly. That requirement had existed, in some form, since the Fed’s creation. Gone. Then the Fed crossed another line, supporting corporate credit, including bond ETFs with limited high-yield exposure. Congress sent $953 billion in forgivable PPP loans to businesses and $800 billion in direct stimulus payments to households. All of it was financed by debt that the Fed was purchasing at the exact same time… Every budget enforcement mechanism that was ever created… deficit targets, pay-as-you-go rules, spending caps… all of them expired, were waived, or were simply ignored. Not one survived contact with the next crisis. The PatternThis process doesn’t reverse. And we have to stop pretending it ever will… No government has ever voluntarily reimposed a limit or rule on its ability to spend and print money. If you find that needle in the haystack, you let me know. I can’t find it. The ratchet only turns one direction. Each crisis produces a new intervention. That intervention creates a new precedent. And that precedent makes the next intervention larger, faster, and less controversial. Nobody even bothers to complain at scale anymore. It’s just how the system works. In 2008, TARP’s $700 billion authorization was controversial enough to fail its first vote in Congress. In 2020, trillions of dollars moved through Congress in just weeks. The next crisis? The printer is already humming... It Will Keep GoingMonetary systems can last much longer than people expect. The current framework isn’t going to collapse tomorrow. But a new framework will ultimately be necessary. People always ask me what that would look like. That’s a subject for another article... But for now, understand that the transition could be quite jarring… a teardown and a rebuilding. It’d be the kind of structural reset that reprices everything. The important question isn’t when the system changes. It’s what you own when it does. In any monetary reset… whether it’s a new reserve currency framework, a return to commodity backing, a digital system, or something nobody has imagined yet… certain assets must be repriced because their value doesn’t depend on the system. They exist independent of whatever monetary architecture sits on top. The roads, the farms, the toll booths, and the critical infrastructure that every economy requires, regardless of what currency it uses. Farmland feeds people in dollars, euros, or whatever comes next. Energy infrastructure powers data centers and cities, whether the Fed exists or not. Transmission lines and water rights don’t care about the monetary framework. They’re the bottlenecks through which economic activity must flow. We’ve had 113 years of removing guardrails. Here we are… with a view… Over at Postcards, the Chokepoint portfolio is up 9.8% since inception in December on the back of strong yields and assets that provide inflation protection and access to things that must be repriced in the future. The only assets that survive every version of this story are the ones that sit at the chokepoints of the real economy…. The latest pick just dropped on Sunday. These are the things you can’t print, can’t automate, and can’t build fast enough to meet demand. So once again… Own the chokepoints. Stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "The de-organizing principle, for any society, is to print money..."

Post a Comment