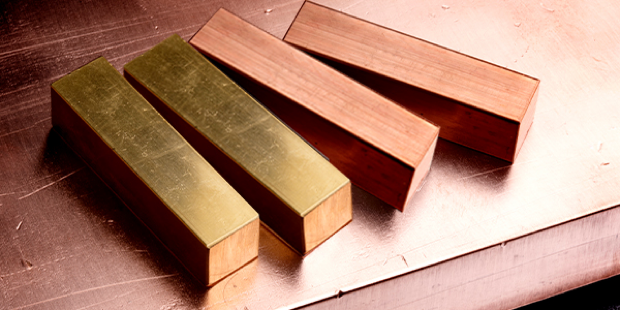

Gold and Copper Surges Signal a Rare U.S. Mining Opportunity: Fully Permitted CK Gold Project Positions USAU for Explosive Growth with H.C. Wainwright’s $27.50 Price Target! U.S. Gold Corp. (NASDAQ: USAU) is riding the perfect storm of record-high gold prices and surging copper demand. With gold surpassing $5,500 per ounce this year and copper entering a historic supply crunch driven by electrification, renewable energy, and infrastructure needs. USAU’s CK Gold Project in Wyoming stands out as one of the few fully permitted, shovel-ready gold-copper operations in North America. The project’s 1.02 million ounces of gold and 260 million pounds of copperin proven and probable reserves, combined with an expected 110,000 ounces of annual production, gives investors leveraged exposure to the commodities fueling the 21st-century economy. Analysts are taking notice: H.C. Wainwright maintains a Buy rating on USAU with a $27.50 price target, highlighting the company’s near-term production potential, strong economics, and strategic positioning in the U.S. mining-friendly jurisdictions of Wyoming, Nevada, and Idaho. With a management team led by mining veteran George Bee, institutional backing from investors like Eric Sprott and Franklin Templeton,USAU is poised to translate its resources into revenue. Discover why USAU is a must-watch as gold and copper prices soar and domestic production takes priority

This Week's Featured Story Grab's 2026 Selloff Had Reasons—But the Rebound Case Is BuildingWritten by Thomas Hughes. Article Posted: 2/13/2026.

What You Need to Know- Grab Holdings is growing in Southeast Asia and is deeply undervalued relative to long-term forecasts.

- Analysts and institutions show strong conviction in their bullish posture.

- Free cash flow enables a buyback authorization that can help support price action.

Grab Holdings' (NASDAQ: GRAB) 2025 and early‑2026 price pullback was not unwarranted, as merger and growth concerns emerged. However, trading at roughly 40× this year's earnings and about 2× the 2035 consensus earnings, GRAB presents a deep-value opportunity in a stock poised to rebound. The pullback followed news of a proposed merger with Indonesian ride‑share competitor Go To, which has not yet been finalized, and the prospect of significant legislative changes in Indonesia that could limit profit potential in one of Grab's largest markets. Watch Now! Porter Stansberry & Luke Lango join forces to unveil:

The Three Titanic Forces Converging To Unleash A New 1776 Moment

"We have never seen wealth created at this size and speed" MIT Researcher Click here for the stocks to buy and sell now Grab is well‑positioned for growth in Southeast Asia, is profitable, and is currently outperforming expectations. Regional growth is underpinned by industrialization, infrastructure investment, and a rapidly expanding middle class with increasing access to digital communications. These are strong tailwinds that expand Grab's addressable market, raise disposable incomes, and deepen digital adoption. Near‑term headwinds should pass.

Grab Has Strong Quarter, Authorizes Share BuybackGrab delivered a strong Q4 2025, reporting revenue of $966 million, up 18.6%. The top line beat consensus by 40 basis points and was supported by growth across all segments. Deliveries revenue, about half the topline, rose 16% year‑over‑year on a constant currency basis, helped by a 21% increase in gross merchandise volume. Mobility grew 15%, while the smaller Financial Services segment expanded 36%. Margins also improved. The company's quality improvements and revenue leverage produced meaningful gains: adjusted EBITDA rose 54%, the company moved to operating profit from prior losses, and adjusted free cash flow increased 78% to $290 million. Adjusted EPS was roughly break‑even versus the $0.01 consensus, but management provided constructive guidance — targeting low‑20% revenue growth and nearly 45% adjusted EBITDA growth in 2026. In a sign of confidence in cash flow and the growth outlook, Grab's board authorized a follow‑on $500 million share buyback. That amount is worth nearly 3% of the mid‑February market cap and is expected to be executed over the next two years. The move not only signals board confidence but also provides a tailwind for price action. Analysts and Institutions Have Conviction in GRAB's FutureAnalyst data shows strong conviction. The seven analysts tracked by MarketBeat assign the stock an overall Buy rating: six at Buy or stronger (about 85% of the group) and one at Hold. Their average target is near $6.50, about a 50% upside from early‑February support levels and would mark a five‑month high if reached. Institutions collectively own 55% of the stock and have been accumulating. MarketBeat data shows roughly $3.60 of buy‑side activity for every $1 of sell‑side activity on a trailing 12‑month basis, with early‑2026 activity consistent with that trend. That institutional base is a solid support that can help drive the stock back toward near‑term highs. Grab's stock price appears set up to advance. While downside risk remains, the chart reflects oversold conditions and divergences that suggest bulls have regained control and can reclaim lost ground. Key resistance targets are $4.50 and $5, both likely to spark volatility. Catalysts for a move higher include continued revenue growth and improving profitability in future quarters.

This message is a paid advertisement for US Gold Corp. (NASDAQ: USAU) from Huge Alerts and Sideways Frequency. MarketBeat Media, LLC receives a fixed fee for each subscriber that clicks on a link in this email, totaling up to $12,500. Other than the compensation received for this advertisement sent to subscribers, MarketBeat and its principals are not affiliated with either Huge Alerts or Sideways Frequency. MarketBeat and its principals do not own any of the stocks mentioned in this email or in the article that this email links to. Neither MarketBeat nor its principals are FINRA-registered broker-dealers or investment advisers. The content of this email should not be taken as advice, an endorsement, or a recommendation from MarketBeat to buy or sell any security. MarketBeat has not evaluated the accuracy of any claims made in this advertisement. MarketBeat recommends that investors do their own independent research and consult with a qualified investment professional before buying or selling any security. Investing is inherently risky. Past-performance is not indicative of future results. Please see the disclaimer regarding US Gold Corp. (NASDAQ: USAU) on Sideways Frequency' website for additional information about the relationship between Sideways Frequency and US Gold Corp. (NASDAQ: USAU). |

0 Response to "USAU: The U.S. Gold-Copper Story Investors Can’t Ignore."

Post a Comment