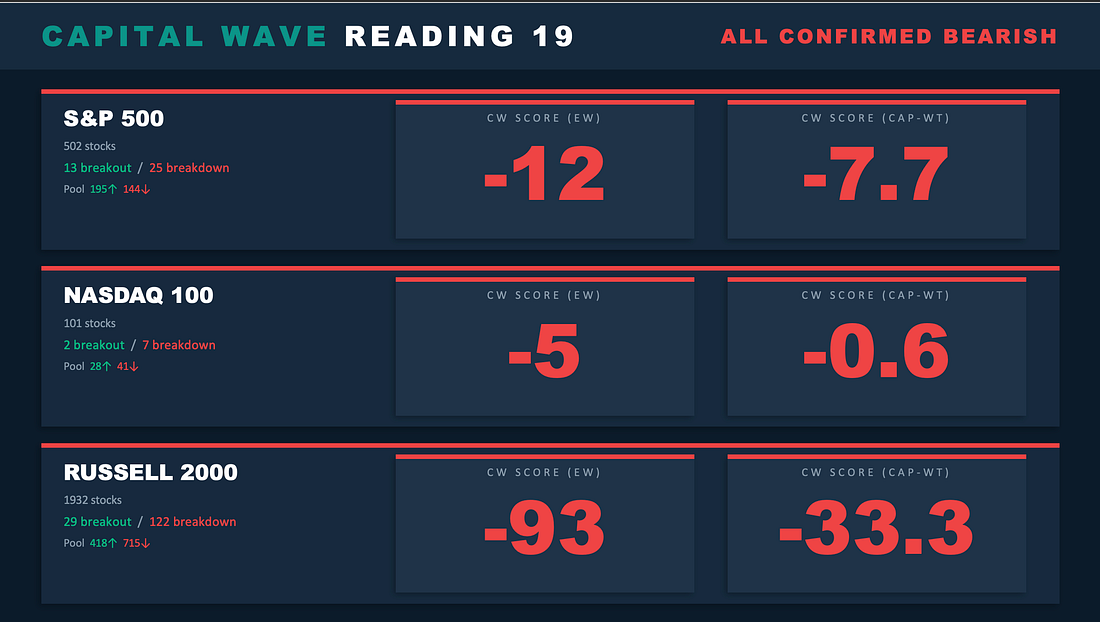

The Next Big Narrative Is Already HerePrepare for everyone, everywhere to be an expert on AI disruptions and put options...Dear Fellow Traveler: Why are we in a Red, negative momentum environment? (Slams triple espresso… starts stuffing lip with zyn pounches)… The next big narrative is here… In early February, the “AI scare trade” ripped through sector after sector. Software stocks got hit first, with roughly $1 trillion in market cap erased. Then wealth management stocks cratered when Altruist unveiled an AI tax-planning tool. Raymond James had its worst day since March 2020. Schwab dropped 7.4%. Then insurance stocks got hammered. Then, real estate services, with CBRE, JLL, and Cushman & Wakefield, all dropped 12% to 14% in a single session. The pattern was simple… An AI company releases a new tool, investors panic, the sector dumps, analysts scramble to say it’s “overblown,” and then the next sector gets hit. Salesforce is down 30% in 2026. Adobe is down 25%. TTEC, a business process outsourcing company, has lost 94% of its value since January 2023, just a few months after ChatGPT launched. WPP’s advertising business lost 61% in the last 12 months... This is real money being destroyed in real time. It’s Already Started…When a clear, scary, easy-to-explain narrative takes hold, the promotion and media hype machine kicks into gear. The “Retail Ice Age” was one such narrative. We were early on that one. That’s when you saw the stock of places like Sears and JCPenney collapse because of e-commerce. The AI disruption narrative is the next version, but bigger. It touches every white-collar sector at the same time. The problem? Software forward P/E ratios are already compressed from 39x to 21x. The BPO stocks are already in the gutter. The first wave of panic selling in wealth management and real estate services has already happened. There are still opportunities on the short side. You really have to know where to find them. A lot of this move has already happened, and the cost of shorting many of these names will keep rising. I’m not saying don’t short… I’m urging caution because of how markets work. Most people only understand Layer 1… The disruption itself. AI is automating cognitive work. Cost-per-task is collapsing. About 92% of Fortune 500 companies are using generative AI. Baker McKenzie laid off over 700 people. Klarna shrank headcount by 40%. Layer 2 is the deflation. This is where I used to get questions... But they don’t understand that they will cause more damage if they don’t get the basics. If AI undercuts the workforce at scale, it becomes the most deflationary technology ever deployed. Bigger than China joining the global labor force. Bigger than the internet on retail. Bigger than the fall of the Berlin wall… Unemployment has risen to 4.6%. Consumer sentiment is under pressure. Entry-level job postings dropped sharply. The policy response so far? Nothing... There is no coherent AI workforce policy. There’s been no significant retraining at scale. Remember when people told coal miners to learn to code? Well… now we don’t really need coders anymore… We now just have executives quoting “efficiencies” in layoff announcements. Layer 3 is where you make money. As deflation hits, the money printer would turn on. A fiat system requires new capital to refinance and recharge. If AI-driven deflation shows up in the data, the Federal Reserve will respond with monetary expansion. It’s not a question of if. It’s when. There is no time for some other idea… The fallback is the nuclear option. Momentum is linked to liquidity. Momentum comes down to a number. If you’re trying to short a lot of these names and you don’t understand policy, you’re going to lose. You’ll wake up in a short squeeze. You’ll see a hated rally that takes some of these names from oversold to overbought… and wonder why. The answer lies in the fact that markets and stocks don’t go straight down. Weakening stocks experience lower highs and lower lows… and a lot of the best short sellers have thrown in the towel and moved on with their lives because the rules and outcomes changed dramatically… If you’re going to play this game, you need to be good at it. You need to learn about Implied Volatility Rank, IV-52, probability of profit, put spreads, and reversion momentum. If you don’t know what any of these terms mean… well… I’d better do a Saturday session. Because you’re walking into a market full of broker-dealers who WANT TO SELL YOU PUT OPTIONS. And if you don’t understand the math behind them, you’re facing an incredible challenge… How to Handle This TradeWe start with Momentum. We operate a simple scoring system that tells you when it’s okay to short… and when you need to get out of the way as markets run higher due to positive inflows… Meanwhile… let’s talk about a real investment strategy for this narrative... When the world is uncertain, when technology is deflationary, when the policy response is inflationary, and when nobody in charge has a plan, you own the things that can’t be printed, can’t be automated, and can’t be replicated. You own real assets. In two categories… Scarce assets… and productive assets. The AI buildout itself is driving demand for copper, rare earths, lithium, and energy. Over $500 billion was spent on data centers in 2025, with another $5 to $8 trillion in AI infrastructure spending expected through 2030. You can’t prospect-engineer a gold deposit. You can’t 3D-print a copper mine. Then there are productive assets… think farmland, timberland, energy infrastructure and pipelines, water rights, and power generation. These generate income, are hard to replicate, and become more valuable as the monetary base expands. Every data center needs energy. This is why I’m so optimistic about natural gas pipelines. The companies that own power generation, transmission, and distribution are sitting on assets that underpin the entire AI revolution. Now… if you’re going to short, you have to find the disrupted sectors. BPO companies, staffing firms, legacy software, and advertising holding companies. Those are obvious. You have to be patient. Instead of buying straight puts, consider using put spreads to define risk and improve your probability of profit… Focus on the technicals as they arrive. It’s better to short these names when the stocks aren’t oversold. Don’t know what that is? Then you shouldn’t be shorting… Use puts, use defined-risk strategies, and be selective. Rely on negative momentum. On the other side… buy long exposure to real, scarce, productive assets. Think Gold. Copper. Energy infrastructure. Power generation. This is the physical stuff that can’t be replicated and is in high demand from the very technology disrupting everything else. The disruption narrative is obvious. That’s why every newsletter company will start pitching this idea… But the real edge is what you own on the other side. When the dust settles, when the Fed fires up the printer, and when everybody realizes you can’t eat a chatbot or live in a software subscription... the people who own the scarce, productive, real assets of the world will be the ones standing. Don’t fear the machines. Trade like them, and own what they can’t replicate. We’re coming off a long weekend. Join the show at 8:45, and we’ll get ahead of things. Just click here. Now… let’s get to the market update… Traders Focus Futures are soft coming into the week. The Nasdaq is down close to 1% in the premarket, while the S&P and Russell are holding up a little better. That divergence has been the theme so far this year. The Nasdaq is down about 3.5% year to date. The Russell is up nearly 6%... Continue reading this post for free in the Substack app |

Subscribe to:

Post Comments (Atom)

0 Response to "The Next Big Narrative Is Already Here"

Post a Comment