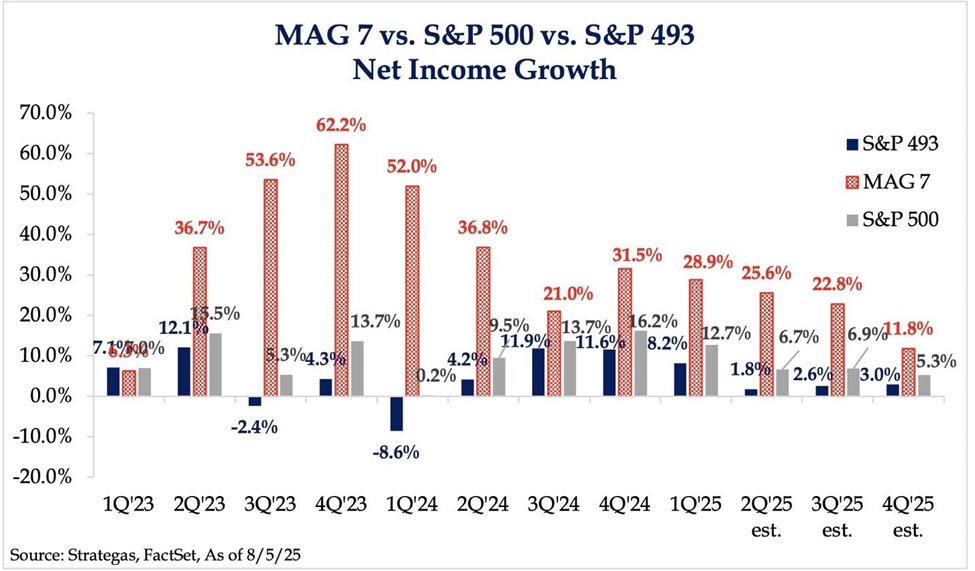

A “tale of two economies” with Luke Lango… is gold breaking out or not?… how will CPI data come in tomorrow?… a reason for market optimism with Jonathan Rose VIEW IN BROWSER Today, we have a tale of two economies. There’s the AI Economy, humming along with relentless momentum, booming innovation, and insatiable enterprise demand. Then there’s the Everything Else Economy — consumer, travel, discretionary — which is feeling the brunt of tariffs, economic uncertainty, and a pinch of macro paranoia. That comes from our hypergrowth expert, Luke Lango. As we profiled in the Digest last week, there’s a growing divide today between the “haves” and “have nots” – both in the market and in our society. One of the most influential factors driving this growing divide is wealth generated from investments in cutting-edge technology and artificial intelligence. Luke, along with Louis Navellier and Eric Fry, call this divide “The Technochasm.” Luke put some numbers on this last week that are important for all investors to see. Let’s go to his Innovation Investor Daily Notes: As evidence that you needto be all-in with AI, take a look at the profit growth rates for the Magnificent 7 tech stocks (firmly in the AI Economy) and the S&P 493 (which comprises some AI Economy stocks, but also a lot of Everything Else Economy stocks). This quarter, the Mag 7 is expected to grow profits by 26%, versus just 2% growth for the S&P 493. The same dominance continues as we look ahead to the end of the year. Luke writes that in the third and fourth quarters, Magnificent Seven profit growth is expected to run at 23% and 12%, respectively, while the S&P 493 is expected to grow profits by just 3% in each quarter. So, we basically have the Mag 7 stocks growing profits at ~20% each quarter, while the S&P 493 grows them at just ~2.5%. Back to Luke: Inflation is currently running north of 2.5%, so the S&P 493 will essentially have negative real profit growth for the rest of the year. Ouch! This is why we need to be all-in with AI stocks. Everything else isn’t even growing in real terms.

Here’s Luke’s Technochasm-themed bottom line: Overall, we remain bullish, but only on AI. The bifurcation of the economy is very real right now. You have the AI Economy and you have the Everything Else Economy. The former is on fire and thriving. The latter is struggling and barely surviving… We think the divide between the AI Economy and the Everything Else Economy will widen dramatically over the next 6-12 months (at least). So… lean into AI stocks… lean away from other stocks… and get on the right side of history. If you want Luke’s latest AI picks, they’re coming from “Physical AI” – including humanoid robots. Last week, Luke – along with Louis and Eric – released their latest collaborative investment research package. It’s about how to position yourself today for the coming era of Physical AL. Their Day Zero Portfolio holds the seven stocks they’ve identified as best-of-breed in AI-powered robotics, providing targeted exposure to the next wave of AI exponential progress. You can learn more here. | Recommended Link | | | | When Tim Cook stood in the Oval Office last week, all eyes were on the “unique 24K gold gift” he presented to President Trump. But many viewers missed an even more important moment in that 30-second clip. One that unmistakably singled out what Futurist Eric Fry calls “possibly the best AI investment anyone could make right now.” Eric believes this little-known partner to Apple could go crazy over the next 12-24 months, potentially leaving well-known AI stocks like Nvidia, Microsoft and Google in the dust. Click to get full details on the company. |  | | Is this the gold breakout we’ve been waiting for? Let’s rewind to our July 29 Digest: Since peaking in late April at $3,432, gold has been trading sideways, unable to break through resistance at the general $3,430 level.

But notice what’s happening… Gold is setting up a bullish “ascending triangle” technical formation.This is a popular pattern used in technical analysis to identify potential breakout opportunities. It's bullish, suggesting that an existing uptrend will likely continue after the pattern completes… To trade this pattern, wait for gold to break definitively above the upper resistance line around $3,430. Fast forward to this past Friday when gold futures hit a new high above $3,500 when President Donald Trump discussed tariffing gold bars. Here’s Bloomberg: The decision, if it remains in place, has sweeping implications for the flow of bullion around the world, and potentially for the smooth functioning of the US futures contract. In the wake of the news, gold futures popped, breaking above resistance. Here’s how that looked on Friday:

We’re watching closely but not jumping in yet Remember, a price breakout alone isn’t necessarily a green light to jump into a new gold trade. For such confirmation, we want a significant and sustained increase in bullish trading volume. In his Breakout Trader service, Luke has explained why outsized volume is critical for a new trade: A common mistake traders make is overlooking the importance of volume, leading them to buy into a trade that appears to be breaking out on weak volume, only to see it fizzle and reverse… For a [true] breakout, bullish price action is a requirement, but it alone is not sufficient. That rising price needs the support of outsized volume. Luke likens volume to the wind that powers a sailboat. Even if you’re headed in the right direction, you won’t go far without enough wind. It turns out, waiting for the follow-through of strong volume was the right call… As we’re going to press on Monday, news is breaking that the Trump administration is now saying that tariffs will not apply to gold. From CNBC: President Donald Trump said Monday that gold will not face tariffs, knocking down a ruling by U.S. customs officials that bars of the precious metal imported from Switzerland would face duties. “Gold will not be Tariffed!” Trump said in a Truth Social post. Gold futures closed 2.48% lower at $3,404.70 per ounce after the announcement. Given this news, outsized buying volume hasn’t shown up, gold futures are selling off, and gold is falling back below its resistance line.

So, while we’re still bullish on a gold breakout, it’s not “go time” just yet. We’ll keep tracking this. The next clue about interest rates drops tomorrow Tomorrow brings the July Consumer Price Index (CPI) report, and economists are bracing for another tariff-related uptick in inflation. Consensus estimates from FactSet call for a 0.2% monthly gain and a 2.8% increase year over year. Stripping out the more volatile food and energy categories, core CPI is projected to climb 0.3% from June and 3% compared with last year. Even though inflation is expected to come in slightly hotter, legendary investor Louis Navellier doesn’t see it being sustained or runaway. Let’s go to his Breakthrough Stocks monthly issue from Friday: Despite persistent attempts to derail the Trump administration’s economic agenda, economic growth without inflation is fully anticipated. There are a few reasons why I do not expect inflation to materialize: - An improving U.S. dollar

- Widespread deflation in China

- Lower energy prices from “drill, baby, drill”

- Imports only account for 14% of inflation calculations

Regardless of how the numbers come in, for the Federal Reserve, they won’t be taken in isolation. They’ll be weighed alongside the recent disappointing jobs report, which suggests the labor market is losing steam. That report, alongside bad ISM manufacturing data, led Louis to conclude: We are teetering on a recession here, folks, and I don’t like to use that R word, but that’s what’s happening. Now, last week, Louis said that a September cut will happen due to the growing economic weakness we’re seeing. And this is now the prevailing opinion. But if the coming data – including tomorrow’s CPI print – suggests that tariffs are reigniting inflation materially, Fed Chair Jerome Powell & Co. will face a tough decision: - Hold rates steady, risking additional job losses, a stock market meltdown, and an apoplectic President Trump…

- Or cut rates to help the labor market, risking pouring gasoline on the fire of inflation that’s already showing signs of life.

All eyes on tomorrow. Finally, if the risk of downward volatility has you worried, veteran trader Jonathan Rose has something to be excited about In short, within President Trump’s recently passed “Big Beautiful Bill” is a retroactive change to how U.S. companies can expense their research and development. Jonathan says that this change has “the power to reshape corporate financials across an entire segment of the market.” Though the market hasn’t responded yet, he says it will. Here are more details from Jonathan: Between 2022 and 2024, U.S. companies weren’t allowed to deduct their R&D costs all at once. Instead, they had to amortize them — meaning they could only write off a little each year, dragging out the tax benefit over five years. Companies were getting punished for doing the very thing we should be rewarding: investing in innovation. But that all changed in 2025. The rule quietly flipped back. Now, U.S.-based R&D spending can be deducted immediately in the year it’s incurred. It doesn’t change revenue. It doesn’t touch margins. But it drastically boosts how earnings and cash flow appear on paper. And in markets, appearance is everything. This has the ability to goose earnings statements overnight. A massive one-time tax break that results in a major lift to earnings has stock-price-moving potential. But Jonathan says this isn’t being priced-in yet – and that’s where the trading opportunity lies. He just dropped the names of five companies that are best positioned to benefit from this tax change – not because of hype or momentum, but because of pure, clean math: - Lyft Inc. (LYFT)

- Unity Software Inc. (U)

- Snap Inc. (SNAP)

- Palantir Technologies Inc. (PLTR)

- Rivian Automotive Inc. (RIVN)

Back to Jonathan: And the best part? These companies don’t need to change a thing operationally. All they have to do is show up with earnings under the new tax math… and the story changes. This is what creative trading looks like in action. You’re not chasing headlines. You’re anticipating how the numbers will be read — not just how they’ll be reported. You’re not looking for what the market is talking about today. You’re positioning for what it’ll be forced to recognize tomorrow. This is just one example of how Jonathan finds tradable opportunities. But finding the right opportunity is just the start… There’s also downside risk protection… how to remain nimble in a trade that doesn’t go exactly to plan… even how to take advantage of curveballs, putting on new, profitable trades in addition to your existing position. In short, it’s about education. And that’s what Jonathan does every day inside his Masters in Trading Options Challenge. Back to Jonathan: You’ve got nothing to prove. You’ve just got to be willing to learn. And once you see how simple it can be, you’ll never look at options the same way again. If you’re ready to learn the right way — with zero pressure, fixed risk, and a community that supports you — I’d love to see you inside the Challenge. Have a good evening, Jeff Remsburg |

0 Response to "Only a Few Stocks Are Investable Today"

Post a Comment